USD/JPY 115 serves as a short-term resistance area

Currencies

The ECB refuses to join the global shift from ultra-easy policy to normalization despite solid demand and surging inflation. On currency markets, the euro pays a heavy price. EUR/USD gave up several supports, including the crucial one at 1.129.

The pound recovered soon from the BoE’s disappointment not to raise rates. Markets have every reason to assume it’s only postponing the inevitable. EUR/GBP 0.84 is being tested and could give in on both sterling resilience and euro weakness.

The ongoing taper process and increased rate hike odds in the US spurred USD/JPY towards the highest levels since 2017. USD/JPY 115 serves as a short-term resistance area.

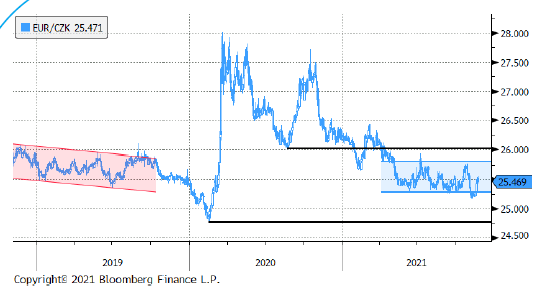

The CNB shocked markets with a whopping 125 bps rate hike to 2.25% in November. Once again, the CZK gains were not excessive and even reversed as concerns about a potential lockdown grow with CE countries deep into a 4th Covid wave.

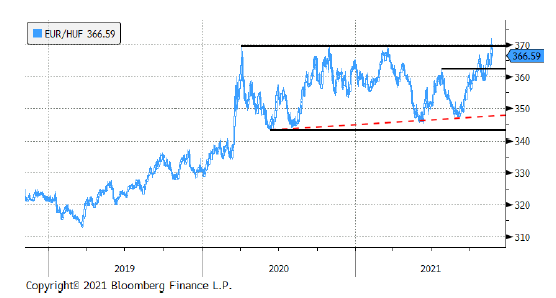

The MNB stepped up the tightening pace from 15 bps to 30 bps in November (base rate now 2.10%). It also announced other technical measures to tighten policy further. The HUF was not impressed, testing all-time lows around 370. It may prompt more aggressive MNB action to prevent a self-reinforcing loop between a weak currency and inflation.

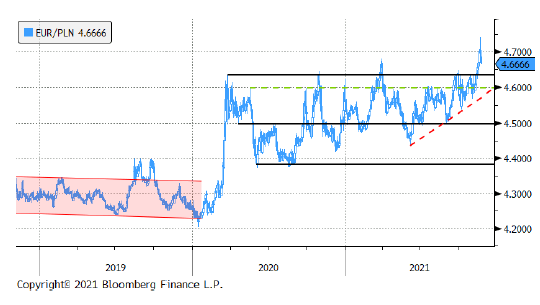

The MNB stepped up the tightening pace from 15 bps to 30 bps in November (base rate now 2.10%). It also announced other technical measures to tighten policy further. The HUF was not impressed, testing all-time lows around 370. It may prompt more aggressive MNB action to prevent a self-reinforcing loop between a weak currency and inflation. The Polish central bank continued to raise rates with a more-than-expected 75 bps to 1.25%. The zloty’s gain was short-lived. Markets rightly believe unabating inflation requires more decisive action but are cautious to frontrun a notoriously dovish NBP. The zloty’s upside in current market circumstances, accompanied by legal uncertainty (EU dispute), seems limited short-term.

Author

KBC Market Research Desk

KBC Bank