Why is China holding on to its COVID-19 Zero plan?

Many Western nations are leaving major lockdowns in the past. With high numbers of people vaccinated and economies eager to get going properly again the obvious move is to leave lockdowns where they belong, in the past.

So why is China still holding onto lockdowns?

Bloomberg Quick Takes has a really helpful article outlining why China is sticking to its Covid Zero plan. Here are the main reasons from that article that stood out. China’s action makes sense in many ways and this is also why it will be tough for them to exit this strategy.

Key reasons China keeps its Covid-Zero policy

China’s plan has been very effective

China’s plan was praised by the World Health Organisation for the most part of the pandemic, and rightly so. In terms of the lowest number of deaths vs 2020-2021GDP shortfall China has excelled on both metrics. Take a look below at the Bloomberg chart.

This is why China is sticking to the plan. You can see that it has been very successful, so it is hard to break into a winning formula. The world has also benefitted as China has been able to keep many factories running even during the worst of the pandemic. It’s been a success.

Vaccinations

Around 90% of China’s population has been vaccinated. However, about half of those over 80+ have not been vaccinated. So, the older population would be vulnerable to a more open society. Also, the general view is that China’s vaccines are not as effective as the mRNA vaccines developed by Pfizer, BioNTech, & Moderna. These vaccines are not available in mainland China.

China is vulnerable to a spike in infections

China also has a patchy hospital network which means it could easily collapse if there was a sudden surge in infections. The Chinese Gov’t thinks the risks of opening up outweigh the benefits in terms of death and disruption.

Lack of an endgame

China does not have an official exit policy for its Covid Zero strategy. According to Bloomberg, China’s top virus expert stated that improving the access to antivirals, vaccination of the elderly, and getting hospitals better prepared should be a top priority. This indicates the way that an exit strategy may gradually appear.

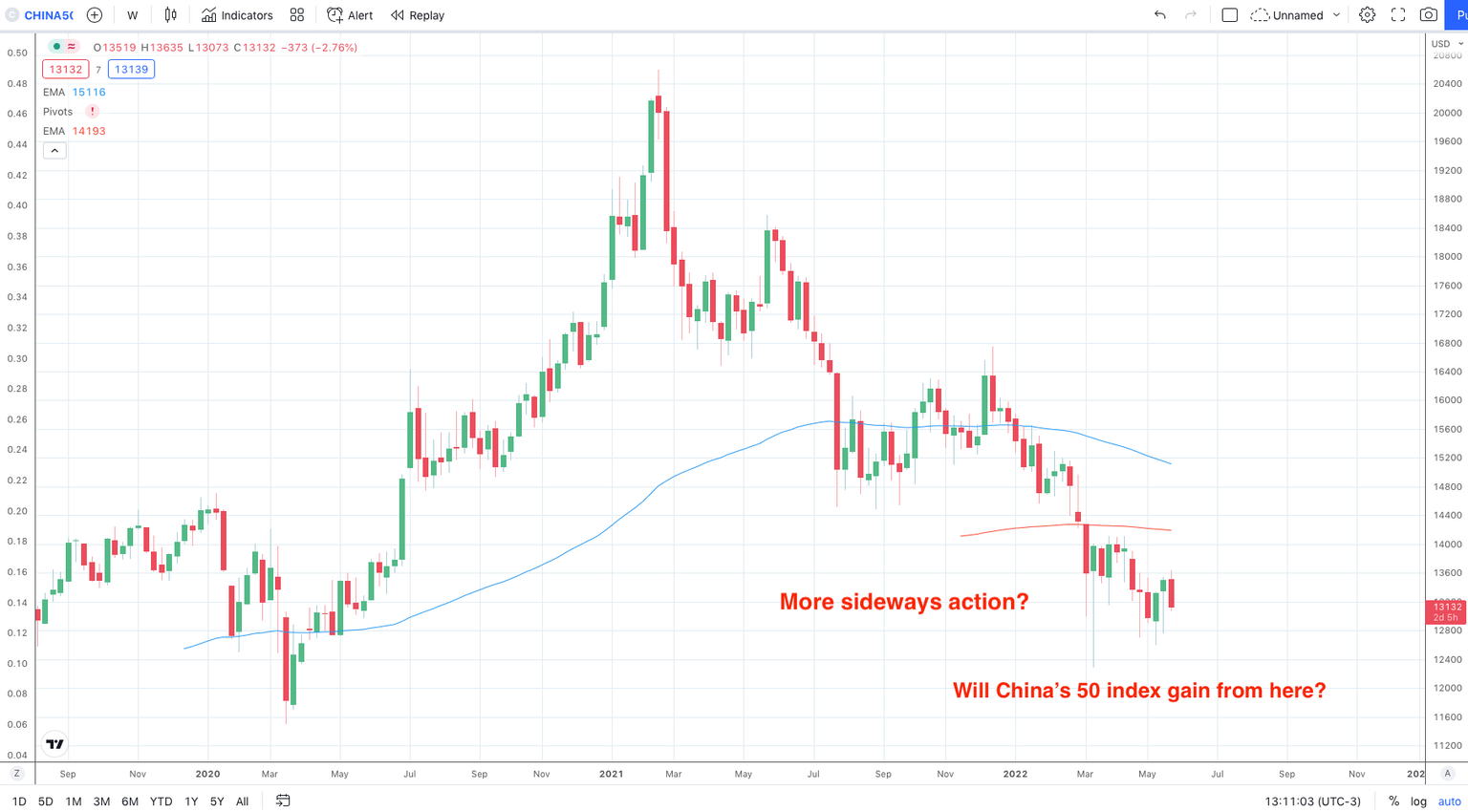

So, what does this article tell us? Well, it shows the logic behind China’s moves. It also shows why it will be very hard for China to have a sudden reversal of policy. The implications are that it will more likely be a slow burn in reversing/exiting the Covid-Zero policy than a quick pivot. So, China’s 50 index may keep moving sideways for some more time.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.