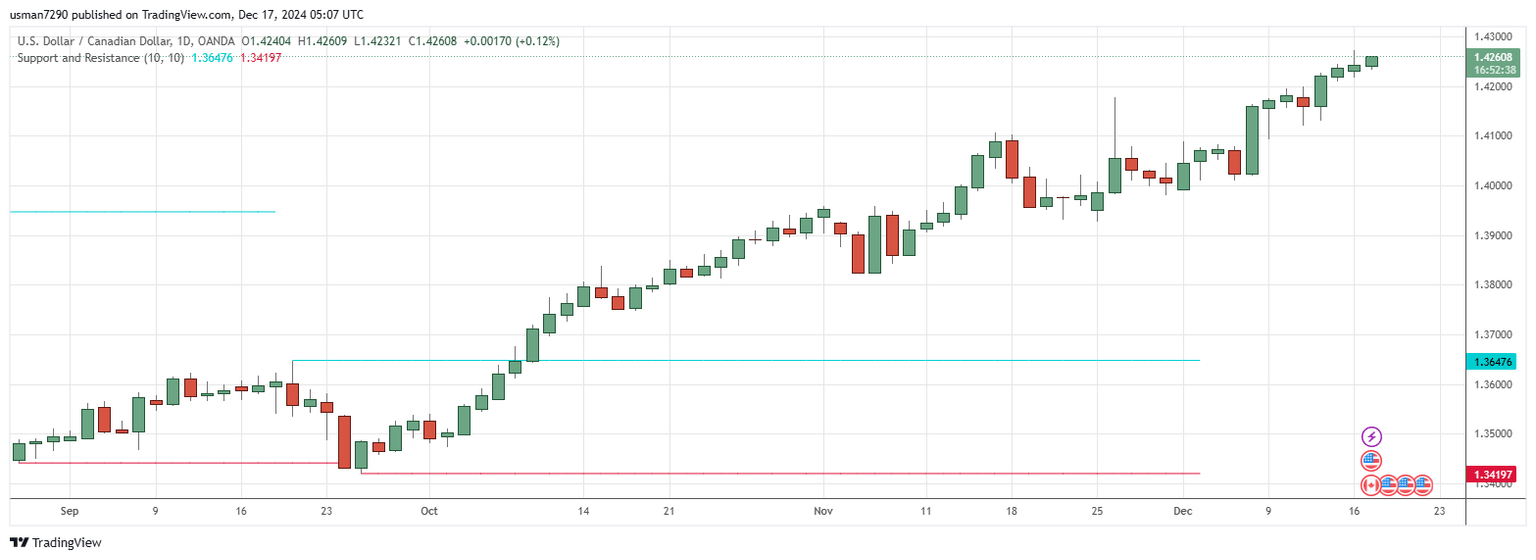

USD/CAD bulls target 1.4350: Key levels and trade setup for today

The USDCAD pair continues to exhibit strong bullish momentum, hitting its first key target at 1.4265 earlier today. This move underscores the pair's resilience within a clearly defined bullish channel, supported by technical indicators that signal further upside potential on the intraday and short-term horizon.

Technical overview

The stochastic oscillator is showing signs of a positive crossover, indicating that the upward trend has room to continue. The next immediate target is set at 1.4350, a level where bulls may look to book profits. The price action remains well-supported above 1.4205, which serves as a near-term critical level. A break below this support could trigger a corrective pullback, bringing the price toward the lower boundary of the bullish channel near 1.4100 before any renewed buying interest emerges.

Meanwhile, the broader trend remains constructive as long as the pair trades within this bullish formation, reinforced by technical support and momentum indicators pointing upward.

Trading strategy and outlook

Given the current bullish momentum and strong technical structure, traders may consider buying dips near 1.4205, with a primary target at 1.4350 and a secondary upside extension toward 1.4400.

However, vigilance is required, as a confirmed break below 1.4205 could invalidate the near-term bullish scenario, prompting a move toward the channel support at 1.4100. For risk management, stops can be placed just below 1.4190 to limit downside exposure.

Key levels to watch:

-

Support: 1.4205/1.4190.

-

Resistance: 1.4320/1.4350.

Trend forecast: Bullish

The technical backdrop supports a continuation of the upward trajectory, with the pair poised to capitalize on improving momentum indicators. Traders should monitor key levels closely and position accordingly for the next potential move higher.

Author

Usman Ahmed

Forex92

Usman Ahmed is a currency trader and financial market analyst with more than a decade of active trading experience.