Reflation trades pummelled as Fed shift resets markets

Global developments

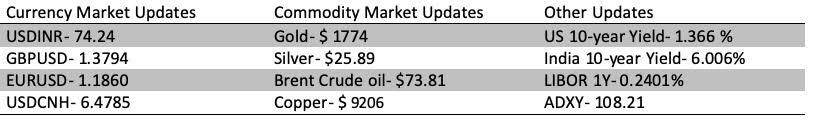

Rising short-term yields in the US have dampened long-term inflation expectations. As a result, the US yield curve has flattened. While 2y yield has risen to 0.26%, 10y yield is now below 1.40%.5y inflation expectations which were close to 2.3% before the policy are now close to 2.10%. The US Fed, therefore, has succeeded in getting the long-term inflation expectations to converge to its target of around 2%. It would not want to let it dip much further for fear of growth stalling. Therefore we may see Fed officials step in to prevent the yield curve from flattening further through verbal intervention. Fall in inflation expectations has caused the US real rates to harden at the longer end and that is fuelling Dollar strength. The focus this week would be on the BoE policy on Thursday.

Domestic developments

The RBI minutes were dovish and MPC members felt it was necessary to prioritize growth over inflation in the wake of the jolt to the economy on account of the second wave.

Equities

Dow and S&P had ended with cuts of around 1.5% on Friday. Asian equities are also trading weak. 15400 is an extremely crucial support for the Nifty followed by 15030. We do not see 15030 getting broken in this swing.

Bonds

The G-sec auction went through reasonably well on Friday. The 2026 security was partially devolved on PDs. The yield on the benchmark 2030 security had ended at 6.01%. We may see long-term yields come under pressure, tracking long-term Yields in the US and on dovish MPC minutes.

USD/INR

Given the dent in risk sentiment, Asian currencies are trading around 0.4% weak against the Dollar. It will be interesting to see if 74.30 holds on a closing basis. Tracking the offshore onshore 1m spread will be crucial to gauge panic if any.

Strategy: Exporters are advised to cover a part of their near-term exposure between 73.80-74.30. Importers are advised to cover through forwards on dips towards 73.30. The 3M range for USDINR is 72.50 – 75.50 and the 6M range is 73.00 – 76.50.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.