Markets brace for heavy falls as Russia-Ukraine crisis escalates

Global developments

The risk sentiment has deteriorated overnight on the escalation in tensions between the West and Russia on Ukraine. Russia ordered troops to be sent to the separatist-controlled areas in Eastern Ukraine. This may likely invoke a response from the US in the form of new sanctions. Safe havens have rallied overnight. Yields on US treasuries have dropped about 7-8bps at the longer end. There is a chance that the Fed may recalibrate its tightening plans given the risks to growth from geopolitical tensions. Crude has surged about 3.5% to USD 97 per barrel. Gold has crossed the USD 1900 mark amid risk aversion. Safe haven currencies JPY and CHF have strengthened. The dollar is otherwise stronger against the commodity, EM, and Asian currencies. US equities were shut yesterday for a holiday. Asian equities are lower with Shanghai down 1.5% and HangSeng lower by 3.3%.

Domestic developments

Equities

The Nifty ended 0.4% lower yesterday at 17206.

Bonds and rates

Gsec yields ended a couple of basis points higher across the curve yesterday with the yield on the benchmark 10y ending at 6.70%. Today the impact of lower US treasury yields could be offset by higher crude prices. Money market rates could be higher by around 5-7bps on account of the Sell-Buy USD/INR swap announced by the RBI as it would withdraw liquidity from the banking system.

USD/INR

The Rupee has strengthened yesterday to 74.35 at one point before the nationalized banks stepped in aggressively to buy Dollars likely on behalf of the RBI. Rupee eventually ended the session at 74.51. The RBI announced a 2y USD/INR Sell-Buy swap for USD 5bn yesterday. We could see the 1y forward spike by around 12-15bps to around 4.20% as a result of the announcement. We expect it to trade a 74.60-74.90 range with an upside bias.

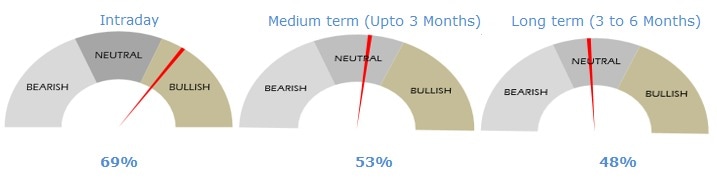

Strategy: Exporters are advised to cover near 75.10 levels. Importers are advised to cover on dips towards 74.30-40 The 3M range for USDINR is 74.30 – 76.40 and the 6M range is 73.50 – 76.50.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.