Recovery in France: Slowed before it started?

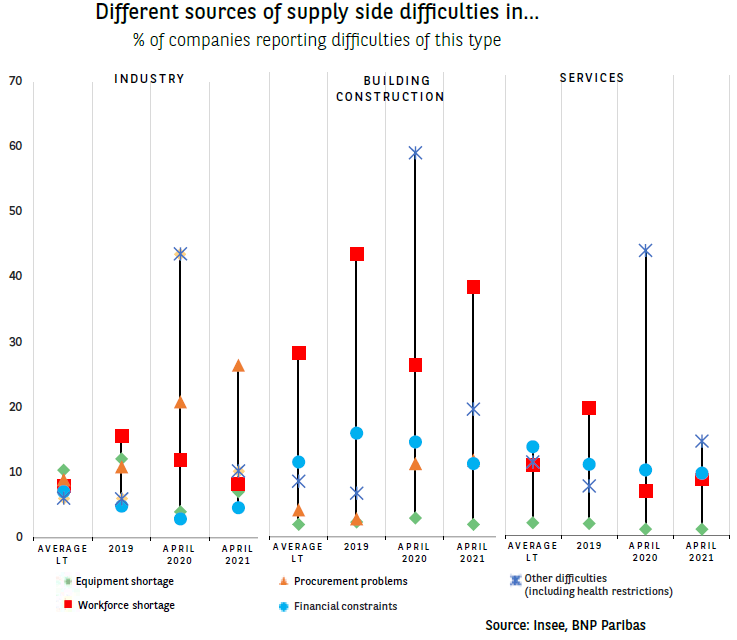

The increase in supply side difficulties identified by INSEE’s economic surveys in April 2021 requires a closer look. It is to be hoped that it will not hold back a recovery that is only just beginning to take shape. The rise has been particularly noticeable in the industry sector and has mainly been blamed on procurement problems that significantly exceed average levels from past years. In the construction sector, a shortage of labour has been the main difficulty (as it was before the crisis) but procurement constraints have also increased sharply. In the services sector, supply side difficulties relate primarily to health protections measures. In this sector however, demand side problems are affecting a greater number of companies.

Procurement issues were also highlighted by the Banque de France in its economic update on 10 May. They were mentioned by slightly over a quarter of companies in the industry and construction sectors, although it is noteworthy to add that they have not so far affected these companies’ own prospects of an improvement in activity levels. This is reassuring and suggests that if these difficulties do hold back the recovery, the effect will be moderate. This said, a rapid easing of the supply side difficulties will be needed. For those relating to health protection measures, this will come from the lifting of lockdown measures. For the problems in procurement and recruitment the way out is less clear.

Author

_XtraSmall.jpg)

Hélène Baudchon

BNP Paribas