The Dollar Index is taking a thrashing

Week to date, the US Dollar Index, a measure of the US dollar’s value against a basket of six major international currencies, is down 2.0%. The downside move changed gears yesterday following the Fed’s rate decision and updated forecasts, showing that three rate cuts are projected in 2024, with the Fed Funds futures pricing double that at six rate cuts for next year! We also saw through the Fed’s dot plot that rate hikes are off the table for now.

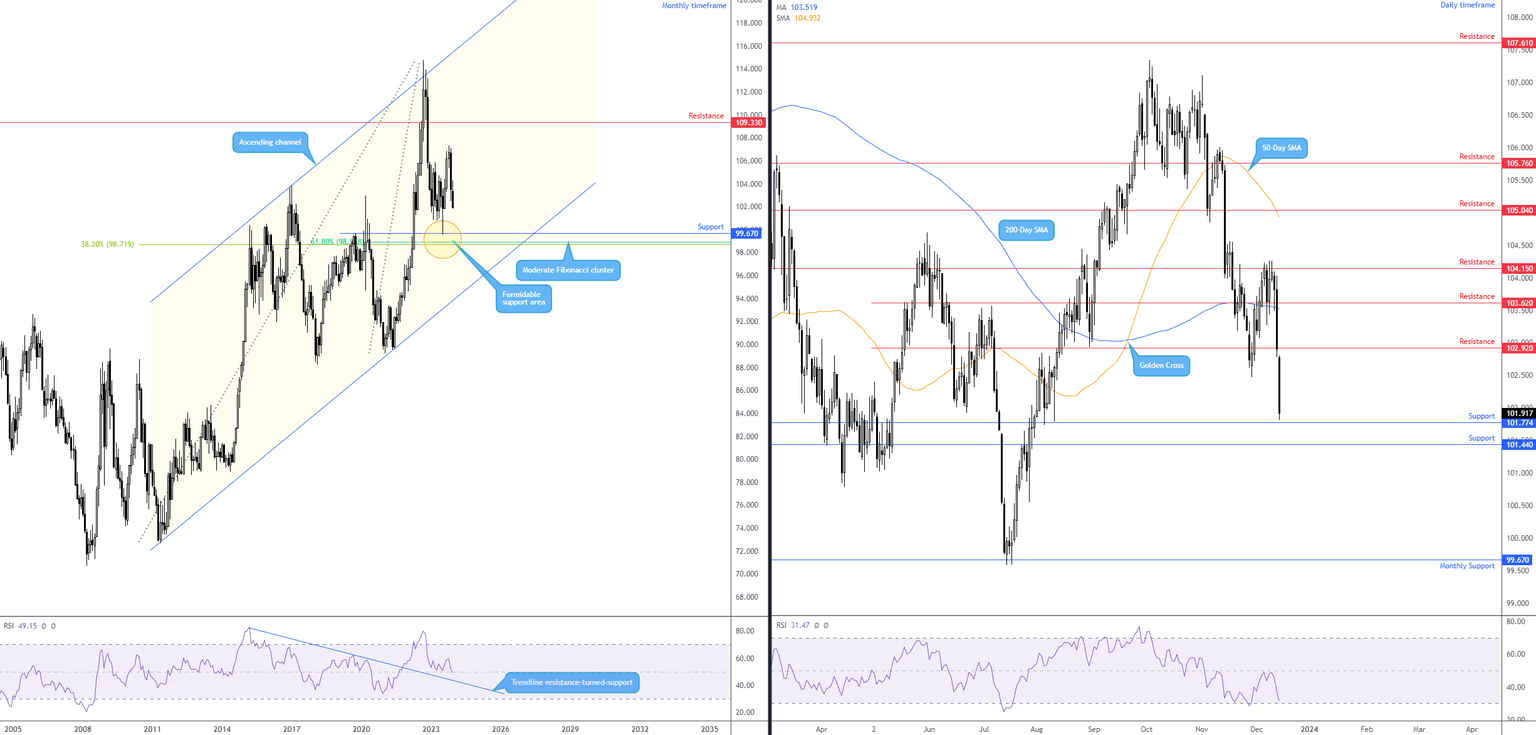

Daily timeframe: Support nearby

According to price movement on the daily timeframe, it has been another one-sided bearish affair for the greenback thus far today, clearing bids around support at 102.92 (now marked resistance) and extending losses south of its 200-day simple moving average (SMA) at 103.52. As you can see, this has landed the index within striking distance of a support zone formed between 101.44 and 101.77.

Additional technical observations from the daily timeframe are that the index is firmly in a downtrend now, shown through a series of lower lows and lower highs, as well as the 50-day (104.93) and 200-day SMAs turning south.

Monthly timeframe exhibits scope to target lower levels

While the daily timeframe is nearing an area of potential support, the monthly timeframe suggests further underperformance could be upon us toward the 100.00 level (support seen just beneath at 99.67).

While it is possible that bulls attempt to make a show from daily support between 101.44 and 101.77, aided by the Relative Strength Index (RSI) nearing oversold space on the daily chart and the 50.00 centreline on the monthly chart, downside appears the more favoured path overall given the macro outlook and room to nudge lower on the monthly. This means we could see buyers challenged at daily support if tested, and a break south here may unlock the trapdoor to the 100.00 area.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,