US inflation is too hot but softening fundamentals point to an eventual cooling

The Fed's favoured measure of inflation come in at 0.4% month-on-month, which is double the 0.2% rate we want to see, but cooling incomes and spending suggest inflation will moderate again in coming months, leaving the door open to a June Federal Reserve rate cut.

Inflation jumps 0.4% MoM, but at least no new surprises

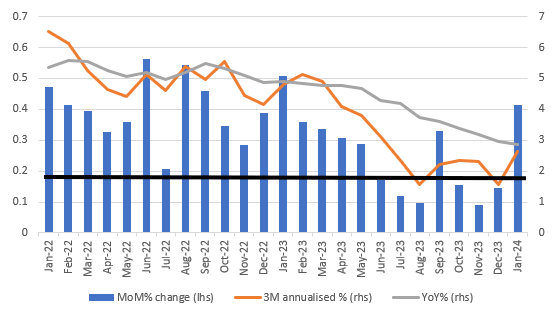

So the core PCE deflator did indeed come in at 0.4% MoM/2.8% YoY as the market had anticipated following those elevated core CPI and PPI prints – but given the recent performance of US data the fear was we could get yet another upside surprise. This is the Fed's favoured inflation metric to follow (it is broader in coverage than CPI and in the Fed's view better represents the spending patterns of the US consumer). The super-core measure, which strips out housing from core services came in at 0.6% MoM. There was a downward revision to December, now reporting a 0.1% MoM increase versus 0.2% initially reported.

While today's number in itself is too hot for the Federal Reserve to contemplate an imminent rate cut, we have to acknowledge that for six out of the past eight months we have been tracking below the 0.17% MoM rate we need to consistently hit to bring annual inflation back to 2% over time. While February may also remain a little hot (remember lots of services change their fee structure at the start of the year), we look for a return to numbers in the 0.2% area from March onwards, helped by factors elsewhere in the personal spending and income report.

The core personal consumer expenditure deflator, MoM%, 3M annualised & YoY%

Source: Macrobond, ING

Softening income & spending should help deliver slower inflation

January personal income did rise a lot more than expected, increasing 1% MoM versus the 0.4% consensus with worker compensation increasing 0.4% MoM, dividend income jumping and a 2.6% increase in transfer payments, largely reflecting the cost of living adjustment (3.2%) for social security recipients. However, importantly, there was a 6% MoM increase in tax payments and with inflation still eating into spending power, real household disposable income was a very disappointing 0% MoM. Given this is the primary source of funds to fuel real consumer spending growth in an environment where households have largely run down pandemic era accrued savings and the costs of consumer credit are so high, this suggests that 2024 spending growth should trend quite a bit softer than in 2023.

Indeed, we got a negative 0.1% MoM reading for real consumer spending in January. Weaker spending growth should gradually help dampen inflation pressures so while there is little prospect of an imminent interest rate cut, we think there will be enough information to trigger a Federal Reserve response at the June FOMC meeting as it starts to move monetary policy back to a more neutral footing.

Real household disposable income ($bn) versus pre-pandemic trend

Source: Macrobond, ING

Read the original analysis: US inflation is too hot but softening fundamentals point to an eventual cooling

Author

James Knightley

ING Economic and Financial Analysis

James Knightley is the Chief International Economist in London. He joined the firm in 1998 and has been covering G7 and Western European economies. He studied economics at Durham University, UK.