Silver building strong momentum – Further gains expected

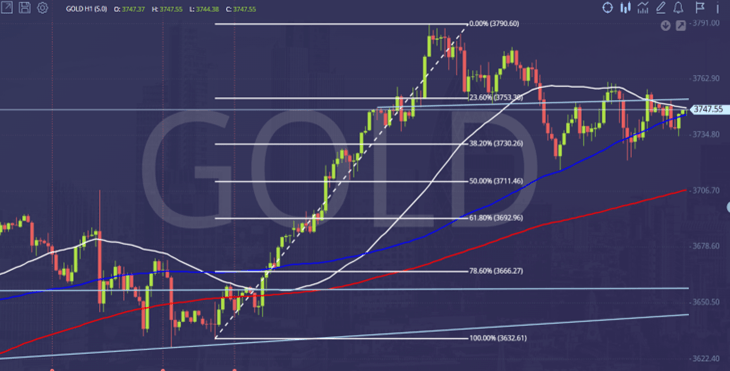

XAU/USD

Gold in a short term correction. The pattern is not yet clear but it could be a bull flag.

We must wait for clarity.

First support at 3725/20. Targets: 3735, 3745. Longs need stops below 3715.

A break below 3715 risks a slide to 3710/08 then 3696/93, perhaps as far as 3690/88.

However shorts are risky in a strong bull trend so I do not recommend - I prefer to sit & wait for a clear signal or pattern.

We could have minor resistance in the 3742/46 & again at 3755/59.

A break above 3761 can target 3771/74 & 3777/79.

Further gains retest the all time high at 3790/3791.

A weekly close above here would be a buy signal for the start of next week.

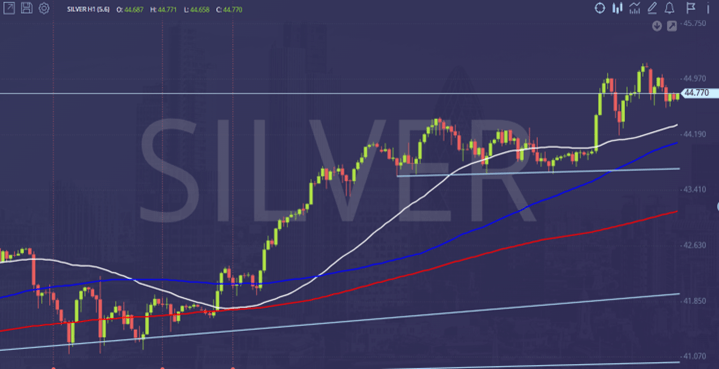

XAG/USD

Silver made a low for the day exactly at first support at 4370/60 for the second day & shot higher through 4410/15 to retest 4444/4446.

The break higher hit my targets of 4455/60 & 4480/85 before a high for the day at 4523.

New targets: 4546/49, 4570/74, 4592/97, 4615.

As I suggested at the start of this week, silver appears to be building strong upward momentum.

Strong support at 4420/15 & longs need stops below 4400.

A buying opportunity at 4365/60 & longs need stops below 4345.

WTI Crude November future

Last session low & high: 6406 - 6535.

WTI Crude beat resistance at 6350/6385 to target 6435/45 & 6520/40.

All targets hit with a high for the day exactly here.

A break above 6560 should be a buy signal targeting 6640/60, perhaps as far as 6530/50.

Support at 6400/6350. Longs need stops below 6320.

Author

Jason Sen

DayTradeIdeas.co.uk