Philly Fed Manufacturing Index Rises To 3-Year High

In what could be a sign of a turnaround in the US manufacturing sector, the Philly Fed manufacturing index rose to a 3-year high in February. The index jumped from 17.0 in January to 36.7.

A positive reading indicates expansion in the sector. The data also surprised the consensus estimates which forecast a decline to 12.0.

German Producer Prices Rise in January

Producer prices in Germany grew 0.2% on the year in January. This reverses the 0.2% decline in December.

The gains came on a 3.6% increase in durable consumer goods. On a month over month basis, producer prices were up 0.8% after a 0.1% increase in the previous month.

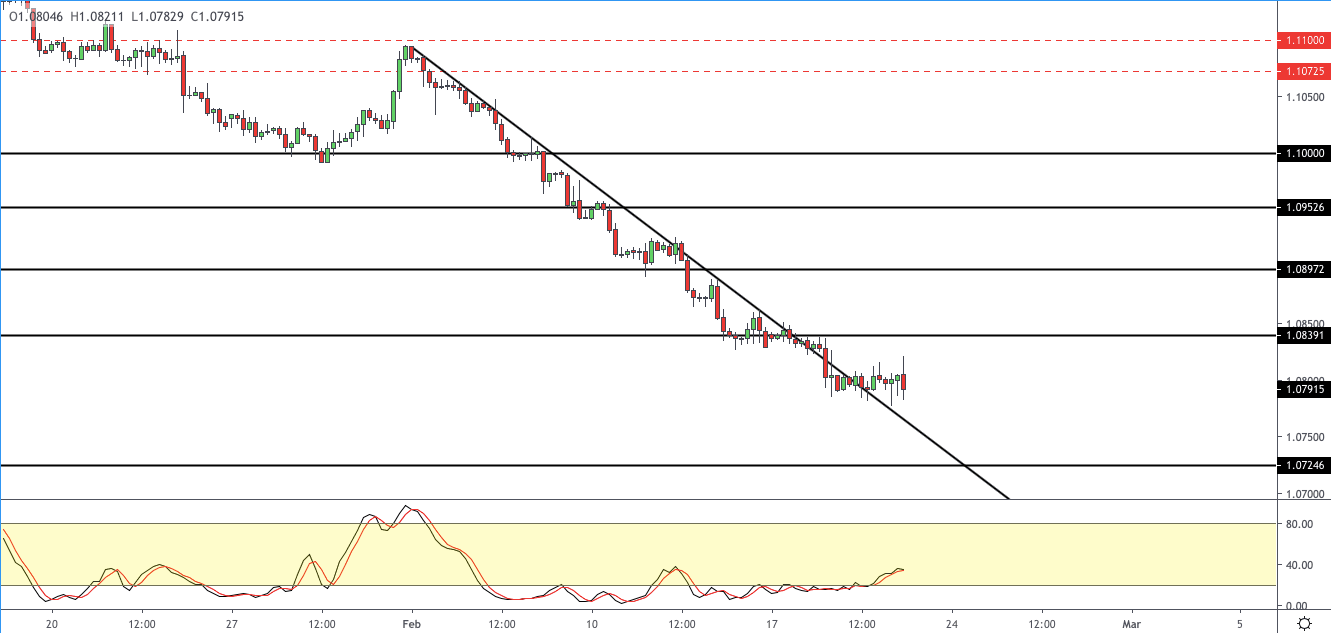

Is the EUR/USD Showing Signs of Bottoming?

The common currency is trading a bit weaker, but the momentum is clearly slowing. Price action remains anchored to the lows at 1.0790 for the past three sessions.

There is a modest increase in the Stochastics oscillator, but this exposes the risk of a bearish bias. A close below 1.0790 will accelerate declines to 1.0724.

Crude Oil Keeps Gains on Inventory Build

The weekly crude oil inventory report from the US-based Energy Information Administration (EIA) saw a modest build-up in inventory. For the week ending February 14th, crude oil inventories rose by 400,000 barrels.

This follows the API’s report of a 4.16 million barrel build-up.

WTI Crude Oil Close to Testing Resistance

WTI crude oil prices had a burst of momentum as price action is trading close to the initial target of 54.75. With this level turning to be resistance, we anticipate a reversal to the gains in the near term.

Price action in WTI crude oil could be confined to the range between 54.75 and 51.65 in the short term.

UK’s Retail Sales Rebounds in January

UK consumers spent more at retail outlets in January, according to data from the UK’s Office for National Statistics (ONS).

The data showed that retail sales, excluding auto fuel, grew 0.9% on the month. It was the first increase in the past three months. Excluding auto fuel, retail sales were up 1.6% from a month ago.

GBP/USD Looks to Paring Losses

The GBPUSD, after losing the 1.2960 handle, is looking to pare losses. Price action is attempting to retreat after slipping to a two-month low.

Any gains will be testing the resistance level near 1.2960 in the short term. We expect price to remain subdued as long as this level is not breached.

Author

John Benjamin

Orbex

John is a market analyst for Orbex Ltd. and is a forex and equities trader having been involved in trading since late 2009. John makes use of a mix of technical and fundamental analysis and inter-market relationships.