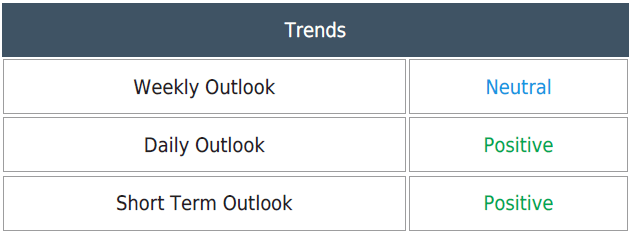

NZD/USD is in a slow painful bull trend

AUD/USD – NZD/USD

AUDUSD beats 7335/40 but then wiped out the gains as we traded back to 7310 before a recovery to 7373.

NZDUSD in a slow painful bull trend but hard to hold longs over the past 2 weeks, with a gain one day & a loss the next.

Daliy Analysis

AUDUSD held above 7335/40 over night for the next target of 7360/80 but we topped exactly here in this slow moving market. A break higher retests resistance at the September recovery high at 7408/13. We should struggle but shorts need stops above 7425. A break higher is a buy signal.

Gains are likely to be limited in this slow bull trend but the downside is likely to be limited too. First support at 7340/30 but below here 7320 risks a slide to support at 7285/75. Longs need stops below 7265.

NZDUSD beats strong resistance at the late 2018 high of 6965/70 to hit the next target of 6985 but only as far as 11 pips from the next target of 7015/25. A break above 7035 targets 7050/60.

First support in the bull trend at 6955/45. However below 6935 meet a buying opportunity at 6895/85 with stops below 6870.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk