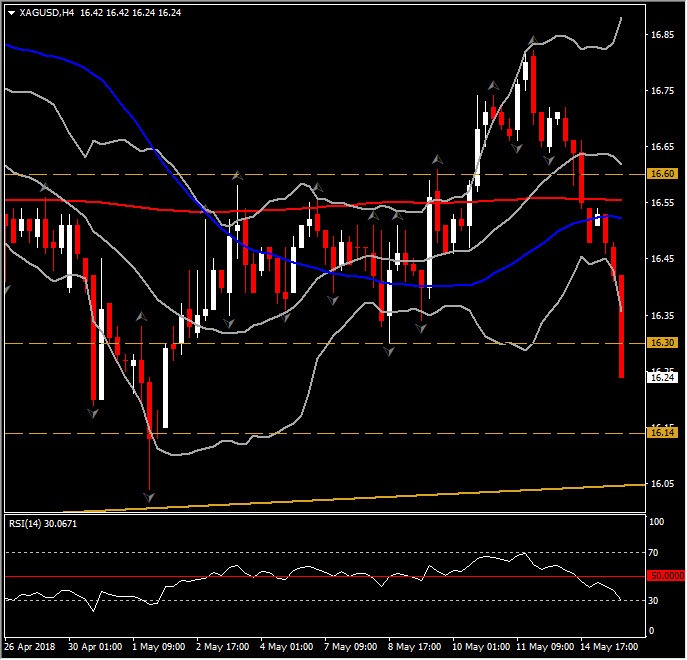

XAGUSD, H4 and DAily

Silver drifted lower, down to the last week low, at $16.30, from $16.72 highs. The sellers entering the picture as the dollar rallies, and as Treasury yields firm. The USDIndex is on four-session highs of 92.98, up from overnight lows of 92.61.

The Silver has been seen ranging since Ferbuary, with the ranges been narrow within 16.04 – 17.34. The urgency to take the contract higher has been limited since last week, as the market takes a breather from recent geopolitical angst. However there are still a lot of geopolitcal concerns at the background, since pending U.S. sanctions on Iranian exports remain a dominant them in market narratives, while uncertainty about whether the Iranian nuclear deal will survive without the US. Meanwhile, we have ahead the meeting between US and China, with US focused on avoiding a trade war with China and moving towards a peace deal with North Korea.

Silver has been seen crossing yesterday below the 20-DAY MA, while today is down by 1.3% since open price at 50 DAY MA. The price is moving close to recent Daily down fractal, after breaking the support level at 16.30, in the daily chart with weak momentum. This opens the way to 16.00 level. The RSI is currently 43, while MACD confirms the increase of negative momentum. Hence despite that asset has been in a Falling wedge, the last year, we still have not seen any sign of reversal to the upwards. Oppositely the XAGUSD is in a negative pressure so far.

The same bearish movement holds in the short-term, as price is traded outside the lower Bollinger Bands pattern, while based on technical indicators, momentum is strong enough to provide a sustained move lower. The RSI is holding slightly above the oversold territory. Next support levels are at 16.15 and at year’s low at 16.04. The latter is a strong support area and therefore is likely to see a reversal to the upwards is price does not manage to break below that area. Resistance holds at the 50-DAY MA, at 16.55.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.