After 147% rally, a Storj price correction is around the corner

- Storj price witnessed a 147% rally in roughly five weeks.

- This move has liquidated $12.40 million worth of shorts and $8.75 million long positions.

- A sell-off could easily trigger a 16% pullback for STORJ, but ideally, a 32% correction to $0.331 is likely.

- A decisive flip of the range high at $0.528 on the daily time frame will invalidate the bearish thesis.

Storj (STORJ) price shows a slowdown in momentum as it rejects from a key hurdle. A build-up of sell orders could trigger a massive correction that could prove harmful for STORJ holders and traders with open positions.

Storj liquidations cross $20 million

Storj (STORJ) price has witnessed a 147% rally in the last 37 days, moving from a low of $0.218 on September 1 to creating a local top at $0.542 on October 9. This move is encapsulated within the $0.275 to $0.528 range, created in early November 2022.

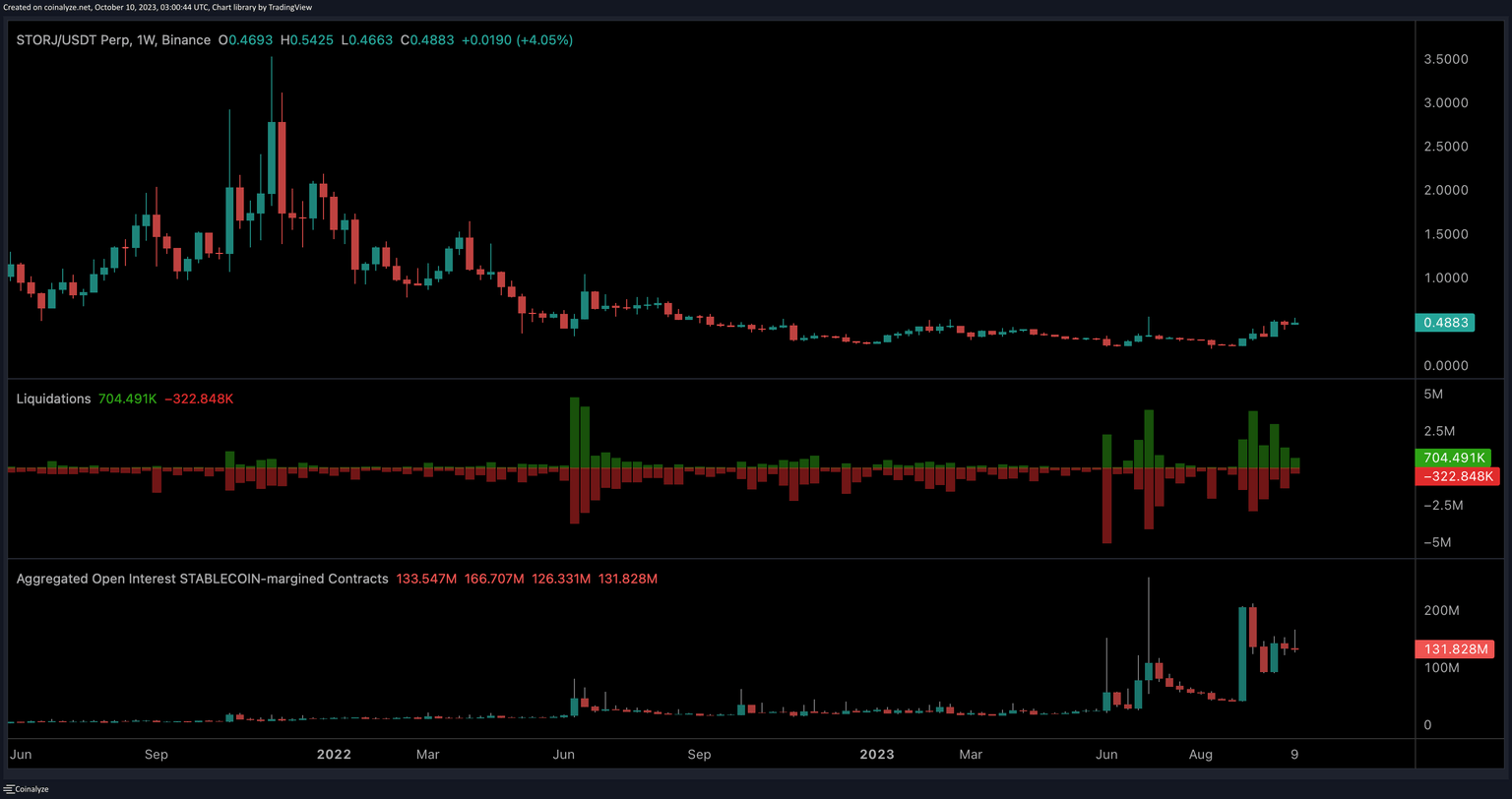

A look at Coinanalyze data shows that the recent upswing for Storj price has pushed roughly $20 million worth of positions into liquidations. STORJ bears took the worst hit with $12.40 million positions kicking the bucket.

Additionally, the open interest, which represents the total number of open positions, has dropped 35% in the last four weeks and currently hovers around $132 million.

STORJ/USDT 1-week chart

The drop in open interest and the massive scale of liquidations suggest that the smart money could be preparing the altcoin for correction. Comparing the recent Storj price action, which has produced three higher highs to the Relative Strength Index (RSI), reveals a bearish divergence.

This technical formation contains an upward-moving price action followed by a declining momentum, which often leads to a correction for the underlying asset.

Before the pullback ensues, there might be a potential spike to the upside that sweeps the October 9 swing high at $0.542 to cull early bears. Following which, Storj price could eye a sweep of the sell-side liquidity resting below the equal lows formed at $0.406. This move would constitute a 15% correction.

But ideally, Storj price is likely to slide lower and find brief support from the $0.380 level, which is the midpoint or equilibrium of the aforementioned range that the altcoin is trading in. In a dire case, scenario, a massive spike in selling pressure could see STORJ wick down to the $0.331 support level, bringing the total move from 15% to 32%.

STORJ/USDT 1-day chart

As mentioned above, a sweep of the local high at $0.542 to cull early bears is likely for Storj price. But a daily candlestick close above this level will suggest a shift in paradigm and invalidate the bearish thesis. This move could also attract sidelined buyers and potentially propel STORJ to sweep the buy-side liquidity resting above July 5 swing high at $0.554.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.