Algorand price remains on track to retest $1.20 amid impending bear cross

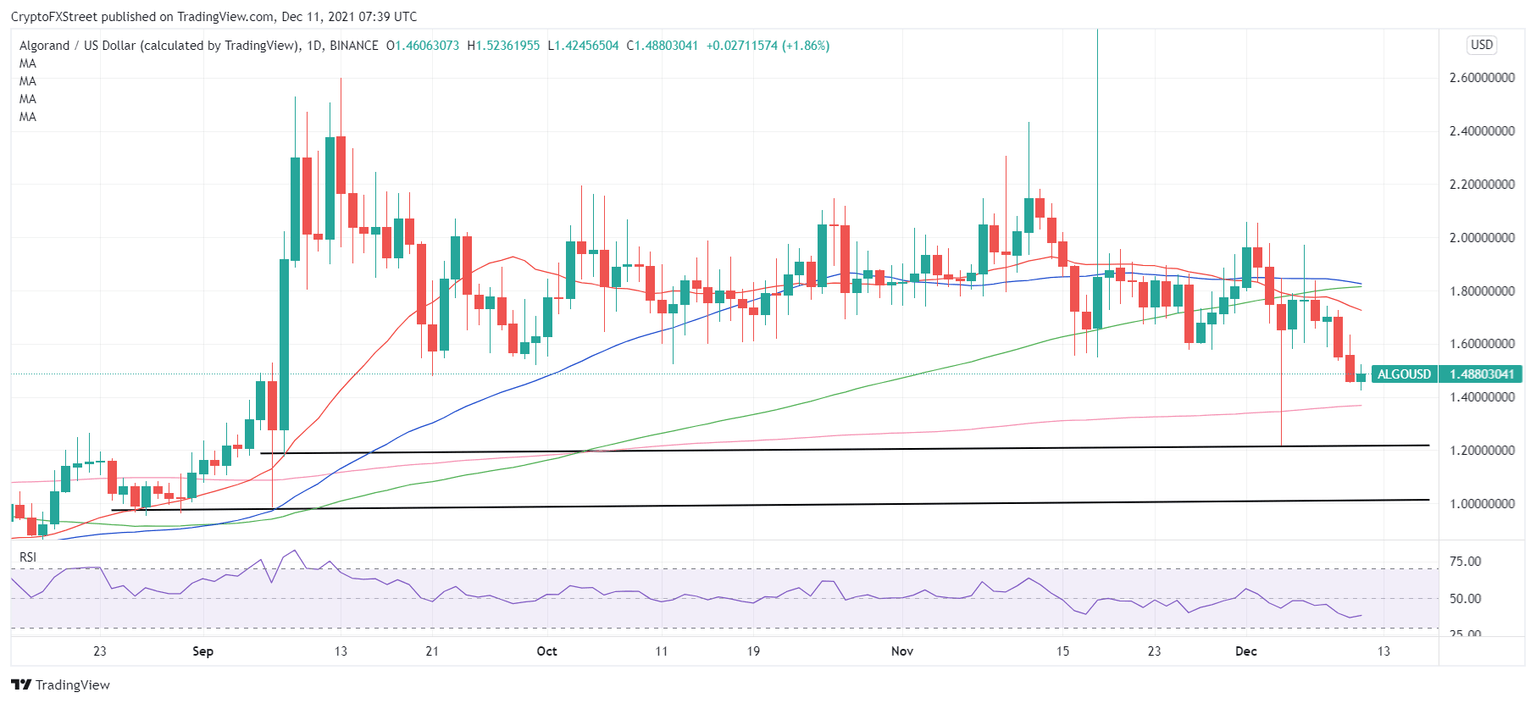

- Algorand price looks to retest 200-DMA support despite the rebound.

- Looming bear cross and negative RSI keep ALGO sellers hopeful.

- Acceptance above $1.82 is critical to reverse the downtrend in the near term.

Algorand price rebounds from weekly lows of $1.42 this Saturday, although lacks the upside follow-through, tracking the price action seen in the flagship cryptocurrency, Bitcoin.

ALGO price has been on a downtrend so far this week, having peaked just under the $2.00 mark on Monday. Since then, the altcoin has lost roughly 15%.

Buyers are now looking to find their feet, as the ALGO price jumps 2.64% on the day, currently trading at $1.50.

The downside remains more compelling for Algorand price so long as it holds below the $2.00 barrier.

Algorand price to resume downtrend amid bearish technicals

Algorand sellers have taken a breather this Saturday, allowing some time before they resume the bearish momentum.

In the meantime, ALGO bulls are coming up for their last dance. Although with the 14-day Relative Strength Index (RSI) still lurking below the central line, the bounce could likely remain short-lived.

Adding credence to a potential move lower, the 50-Daily Moving Average (DMA) is on the verge of piercing the 100-DMA from above.

If the bearish crossover occurs then it would flash a negative signal for ALGO traders, prompting a fresh decline towards the all-important 200-DMA at $1.36.

On a firm break below the latter, ALGO bears will look to take out the December 4 lows of $1.21.

Further south, the $1.00 psychological level will come into the picture.

ALGO/USD Daily chart

Alternatively, the road to recovery could face an immediate hurdle at Friday’s high of $1.63, above which the downward-pointing 21-DMA at $1.73 could probe the bearish commitments.

Additional recovery gains could be seen only on acceptance above the $1.82 supply zone, where the 50 and 100-DMAs converge.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.