Will Exxon Mobil Corporation (XOM Stock) continue to slide?

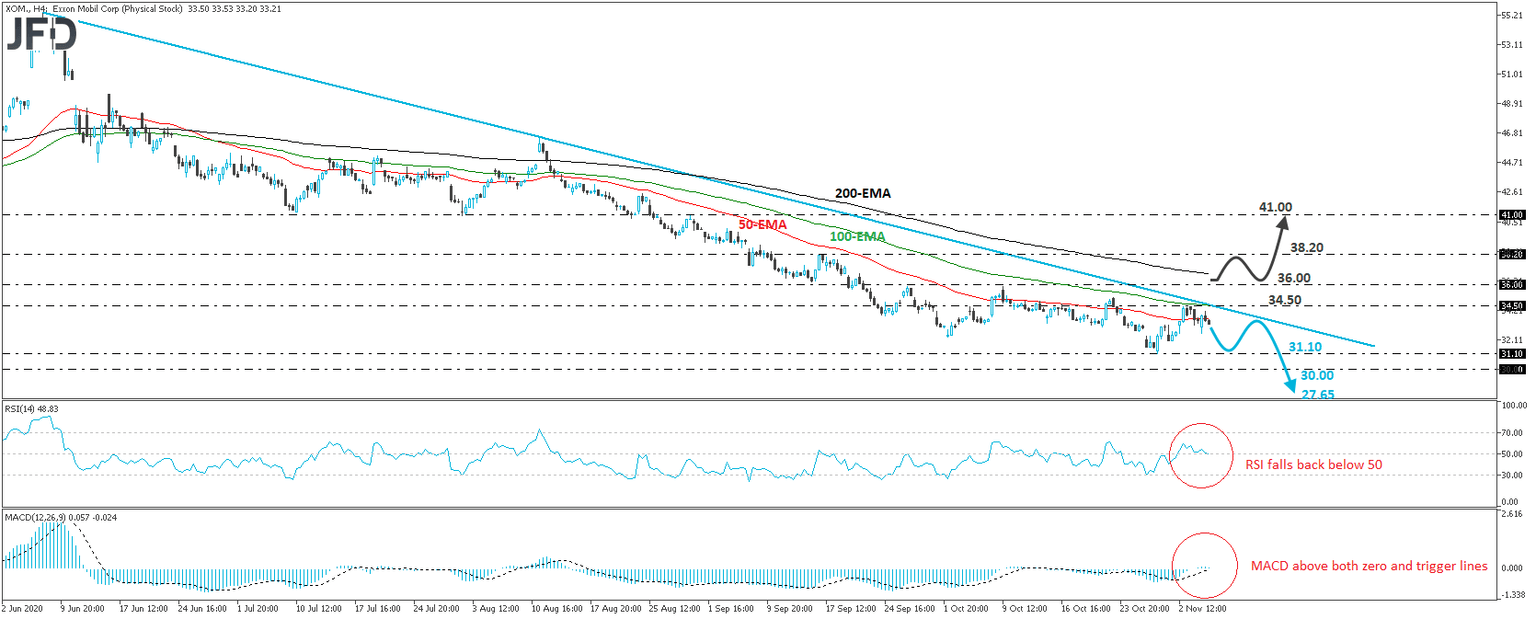

The Exxon Mobil Corporation stock traded slightly lower on Wednesday, after hitting resistance near 34.50 on Tuesday. Overall, the stock has been trading below a downside resistance line since June 8th and thus, we would consider the medium-term outlook to be negative.

Another round of selling may result in a test of the 31.10 level, which is marked as a support by the low of October 29th, or even the round figure of 30.00, which stopped the price from moving lower on March 23rd. If that psychological zone fails to hold this time around, we may see the price testing territories last seen back in 1997, with a potential upcoming support being the low of September of that year, at around 27.65.

Shifting attention to our short-term oscillators, we see that the RSI turned down again and fell back below its 50 line, while the MACD, although slightly above both its zero and trigger lines, shows signs of topping. Both indicators suggest that Exxon Mobil may start gathering negative momentum again soon, which enhances the case for further declines in the short run.

In order to abandon the bearish case, we would like to see a strong recovery above the key resistance zone of 36.00, which prevented the share from moving higher on September 28th and October 9th. The price would already be above the aforementioned downside line and investors may initially target the high of September 16th, at 38.20. Another break, above 38.20, may extend the recovery towards the 41.00 zone, marked by the high of August 28th. That zone also acted as a good support area on July 10th and 31st.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD