Platinum flirts with two crucial resistances

Metals are trying to shine ahead of the Federal Reserve (Fed) meeting. So far, they are pretty shy, but the small movements seen now can develop into something bigger in the near future. Today we won’t talk about gold or silver but only platinum, which out of those three actually has the biggest chance to succeed.

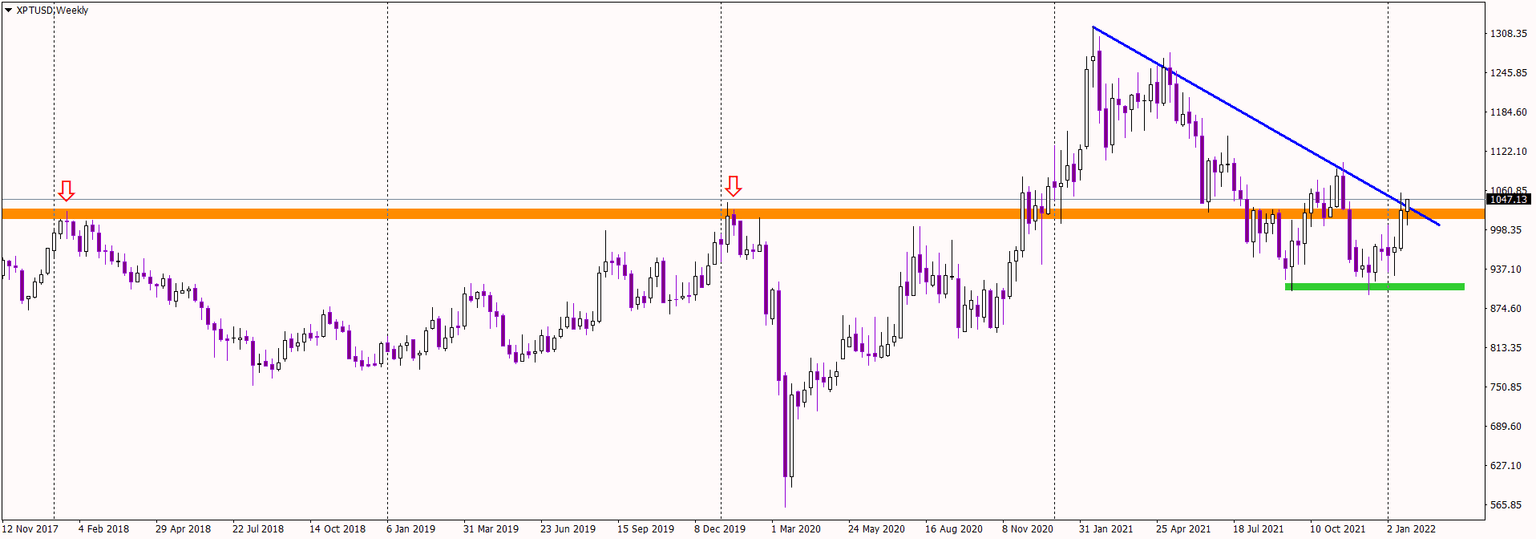

Platinum is currently in a place that’s absolutely crucial for its future. The price is on the crossing of two resistances: a horizontal and a dynamic one. The horizontal is the area around 1025 USD, which has proved to be effective in 2018 and 2020 (orange). The dynamic one is the mid-term down trendline (blue), connecting lower highs since the beginning of the 2021.

A breakout of these two resistances – as in the price closing the day above them - would be an amazing long-term buy signal. That would be the first but very important step towards reaching highs from early 2021.

Of course, on the other hand, failing to break that resistance and in consequence bouncing off it, would be a strong sell signal.

Which one will Platinum choose? I guess we’ll find out pretty soon with a little help from the Fed. There’s a clear scenario, whichever way platinum moves.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.