Why we’re expecting a cautious recovery in Dutch commercial real estate

We think a further recovery in demand for commercial real estate in the Netherlands is possible this year. Still, ongoing economic uncertainty means that some caution in building forecasts is warranted. It cannot be ruled out that long-term interest rates may rise more than expected, which would put downward pressure on investor demand.

Investment demand in the commercial real estate market is picking up

We saw a broad recovery of the commercial real estate market in 2024, marked by higher investment volumes in rental housing, logistics real estate, offices, and retail compared to the year before. Aside from a higher number of transactions, prices in the commercial real estate market also stabilised.

Further recovery expected in 2025

We expect investor activity in the Dutch commercial real estate to pick up further in 2025. This is down to three main factors:

-

Price declines have increased returns: In response to the sharp rise in interest rates in 2022, commercial real estate prices fell on average by about 13% until the end of 2023. At the same time, rent increases in most cases kept pace with inflation. Due to both developments, expected investment returns increased in 2022 and 2023.

-

Economic growth: The Dutch economy is expected to grow by 1.6% this year. The positive effect of this on user demand for commercial real estate helps limit the risk of prolonged vacancies and opens up more room for further rent growth.

-

More stable interest rates: IRS swap rates, which partly determine financing costs, have shown a more stable trend over the past couple of years than in 2022. A more stable trend in interest rates helps reduce the risk perception of real estate investors. Additionally, the five-year IRS swap rate has been about 90-100 basis points lower since its peak in the third quarter of 2023. Both developments contribute to more positive sentiment among investors.

Long-term capital market rates are expected to rise slightly in 2025

Looking ahead, we expect the 10-year capital market rate to rise by about 30bp this year and the five-year IRS swap rate by about 15bp. The main drivers here are the phasing out of the European Central Bank's asset purchase programme and higher US growth and inflation expectations. For shorter-term capital market rates, there is still room for some decline as we expect the ECB to further lower its policy rate to 1.75%.

Slightly higher interest rates expected again

Development of the 5-year IRS swap rate.

Source: Macrobond, ING

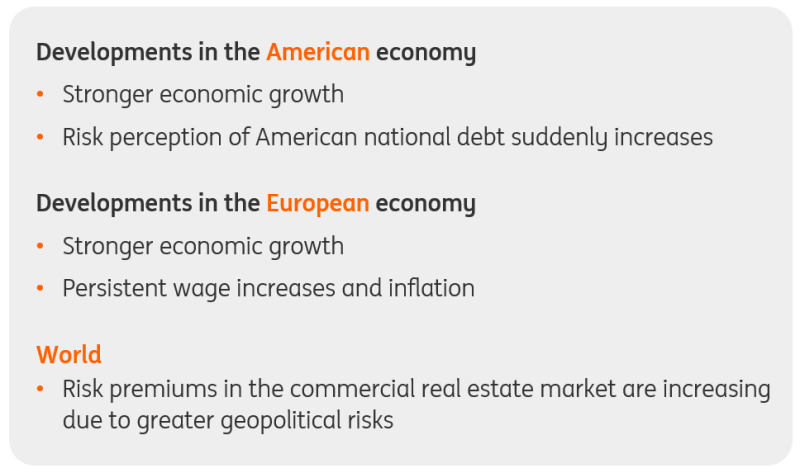

Higher interest rates cannot be fully ruled out

Financing rates in the commercial real estate market may develop differently than expected due to future uncertainties; if geopolitical risks begin to rise, for example, or if US President Donald Trump's policies turn out differently than expected. The likelihood of scenarios with higher interest rates than in our baseline scenario seems low for now. Still, we cannot not rule out this risk, and in turn that could slow demand from real estate investors.

Higher financing rates cannot be ruled out

Deviations from our baseline scenario that could result in higher financing rates in the commercial real estate market than expected

Source: ING research

Read the original analysis: Why we’re expecting a cautious recovery in Dutch commercial real estate

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.