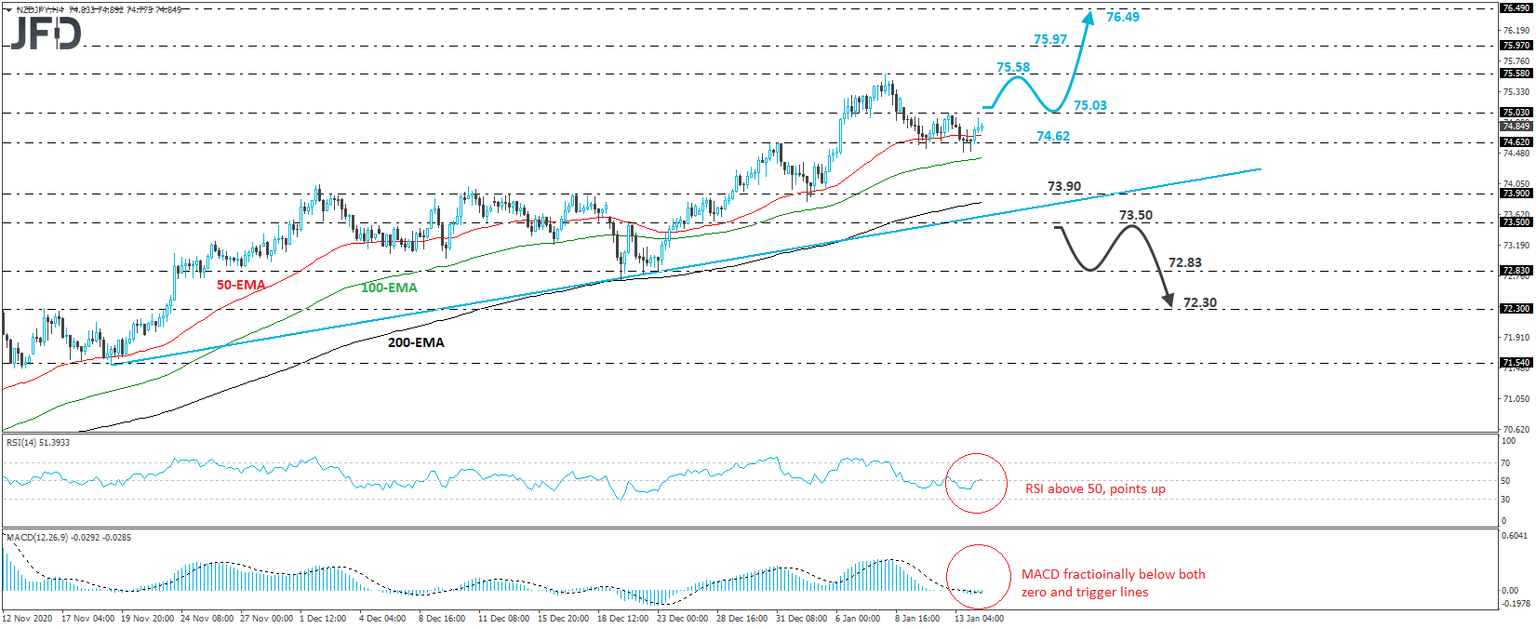

NZD/JPY stays in uptrend mode

NZD/JPY traded higher today after it hit support slightly below the 74.62 barrier, marked by the inside swing high of December 31st. Overall, the pair continues to trade above the upside support line drawn from the low of November 19th, and thus, we would consider the short-term picture to still be positive.

If the bulls are willing to stay in the driver’s seat and manage to break Tuesday’s peak at 75.03, then we may see them targeting the high of January 8th, at 75.58. A break above that hurdle would confirm a forthcoming higher high and may initially target the 75.97 level, marked as a resistance by the highs of April 1st and 15th, 2019. If that level is not able to stop the advance, then we may experience extensions towards the peak of March 26th, 2019, at 76.49.

Taking a look at our short-term oscillators, we see that the RSI rebounded and just poked its nose above its 50 line, while the MACD, although fractionally below both its zero and trigger lines, shows signs that it could also turn up soon. Both indicators suggest that the pair may start picking upside momentum soon, which is in line with our view on further short-term advances.

Now, in order to abandon the bullish case and start examining whether the bears have stollen the bulls’ swords, we would like to see a clear and decisive dip below 73.50, marked by the inside swing high of December 21st. This would take the rate below the aforementioned upside line and may pave the way towards the 72.83 territory, which provided support between December 21st and 23rd. Another break, below 7283, may extend the fall towards the inside swing high of November 16th, at 72.30.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD