Sign of post-tariff air pocket in Durable Goods Orders

Summary

The best that can be said of today's durable goods report for April is that there are signs of life in spending on info-processing equipment, and the drop in civilian aircraft orders was not as big as feared. But underlying orders activity is sputtering after firms front-loaded orders pre-tariffs.

Underlying orders losing ground

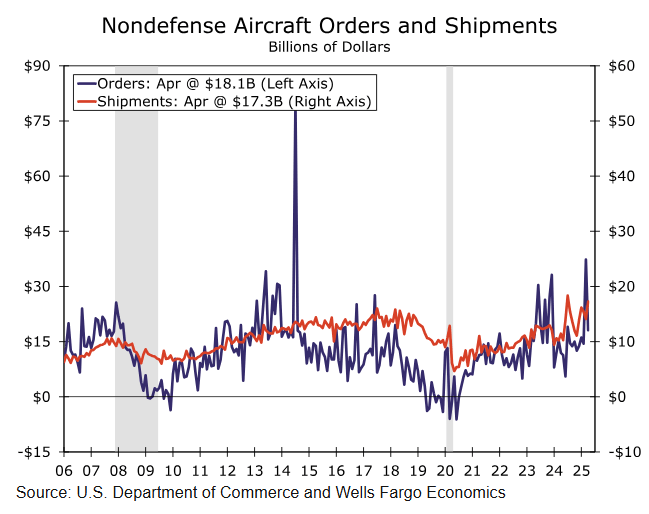

Durable goods orders fell 6.3% in April amid a drop in civilian aircraft orders (chart). Coming on the heels of a 158% surge in aircraft orders the prior month and amid fairly soft orders data from Boeing, we had been expecting a larger decline than the 51% drop in aircraft that was revealed in today's report (chart).

Excluding transportation orders rose a scant 0.2%, a rise that was essentially negated by a downward revision to the prior month's flat reading which now shows up as a 0.2% decline. The upshot is that when you exclude the volatile transport sector, the level of underlying durable goods orders is only slightly lower in April than it was in February.

The flattening in orders activity was presaged by the ISM manufacturing new orders component which has been back in contraction territory for the past two months. The softening in animal spirits is also evident in the National Federation of Independent Businesses (NFIB) small business optimism index which has fallen in each of the past four months. The capital expenditure plans index from that same NFIB survey tied a 14-year low last reached in April 2020 at the height of the pandemic.

At the end of the day there is little sign of resiliency in capex today. Businesses have grown increasingly cautious on the outlook and underlying capex conditions remain constrained, not just by continued uncertainty related to tariffs but around the cost and accessibility of capital and, perhaps most importantly, underlying demand conditions.

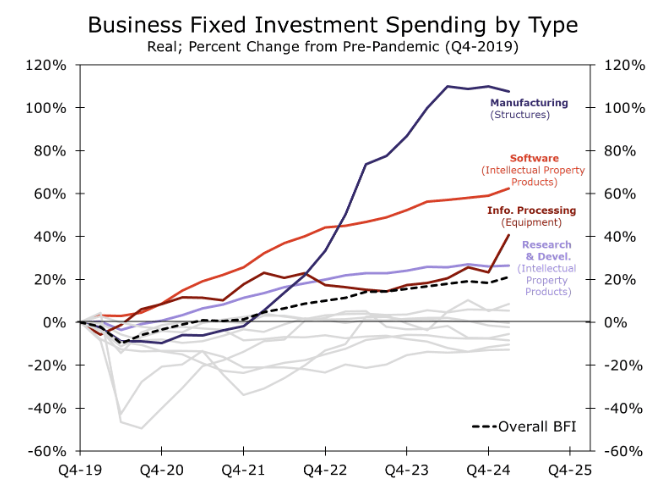

Despite choppy and broadly negative orders data, equipment spending was actually solid in the first quarter, marking the fastest quarterly pick-up in 14 years outside a one-quarter post-pandemic pop in Q3-2020. But most of the strength stemmed from the fastest quarterly gain in information processing equipment on record, which suggests businesses likely pulled forward some demand ahead of tariffs.

Even as information processing has been a bright spot in the post-pandemic capex environment, the Q1 bounce marks a notable pickup—as seen in the nearby pulled forward, it's the third fastest category of capex spending today. We may ultimately not see as much payback in Q2 as we were previously expecting either. Nondefense capital goods shipments, which feed into the BEA's measure of equipment investment, bounced back in March (+3.5% when including aircraft) after ending Q1 on a weak note.

While aircraft continues to drive some strength, spending on computers & related products were the lone-bright spot in April where orders rose 6.5% during the month, and suggests demand here may be more than just tariff-induced. In a time when large capital outlays may feel irresponsible, businesses continue to funnel some dollars into information processing equipment which can require less of an outlay than refitting machinery and can ultimately aid in materializing technological advancement.

All told, core capital goods orders (nondefense and excluding aircraft) slipped by the most in six months underscoring the weak underlying trend in demand today and suggest that the growth in H1-2025 equipment investment likely overstates the current strength in capex.

Author

Wells Fargo Research Team

Wells Fargo