Pre Asia open: Hurricane to headwind

Markets

US stocks are trading moderately higher, and bonds lower Monday as bank stresses relax a bit further. And this allows investors more breathing room to position ahead of a busy end-of-the-month data week docket and an even busier April with Q1 earnings season knocking on the door.

A key source of relief in the banking system has come from government messaging. President Biden, Secretary Yellen, and Chair Powell have indicated that all depositors are likely to be protected in essentially all cases at all banks.

Today's move higher in rates highlights the importance of duration and cost of capital as longer duration Tech and Communication Services stocks -- which had outperformed over the past few weeks -- are the worst performing sub-sectors in the S&P 500 today. Coupled with the overall resilience we've seen in equity markets since the banking contagion began, higher yields and today's market movement seem somewhat contradictory in the wake of what could be a meaningful growth shock to the US economy. But higher rates reflect a macro sigh of relief of sorts which signals the worse case recessions scenarios move to the back burner for now.

While last week's hurricane could still provide significant headwinds due to the reduced availability of credit to the real economy, there is a growing recognition that this could help the Fed inflation fight by keeping growth below potential despite China reopening amid an improving backdrop in Europe.

And as importantly, the rates markets are starting to pull off bets that this banking event forces the Fed to ease aggressively due to imminent recession concerns. After a lengthy yield curve inversion, pricing in Fed cuts confirms that investors think the recession is around the corner. And while the odds of one have picked up, a soft landing is not entirely out of the conversations.

And while there are many issues folks should be concerned about, from tighter lending standards to eroding the commercial real estate market values. Still, these concerns were on investors’ radars before the SVB risk event. And, despite the higher yields today, rates have fallen massively, attenuating some of the issues that banks have been facing.

In the meantime, officials will continue to have an information advantage over market participants. To that end, traders will focus more on policy speeches and potential adjustments to policy tools than the macro data for some time.

As was widely discussed in trading circles over the weekend, it seems reasonably likely that the SNB accounted for a significant portion of FIMA activity. The most important clue came in the SNB statement last week, “The SNB is providing large amounts of liquidity assistance in Swiss francs and foreign currencies” (emphasis added). Yesterday, we received some further evidence. First, the SNB reported muted Dollar auction activity with only one bank participating. Second, the SNB also reported a similarly sized jump (CHF 52bn) in bank sight deposits this morning. All of this suggests that the SNB used its Fed holdings to access Dollars in a large but relatively concentrated fashion and therefore was likely related to the SNB’s emergency actions. In principle, these actions have no direct currency impact; central banks use the FIMA facility to swap US Dollar assets (Treasuries) for US Dollar cash.

This week, we get initial March soft data and the February core PCE, but most markets participant will be focused on the H.8 lending data that comes out on Friday. Bank lending data in the H.8 release should become a more important complement to the Fed balance sheet data (H.4.1) in the future as the lending data (which is released with a longer lag) starts to cover the stress period and has more direct implications for the economic impact.

Investors will better understand the data that helped inform the March FOMC decision and Committee projections in the coming weeks. But it is worth noting that all but one participant anticipated at least one more rate hike this year, so it seems likely that at least lending data through that time did not strongly preclude some further policy rate tightening.

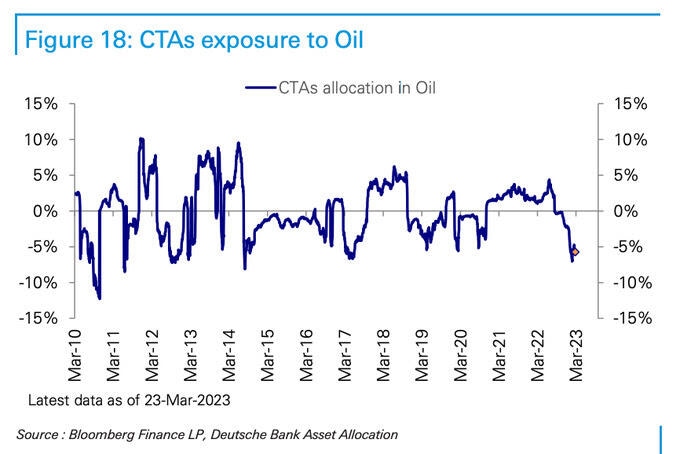

Oil

Just as oil traders were coming around to the idea that the latest US banking episodes end up as a smaller rumble than a global contagion risk, oil prices received an unexpected supply shock bounce amid reports that Turkey stopped pumping crude from Kurdistan via a pipeline following an arbitration decision that confirmed Baghdad's consent was needed to ship the oil. Given the low net open interest in Oil futures, traders were likely forced to chase this move and probably not adequately positioned for any shift to $80, which could be a pivotal move since CTA’s are thought to be short. However, their technical signals appear to be all over the place recently.

The oil market turned excessively pessimistic due to a possible US credit impingement. But prices should recover well in most of the current growth scenarios unless there is an unlikely economically damaging US credit crunch, which would most likely turn global. But after a VAR shock, it could be a slightly longer road to Brent $90 than we had expected into Q2. Still, with volatility easing, it should allow bullish fundamentals to better compete with headline stress.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.