The major indices have a moderate down day – What's next for S&P 500?

Recap July 26 - The S&P opened with a 14 handle gap down and then continued another 38 handles lower into a 12:01 PM low. From that low, the S&P rallied 19 handles into a 1:12 PM high. From that high the S&P declined 23 handles into a 3:08 PM low of the day. From that low, the S&P bounce 9 handles into the close.

7/26 – The major indices had a moderate down day to finish with the following closes: DJIA - 228.50; S&P 500 - 45.79; & the Nasdaq Comp. - 220.09.

Looking Ahead – Tuesday had a moderate decline for most of the day. However, in overnight trading the market has rallied enough to wipe out most or all of Tuesday’s decline. This in combination with Wednesday being a Fed day says to me, Wednesday looks like a good time to take the day the day off. The next major change in trend window is for a three 3 way cluster coming on 7/28 PM – 7/28 AC. Please see details below.

The Now Index has moved back to the NEUTRAL ZONE.

Coming events

(Stocks potentially respond to all events).

B. 7/28 PM – Helio Mars enters Aries. Important change in trend Stocks.

C. 7/28 PM – New Moon in Leo. Major change in trend Financials, Grains, Precious Metals, CORN, GOLD, OJ.

D. 7/28 AC – Jupiter in Aries Retrograde. Major change in trend Oats.

E. 8/01 PM – Pluto Contra-Parallel US Sun. Major change in trend US Stocks, T-Bonds, US Dollar.

F. 8/03 AC – Moon’s North Node 90 US Moon. Major change in trend US Stocks, T-Bonds, US Dollar.

Stock market key dates

Market math

Fibonacci – 7/28.

Astro – 7/27, 7/29, 7/29 AC.

Please see below the S&P 500 10-minute chart.

Support - 3880 Resistance – 4012, 4088.

Please see below the S&P 500 Daily chart.

Support - 3880, 3780, Resistance – 4012, 4088.

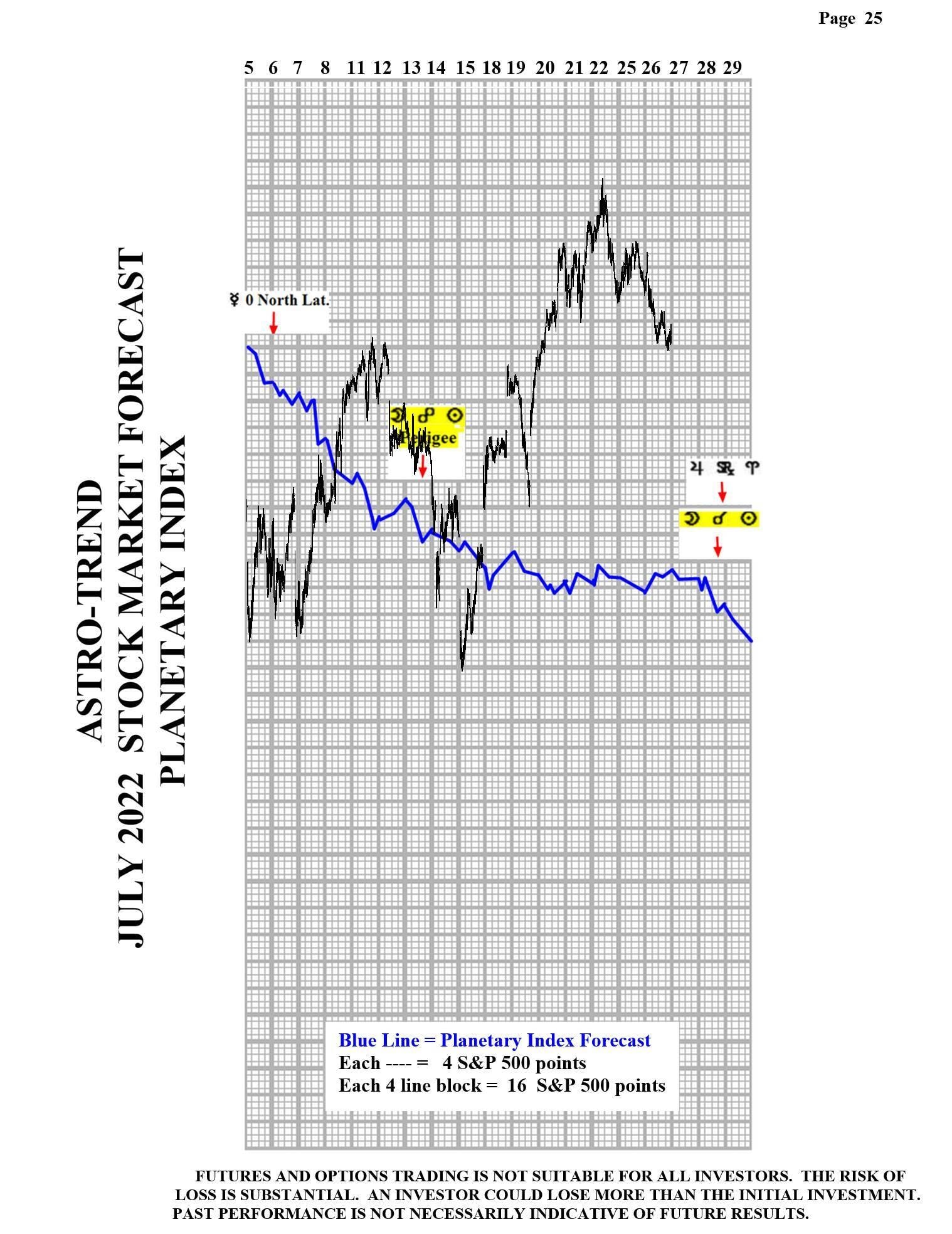

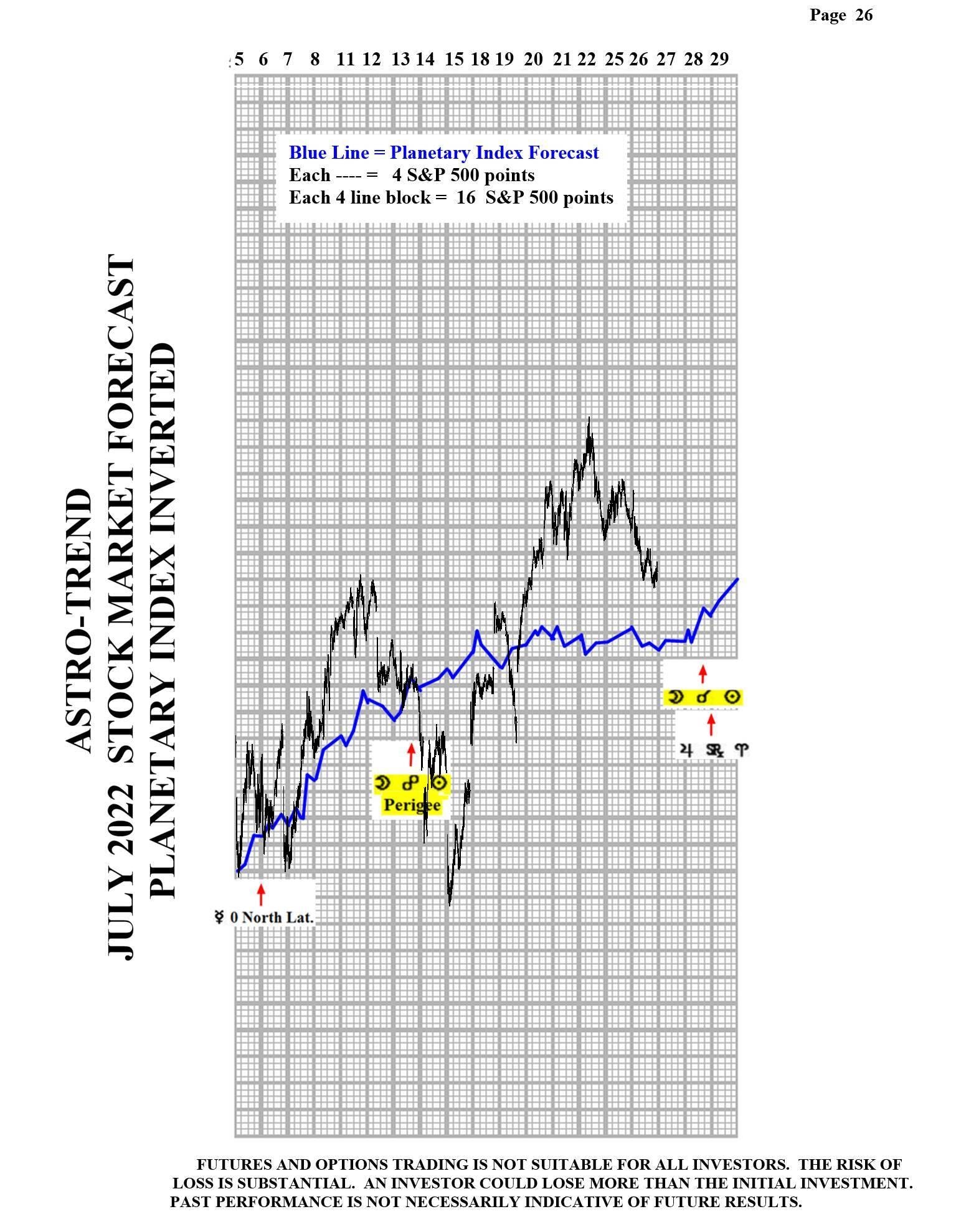

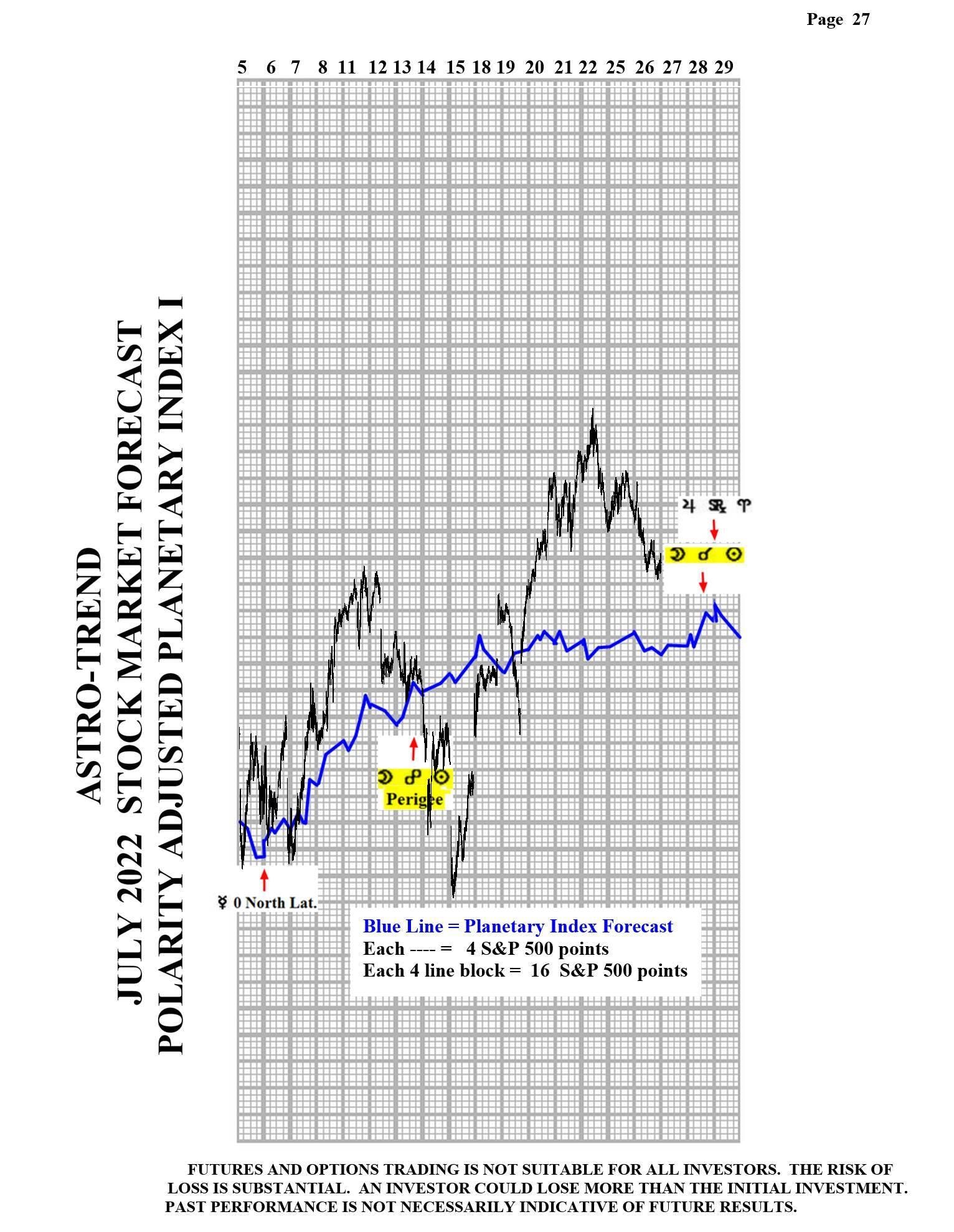

Please see below the July Planetary Index chart with S&P 500 10-minute bars for results.

Author

Norm Winski

Independent Analyst

www.astro-trend.com