USD/JPY declines as safe-haven demand bolsters the Yen

The USD/JPY pair retreated to 153.10 on Friday, with the yen retaining a portion of its recent gains amid a flight to safety. A sharp uptick in stock market volatility, driven by concerns over a potential overvaluation of artificial intelligence stocks, prompted investors to seek refuge in traditional safe-haven assets, thereby supporting the Japanese currency.

The pair faced additional pressure from a broadly weaker US dollar. Signs of a cooling US labour market have reinforced market expectations of an imminent interest rate cut from the Federal Reserve.

Domestic data from Japan presented a mixed picture. Consumer spending in September rose by a modest 1.8%, following a 2.3% increase in August and falling short of the 2.5% forecast. While nominal wage growth accelerated to 1.9%, real household incomes continued their decline, falling 1.4% year-on-year. This marks the ninth consecutive month of decline in real incomes, highlighting the persistent squeeze on purchasing power.

In light of this, Bank of Japan Governor Kazuo Ueda stated that the central bank's wage growth forecast for 2026 will be a critical determinant for resuming rate hikes. For now, the BoJ maintains its accommodative stance, leaving monetary policy unchanged.

Technical analysis: USD/JPY

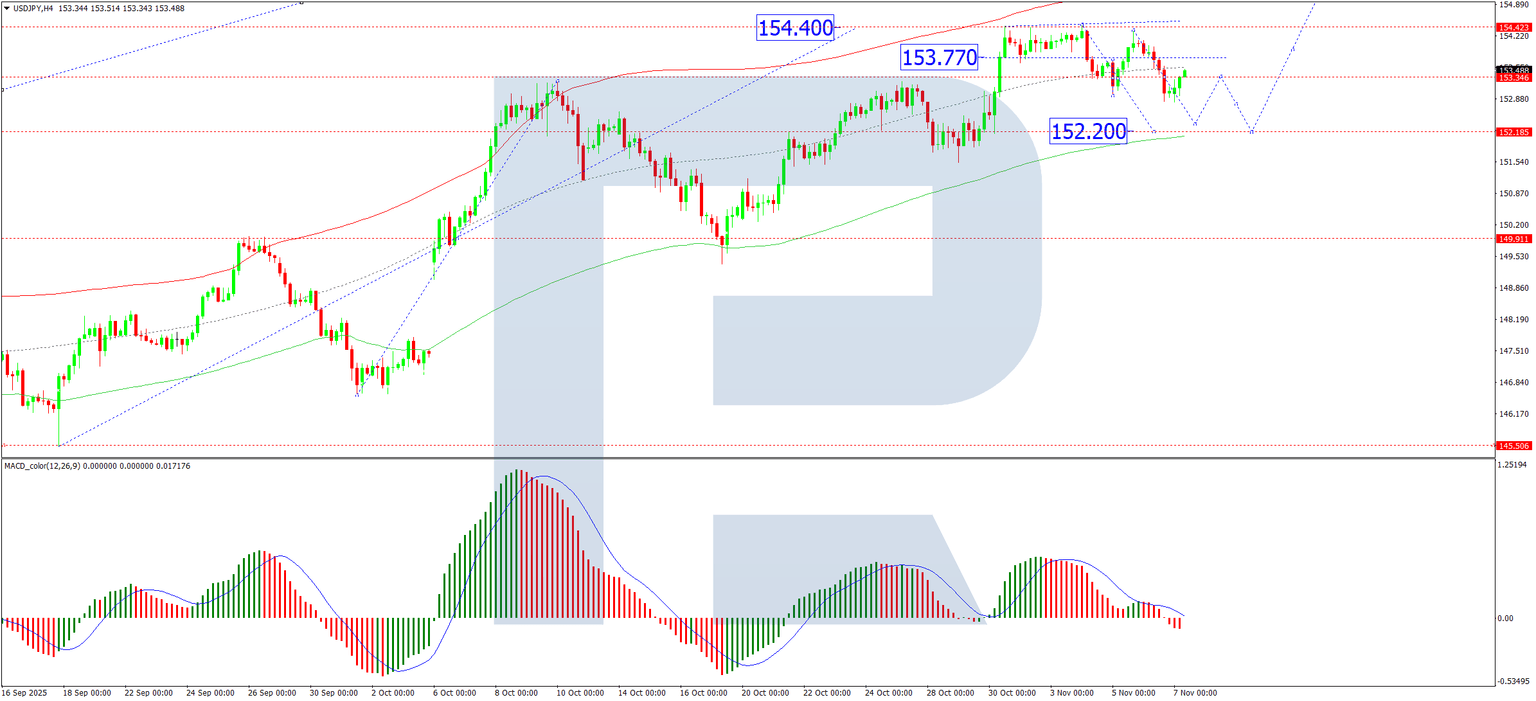

Four-hour chart

On the H4 chart, USD/JPY is forming a consolidation range around 153.33. We anticipate a near-term expansion of this range to the downside, targeting 152.20. Following this, the primary scenario involves an upward breakout, initiating a new bullish wave towards 155.70. An alternative downward breakout would signal a deeper correction towards 149.90 before any sustained recovery can begin. The MACD indicator supports this view, with its signal line below zero and pointing downward, confirming the current corrective momentum.

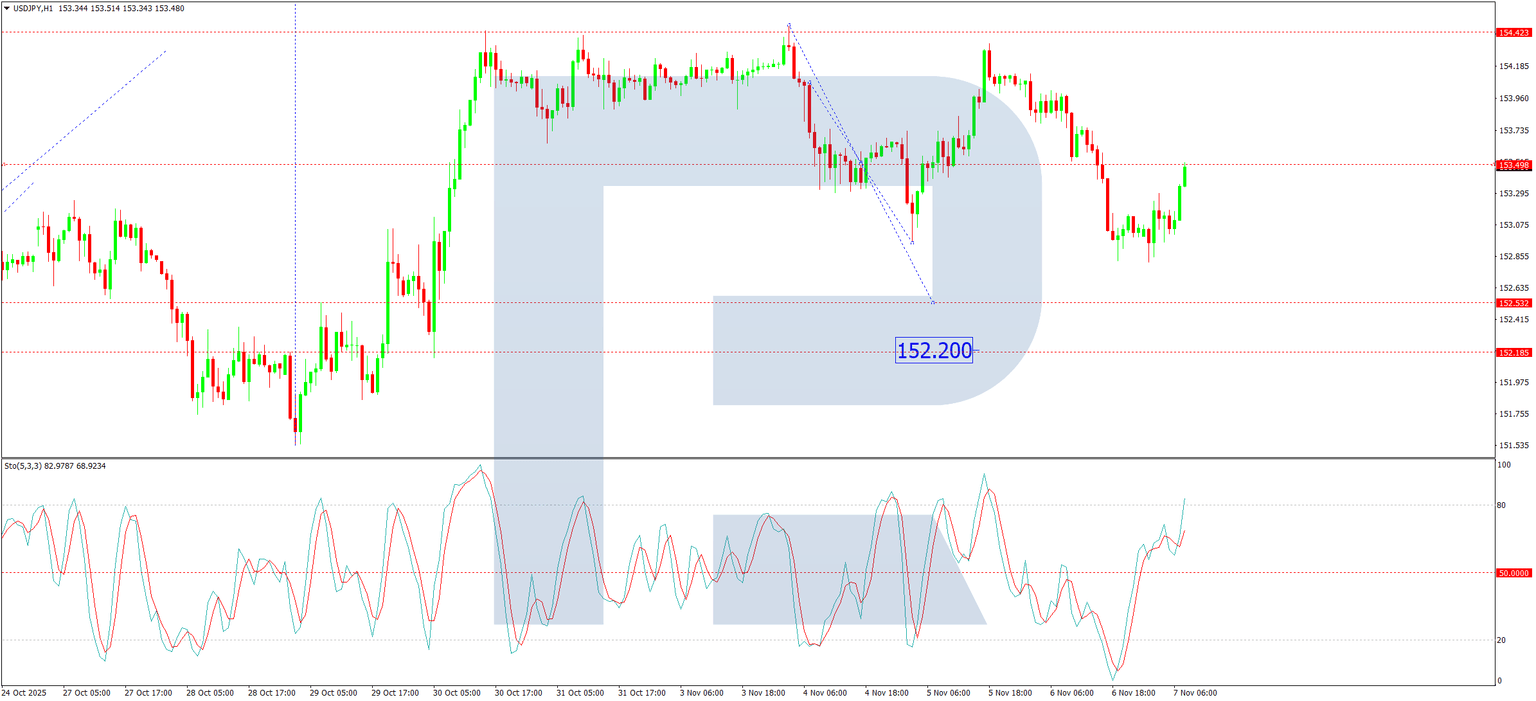

One-hour chart

On the H1 chart, the pair is completing a corrective rise to test 153.50 from below. A tight consolidation range is forming around this level. We expect this range to break downwards initially, with a first target at 152.52. A rebound to 153.50 may follow. The broader trajectory hinges on the subsequent breakout. An upward breakout opens the path to 155.70, while a downward breakout would likely extend the correction towards 149.90. The Stochastic oscillator on the H1 offers a conflicting short-term signal. Its signal line is above 50 and rising towards 80, suggesting the potential for limited near-term upside before the next directional move.

Conclusion

USD/JPY is caught between a weaker US dollar and mixed domestic signals from Japan. The immediate driver is risk sentiment, which has provided the yen with temporary support. Technically, the pair is in a consolidation phase, with a near-term bias for a dip towards 152.20. The medium-term outlook, however, remains tentatively bullish, targeting 155.70, contingent on a successful upside breakout from the current range.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.