Trade gap widens to record amid import surge

Summary

Businesses pulled forward needed industrial supplies and retailers stocked their shelves with consumer goods in March ahead of tariffs. April may bring a last ditch effort of firms front running tariffs, but after that net exports are set to reverse dramatically.

Out of balance

We already learned that a major front-running by U.S. businesses led imports higher and culminated in a near-five percentage point drag from net exports on first quarter GDP growth—the biggest drag from net exports in data going back more than a half-century. Today’s data tell us the details of March trade.

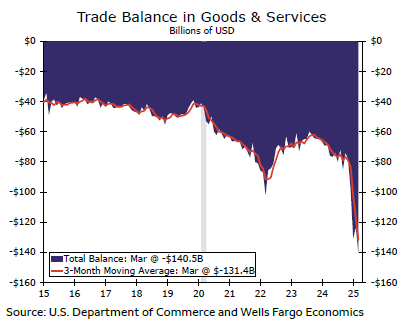

Industrial supplies imports have been the main event having surged in December and January, and continued to pour into the country at elevated levels in February and March. March also brought a bit of a newer pull forward development, with consumer goods imports up 28% or by $22.5 billion during the month. A surge in pharmaceutical products drove most of the gain in consumer goods imports, but most categories were higher over the month. Together these categories led total imports to rise 4.4%, which dimmed the more modest 0.2% gain in exports (chart). The total U.S. international trade deficit widened to -$140.5 billion (chart).

Author

Wells Fargo Research Team

Wells Fargo