US weekly prospects

United States

-

Powell emphasized data dependence, no clear signal following January jobs surprise.

-

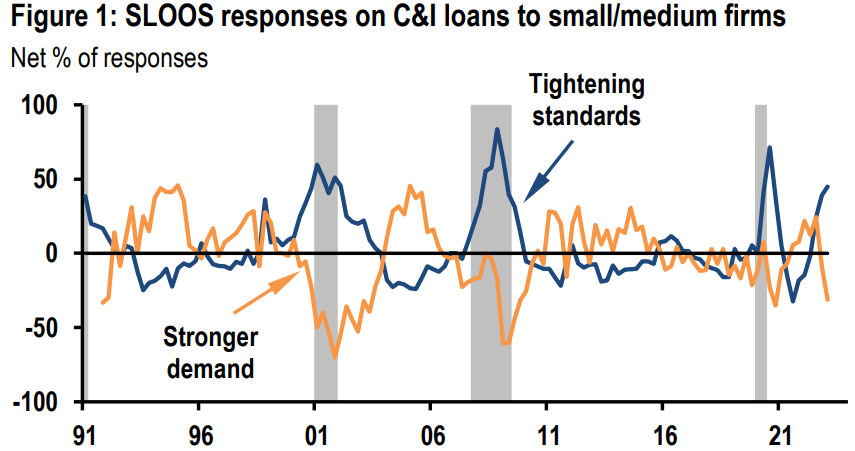

SLOOS showed tightening lending standards and weakening loan demand.

-

Initial claims moved up but stayed very low.

-

I forecast 0.5% gains for headline and core CPI: retail sales up 2.2%.

-

The week ending February 3 brought a lot of economic news, with a mid-week FOMC meeting and a very strong January jobs report on Friday.

The economic news has been much quieter since then, with FOMC chair Powell not giving much new information about monetary policy and limited economic reports (which generally were middle or lower tier in terms of profile).

Powell could have used his remarks on Tuesday to update signalling following the surprisingly strong January jobs report, but instead his commentary was pretty like what I heard from the February FOMC meeting.

Elsewhere, the news from the economic reports varied.

The Senior Loan Officer Opinion survey signalled that the economy was weakening, with intensifying tightening of lending standards and declines in demand across various loan types.

Jobless claims filings stayed very low through the latest weekly report, suggesting labour market strength.

Meanwhile, the University of Michigan consumer sentiment index continue its recent upward climb in the preliminary February report, but the reported level of sentiment remains very low.

The trade deficit widened significantly in December, but there was not quite as much widening as was anticipated and revisions were favourable with respect to 4Q GDP growth.

Powell speak again

Powell’s recent remarks at the Economic Club of Washington were pretty like what he said after last Wednesday’s FOMC meeting: disinflation has begun, it has a long way to go, and further interest rate increases are likely needed.

While he gave no sense that he was aiming to “set the record straight” after the perceived dovishness of last week’s presser, he did warn that the peak in the funds rate could be higher, particularly if the labour market remained strong.

In short, this was a message of data dependency.

Late last year Powell and other Fed speakers seemed intent on managing market expectations.

More recently, they appear content conveying that they will respond to the data and letting the market take that as fair warning.

This seems sensible. While Powell has recently questioned the market’s more benign inflation forecast, he hasn’t protested it too strongly— after all doing so would be asserting with vigour that the Fed will miss its inflation target.

Nor has he committed to maintaining restrictive rates for a certain amount of time.

Instead, he’s emphasizing what conditions require restraint.

Last year the Fed guided the market for many steps of the way, which was easier when the goal line was far away.

This year, the market shouldn’t expect the same degree of hand holding.

SLOOS keeps souring

Data from the Senior Loan Officer Opinion Survey (SLOOS) have been signalling weakening in the economy in recent quarters.

Lending standards for the main types of loans have been tightening lately, with this tightening generally intensifying across recent reports.

For example, in the last three quarterly reports, the net share of banks tightening standards for C&I loans to large and medium firms increased from 24% to 39% and now 45% (Figure 1).

For many of the reported lending types, the SLOOS data have shown an intensification of demand declines in recent quarters.

Demand for credit cards, meanwhile, had been increasing on net through the prior SLOOS report, but a net 11% of firms reported declining demand in the latest quarterly report.

Responses for the latest SLOOS were due on January 6; this report generally covers the three months of the fourth quarter.

A variety of economic indicators weakened late last year, and in the limited January data available so far, I see some signs of a pickup in economic activity early this year.

The SLOOS data could behave similarly, but the data in hand do not show signs of firming activity.

Initial claims still very low

The latest weekly jobless claims report continued what generally has been a strong run across recent labour market indicators.

While initial jobless claims filings rose by 13,000 during the week ending February 4, this marked only the first weekly move up since mid-December and the latest level of filings still looked very low by broad historical standards (Figure 2).

The continuing claims data have not been as upbeat lately, but still have been coming in at low levels by the standards of recent decades and look consistent with labour market strength.

The week ahead

With the January CPI report probably the most important economic release.

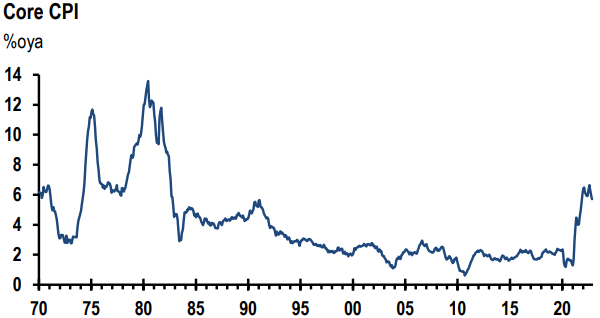

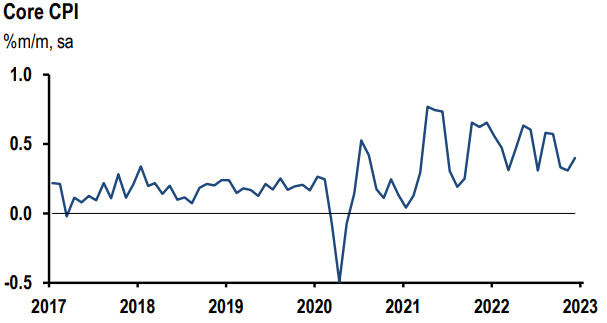

I forecast that the CPI rose 0.5% in January, with a solid 0.5% gain in the core index.

Used vehicle prices have fallen in recent CPI reports, but I expect some pickup in January with this turnaround contributing to firming in the monthly rate of core inflation.

Even though I look for solid monthly changes on both the headline and core CPI measures, I expect the related year-ago inflation rates to keep moderating into January.

The January retail sales report will be an important input for GDP tracking early on in 1Q. I think that retail sales data will behave similarly to a few other key economic indicators, with firming in January following weakening late last year.

I forecast that the headline jumped 2.2% in January, with sales of the important control group rising 0.5%.

We will also get additional reports on prices, manufacturing, and housing, among others.

CPI (Jan)

Release on Wed. Feb14th 00:30 (Sydney Time)

I forecast that the consumer price index rose 0.5% in January, with the related year-ago rate easing from 6.5% in December to 6.4%.

After dropping in recent earlier months, energy prices picked up in January and I forecast a 1.9% increase in the energy CPI to support the headline inflation print.

Food price inflation has been moderating lately and I look for that trend to continue, with a 0.4% increase reported for January (this would match the December gain but would be softer than the increases from earlier months).

Away from food and energy, I estimate that the core CPI rose 0.5% in January, with this 0.46% monthly change close to rounding down to 0.4%.

While this would be the firmest monthly change for the core CPI since September, I think the related year-ago rate will keep cooling, moving from 5.7% in December to 5.6%.

Within the core index, much of the firming in January relative to the past few months is expected to be related to used vehicle prices.

Used vehicle prices in the CPI fell by about 2% per month over the last three months of 2022 but industry data signal that we should see some firming soon, and I forecast a 0.5% gain for the CPI measure in January.

New vehicle prices have been pushing higher lately, but I expect some modest cooling in January with a 0.1% decline in prices.

Public transportation prices, meanwhile, have been a bit volatile in recent months.

With jet fuel prices rising lately, I expect to see some increase in airfares, and I estimate that public transportation prices rose 0.8% in January.

Shifting to the housing measures, I expect rental inflation to remain strong in January, but I look for moderating increases relative to the past couple of months.

I forecast that tenants’ rent increased 0.68% in January while owners’ equivalent rent moved up 0.64%. Industry figures signal that lodging prices moved down in January and I look for an 0.8% decline in the related CPI measure.

In some of the other main categories of the CPI, I estimate that medical care prices rose 0.3% in January, with this increase like the December gain.

Communication prices could get a lift from an increase in postage stamp prices, but I expect the boost from stamp prices to be pretty minor given that the increase took effect late in January and that postage accounts for less than 2% of the weight of the communication aggregate.

Overall, I look for communication prices to inch up 0.1% in January. Apparel prices have risen in recent months and I forecast a 0.4% gain for January.

Author

ACY Securities Team

ACY Securities

ACY Securities is one of Australia's fastest growing multi-asset online trading providers, offering ultra-low-cost trading, rock-solid execution, technologically superior account management and premium market analysis. The key pi