Why Boris' scandals (and two other reasons) may boost GBP/USD toward 1.27, 1.2780

- The UK government has reacted with stimulus to distract attention from scandals.

- Ongoing "Partygate" revelations may bring about more inflation and rate hikes.

- China's easing of restrictions and a FOMO mood on Wall Street also help.

GBP/USD bullish – there are three reasons that point to further gains and positive technicals.

*Note: This content first appeared as an answer to a Premium user. Sign up and get unfettered access to our analysts and exclusive content.

First, the Bank of England may have to raise rates to a higher level and at a faster pace. Why? The British government has announced a substantial stimulus package to mitigate the cost-of-living crisis. It is handing out money to the neediest households. The move came one day after a report showed a "failure of leadership" by Prime Minister Boris Johnson and his team in relation to parties at 10 Downing Street.

Since then, additional news about gatherings during lockdown has appeared, damaging the PM and his Conservative Party. There is room to expect further attempts to distract attention and to benefit the people. More government help means more stimulus, thus higher inflation and faster interest rate rises.

Secondly, China has relaxed restrictions on both factories in Shanghai and residents in Beijing. After the number of covid cases dropped, authorities allowed a return to economic activity in the country's two largest cities. That is good news, which weighs on the safe-haven dollar.

China's President Xi Jinping is sticking to his covid zero policy, and that could haunt markets once again. However, the current calm is promising for the world and for GBP/USD bulls.

Thirdly, the mood in Wall Street has substantially improved. After the S&P 500 avoided an official bear market –a 20% drop from the top – the "buy the dip" mentality returned. It is buoyed by several weak figures from the US, indicating that inflationary pressures may ease.

If the Fed is in less of a hurry to raise interest rates, stocks can rally. The correction has received some enforcement by a "Fear Of Missing Out" (FOMO) mood. Perhaps the worst is not over, but if others are buying, why would I want to stay out? That seems to be the current narrative.

Also here, there is a risk that the upswing has gone too far and that there could be a counter-correction. Nevertheless, the current upbeat mood is unfavorable for the dollar, thus bullish for GBP/USD.

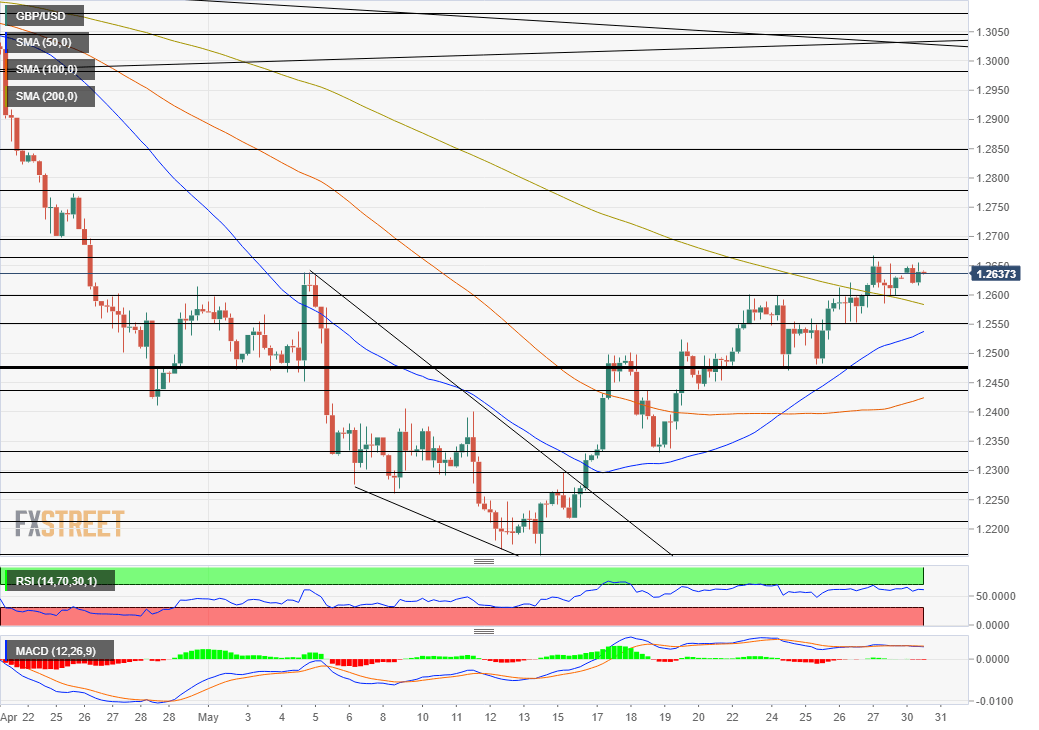

GBP/USD Technical Analysis

Technically, GBP/USD has been holding onto the 4h-200 SMA and the RSI is hovering between 50 and 70 – in healthy bullish territory.

Resistance is at 1.2665, the monthly high, and then at 1.27, 1.2780 and 1.2950, which all played a role in the pair's trading during April. Support is at 1.26, which capped cable earlier this month.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.