USD/JPY pauses as Yen resists downward pressure

The USD/JPY pair is consolidating near 156.57 on Wednesday, pausing after three consecutive days of gains. This stability comes despite a notable shift in rhetoric from Bank of Japan (BoJ) Governor Kazuo Ueda, who stated the central bank is drawing closer to sustainably achieving its 2% inflation target – a strong signal that a policy tightening move could be imminent.

The market is now actively pricing in the possibility of a rate hike as early as next week’s BoJ meeting. Investors’ primary focus will be on Governor Ueda’s post-meeting comments, which are expected to shape the policy outlook for 2025.

The yen’s broader weakness is being fuelled by growing concerns over Japan’s public finances, exacerbated by expanded fiscal spending under Prime Minister Sanae Takaichi’s administration. Furthermore, the yawning interest rate differential between Japan and other major economies continues to incentivise short positions against the yen, which remains one of the world’s lowest-yielding currencies.

Technical analysis: USD/JPY

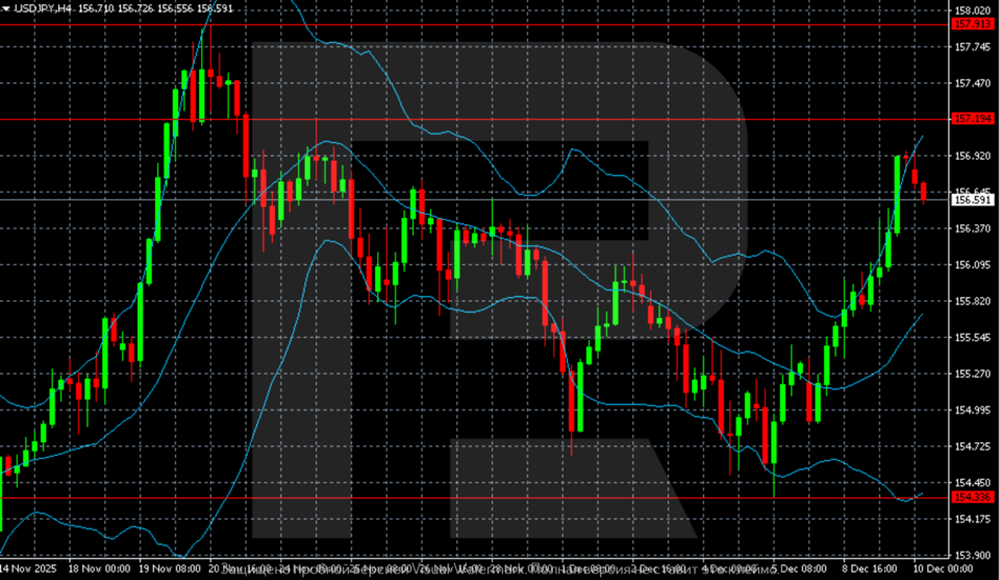

Four-hour chart

On the H4 chart, USD/JPY maintains its bullish structure following a strong impulse that propelled the price from 154.30 to the key resistance zone of 157.20–157.90. The pair is currently consolidating just below the 157.20 level, where selling pressure has previously emerged.

The price holding above the middle Bollinger Band confirms buyers retain overall control. The expansion of the upper band indicates elevated volatility and suggests the market is gathering strength for another attempt to breach resistance.

A decisive breakout and consolidation above 157.20 would open the path towards the 157.90–158.00 area. Should a correction unfold, the nearest significant support sits at 155.60. A break below this level would signal a deeper pullback, potentially targeting the major demand zone and the lower Bollinger Band near 154.30.

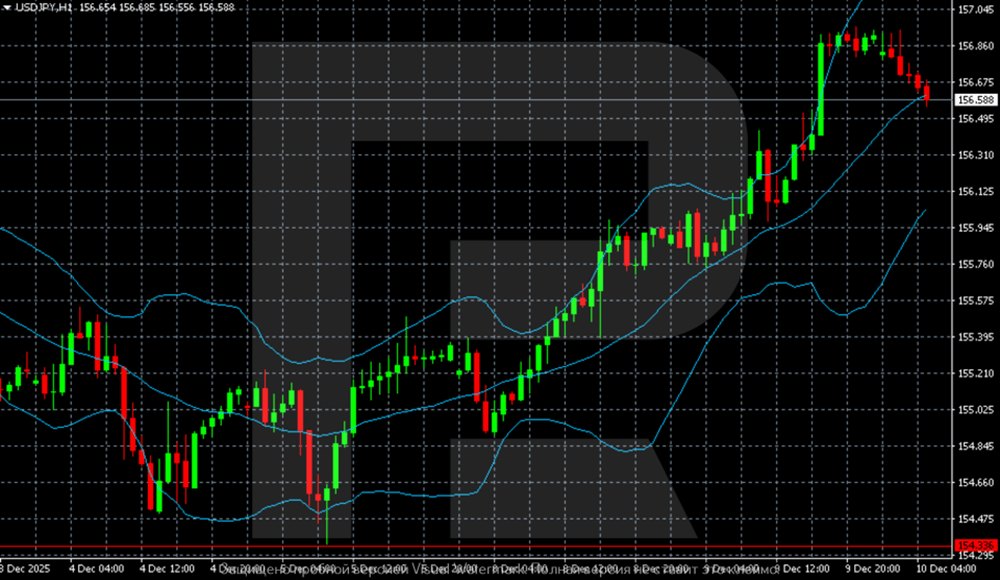

One-hour chart

On the H1 chart, USD/JPY is undergoing a pullback after its recent surge to 157.20. The decline has found tentative support near the middle Bollinger Band, with the pair attempting to stabilise around 156.50.

The near-term structure remains bullish, supported by the price’s position above the middle Bollinger Band. Dynamic support is forming in the 156.00–156.10 zone, aligned with the indicator’s lower band. The Stochastic oscillator has turned down from overbought territory, confirming the current short-term corrective phase.

For the uptrend to resume, buyers must reclaim the 157.20 level, which would pave the way for a test of 157.90. Conversely, a sustained break below 156.00 would be the first clear sign of bullish exhaustion, increasing the probability of a deeper decline towards 155.60.

Conclusion

USD/JPY is at a critical juncture, caught between bullish technical momentum and a shifting fundamental backdrop for the yen. While the pair’s uptrend remains technically intact, the impending BoJ decision introduces significant event risk. A hawkish shift from the central bank could catalyse a sharp correction. In the near term, the 157.20 resistance and 156.00 support levels are pivotal; a breakout from this range will determine the next directional move.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.