Week ahead: US inflation data due out next week

As the week is coming to an end we have a look at next week’s calendar. On Monday, we get Japan’s current account balance for March. On Tuesday we note the BOJ’s summary of opinions for their May meeting, the UK’s employment data for March, Germany’s ZEW figures for May and the US CPI rates for April. On Wednesday we note Sweden’s CPI rate for April and Canada’s building permits figure for March and Canada’s building permits figure for March. On Thursday we get Australia’s employment data for April the UK preliminary GDP rate on a mom basis and Manufacturing rate for March in addition to the preliminary GDP rate for Q1, followed by Norway’s GDP rate for Q1, the Eurozone’s revised GDP rate for Q1 and industrial production rate for March followed by the US weekly initial jobless claims figure, Philly Fed Business index figure for May, PPI rate and retail sales rates for April, Canada’s manufacturing sales rate for March and US Industrial production rate for April. Lastly, on Friday we get Japan’s GDP rate for Q1 and the US UoM preliminary figure for May.

USD – US Inflation data in focus

Fundamentals may have played a role in the dollar's direction this week. Specifically, the US announced on Tuesday that Treasury Secretary Scott Bessent and China’s economic tsar He Lifeng are set to meet in Switzerland for talks in regards to trade. The apparent progress between the two nations following the “trade” hostilities over the past month, may have been a well-received announcement as it may imply a deal may occur between the two nations. In turn such a possibility may alleviate market concerns for the global economy.

On a monetary level, we note the Fed’s interest rate decision occurred on Wednesday. The Fed remained on hold as was widely expected and thus attention turned to the bank’s accompanying statement and Fed Chair Powell’s press conference. Specifically, the comment that “Uncertainty about the economic outlook has increased further.” Showcases the concern by the Fed over the US’s trade policies and may imply that the bank may be prepared to remain on hold for a prolonged period of time.

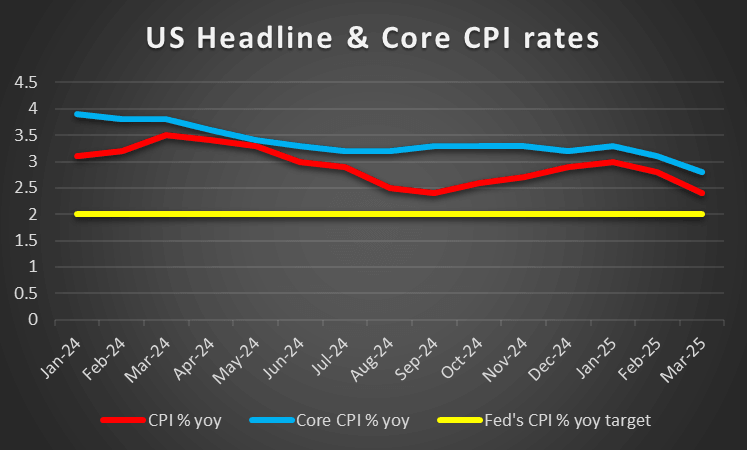

On a macroeconomic level, we are entering a week with traders anticipating the release of the US CPI rates for April which are set to be released next Tuesday. Should the CPI rates showcase an acceleration of inflationary pressures it may amplify calls for the bank to prolong their current monetary policy stance, which in turn could aid the dollar. On the other hand should the CPI rates showcase easing inflationary pressures, it may increase calls for the bank to cut rates in the near future which could weigh on the dollar.

Analyst’s opinion (USD)

Overall the trade talks between the US and China have been well received. However, we remain slightly pessimistic that a meaningful deal will be struck in the first meeting this weekend. Thus, the trade negotiations may take some while before bearing fruit. On the monetary side, we aren’t surprised to see the Fed remain on hold and would not be surprised to see them maintaining their current path, unless a significant easing of inflationary pressures appears in the upcoming CPI rates.

GBP – UK-US Trade deal announced

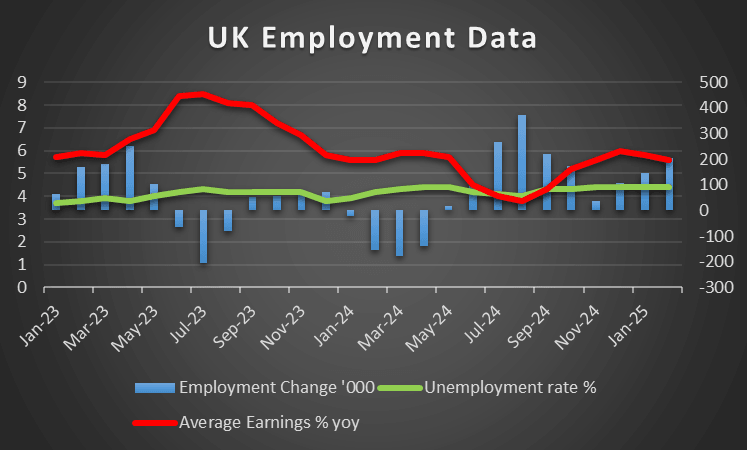

On a macroeconomic level, pound traders have some key financial releases emerging next week, with the UK employment data for March set to be released on Tuesday and the UK’s GDP rates on a mom basis and for Q1 on Thursday. Should the UK’s employment market come in better than expected, implying a resilient labour market in combination with a better than expected GDP rate, it may provide positive signs for the UK economy which in turn may aid the pound. On the flip side, should the data paint a different picture it could instead weigh on the sterling.

On a political level we note the ongoing negotiations between the UK and the US. Specifically US President Trump stated that “The agreement with the United Kingdom is a full and comprehensive one that will cement the relationship between the United States and the United Kingdom for many years to come. Because of our long time history and allegiance together, it is a great honor to have the United Kingdom as our FIRST announcement”. The trade deal was announced yesterday. The trade deal brings down the tariff on car exports from the UK to the US to 10% from 25% for the first 100,000 cars which per the Guardian roughly matches the amount exported by the UK to the US in 2024. Moreover, per the White House “The United States also recognizes the economic security measures taken by the UK to combat global steel excess capacity and will negotiate an alternative arrangement to the Section 232 tariffs on steel and aluminum.” Overall, the announcement is a positive development and could be beneficial for the UK Equities markets.

On a monetary level, the BoE cut rates on Thursday by 25 basis points as expected by market participants. However, fewer policymakers voted for the decision to cut rates with the actual number coming in at 7 versus the expected 9 and two members voting for the bank to remain on hold. Thus in spite of the bank’s decision to cut rates, the decision by two members of the MPC to remain on hold may have been perceived as bullish in nature, which could aid the pound.

Analyst’s opinion (GBP)

Overall, the announcement by President Trump may ease the BoE’s worries about a potential resurgence of inflationary pressures in the UK economy. Yet, interest now turns to the UK’s employment data next week and GDP rates on a mom and quarterly basis. The trade deal is a positive aspect but in reality it maintains more or less the status quo.”

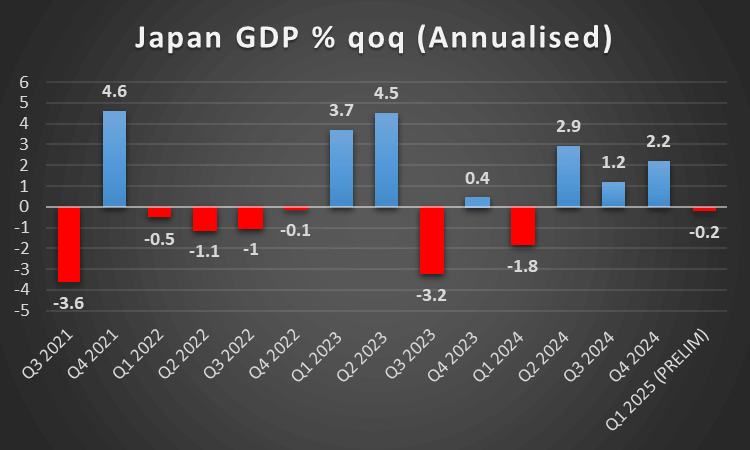

JPY – BoJ minutes showcase uncertainty

On a macroeconomic level for JPY traders, we note the upcoming release of Japan’s GDP rate for Q1 next Friday. The GDP rate is expected to showcase a contraction in the Japanese economy witheconomists currently anticipating the rate to come in at -0.2% which would be significantly lower than the prior rate of 2.2% and would also signal a contraction of economic activity. Such a scenario could weigh on the JPY in the coming week should it come in as expected or lower it may weigh on the Yen. Whereas should it come in higher than expected and showcases an expansion in economic activity, it may instead provide support for the JPY.

On a monetary level the highlight for Yen traders is the bank’s minutes where it was stated that “downside risks stemming from U.S. policy conduct had rapidly heightened and, depending on future developments in its tariff policy, it was quite possible that these risks would even have a significant negative impact on Japan's real economy. On this basis, the member expressed the view that, if this possibility increased, the Bank would need to be particularly cautious when considering the timing for raising the policy interest rate”. The comment showcases the heightened concerns over the economic risks as a result of the Trump administration’s trade policy agenda. The aforementioned comments may be perceived as a willingness by at least one policymaker to potentially refrain from hiking interest rates in the near future which could potentially weigh on the JPY. Lastly, traders may be interested in the release of the BOJ’s summary of opinions on Tuesday, which may provide greater clarity into the bank’s concerns over the risks mentioned previously in this paragraph.

Analyst’s opinion (JPY)

The BOJ’s concerns are not unfounded as trade deals and talks have only just begun. Thus we would not be surprised to see a cautious BOJ in terms of their remarks, which in turn may imply that the bank may refrain from hiking interest rates in the near future. However, the trade rhetoric can easily change on a day by day basis and thus close attention to any new developments may be warranted.

EUR – Germany’s ZEW figures in sight

We highlight the release of Germany’s ZEW figures for May on Tuesday as a gauge from the consumer's perspective of the German economy. Should the ZEW figures showcase an improvement by coming in higher than the prior figures, it may imply a stronger perception of the German economy, which may aid the EUR. On the other hand, should the figures showcase a deterioration of the conditions surrounding the German economy it may have the opposite effect which could weigh on the common currency.

On a fundamental level, the EU has been preparing countermeasures for the US with POLITICO reporting that the EU has put forth a retaliation package worth nearly €100 billion of imports including big-ticket items like aircraft that could get tariffed. Moreover, per the same report the lists include includes passenger cars, medical devices, chemicals and plastics, and a slew of agricultural products. Therefore in contract with other nations such as the UK, the EU appears to be gearing up for a confrontation with the US President or attempting to gain leverage for trade negotiations. Nonetheless, should the EU decide to fully engage in a trade war with the US it may spark concerns over the resiliency of the EU economy, which could weigh on the EUR.

Analyst’s opinion (EUR)

We remain concerned over the US-EU trade relationship, following the announcement that the EU may be preparing a package worth nearly €100 billion. Should the trade relationship with the US rapidly deteriorate, it could weigh on the common currency.

AUD – Australia’s Employment data is due out next week

Fundamentally speaking, Australia’s Prime Minister Anthony Albanese has won his re-election bid with the Labor party currently on track to win 90 seats at the time of this report, comfortably beating the 76 seats required in order to form a government. In turn, the political continuation in Australia may be perceived as bullish for the AUD, as the status quo remains intact.

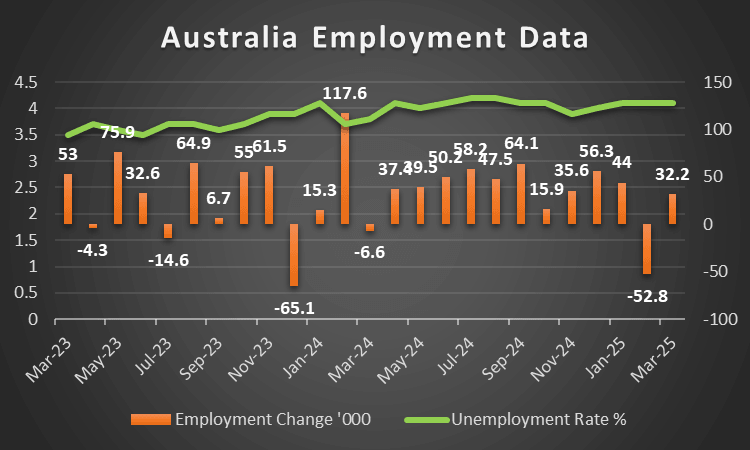

On a macroeconomic level, we note the release of Australia’s employment data for April which is due out next Thursday. Should the Australian employment data showcase a resilient labour market it may be perceived as bullish for the Aussie and vice versa.

Analyst’s opinion (AUD)

Overall, we the Aussie ceding control to the dollar next week, as we have the release of the US CPI rates. However, the Aussie could regain control over its direction with the release of the employment data. However, depending on the narrative which emerges from the US CPI rates, the aforementioned financial release may amplify or negate in part the impact of the US CPI rates.

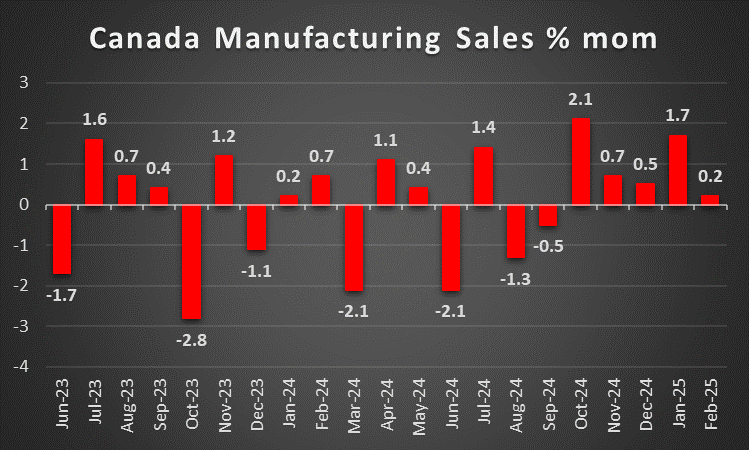

CAD – Canada’s unemployment rate due out today

On a fundamental level for Loonie traders, we note that the Canadian Federal elections have concluded. The final tally with 99.93% of the vote counted, stand with the Labour party acquiring 43.7% of the vote with the Conservative party coming in second with 41.3% of the vote. Therefore the Labour party has emerged victorious after a volatile election period, with Mark Carney now takingover as the Prime Minister of Canada. The continuation of Government with Labour maintaining control may imply political stability and thus may have aided the Loonie following the election result.

On a macrolevel it was a rather quiet week for Loonie traders, yet Canada’s employment data for April is set to be released this afternoon. Of interest is the unemployment rate which is expected to increase from 6.7% to 6.8% which tends to imply a loosening labour market. Therefore should the unemployment rate come in as expected or higher it could potentially weigh on the CAD and vice versa.

On a monetary level, we note the banks heightened concerns over the Trump administration's trade agenda with Reuters reporting that the bank noted “A long-lasting trade war poses the greatest threat to the Canadian economy. It also increases risks to financial stability”. Hence, we remain vigilant and will continue to monitor any comments by policymakers to garner further clues as to how the bank may take into account the ongoing trade developments.

Analyst’s opinion (CAD)

The continuation of political stability with the Labour Government may have been well received by market participants. Yet Canada’s unemployment rate for April which is due out today could potentially weigh on the Loonie, as a loosening labour market could increase pressure on the bank to continue on their rate cutting path. At the same time, the bank’s concerns over a prolonged trade war are visible and should the economic outlook deteriorate it may weigh on the Loonie

General comment

As a closing comment, we expect the USD to remain dominant in the FX market in the coming week given the release of the upcoming CPI rates. For the US Equities markets, we note that Trump has stated “You better go out and buy stock now” which may aid the US Equities markets, considering these are comments from the sitting US President. Yet, we note the friction between the US President and Fed Chair Powell continue with Trump stating that Fed Chair Powell is “Too Late” and is a “FOOL, who doesn’t have a clue”. Moving on, tensions between Pakistan and India remain elevated, with hostilities rising between the two nations. Should the situation escalate even further, it may aid gold’s price given its status as a safe haven asset.

Author

Phaedros Pantelides

IronFX

Mr Pantelides has graduated from the University of Reading with a degree in BSc Business Economics, where he discovered his passion for trading and analyzing global geopolitics.