ECB cuts interest rates again: Are mortgage loans the cheapest now?

The European Central Bank (ECB) announced an interest rate cut on Thursday. The decision has been widely anticipated by the financial markets, motivated by the fact that Eurozone inflation fell to 1.9% in May, below the central bank's target of 2%. But what does this rate cut mean in practical terms for your mortgage?

What impact will the ECB rate cut have on mortgage loans?

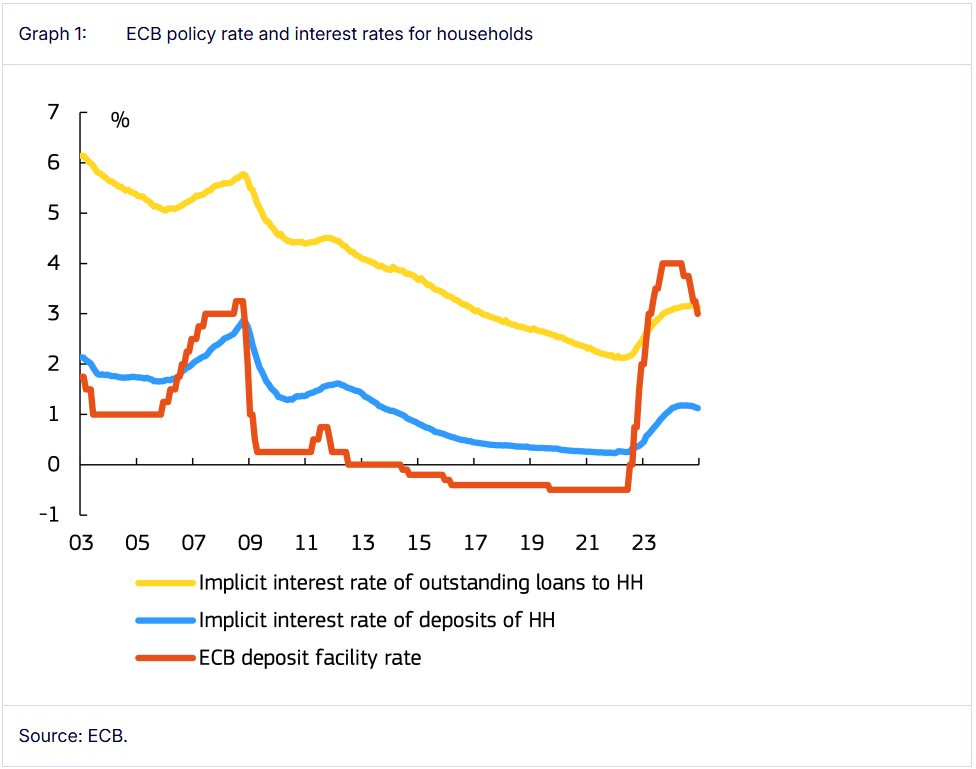

The central bank sets the interest rates at which commercial banks can borrow. When the ECB cuts rates, banks can pass on the cut by offering lower interest rates on loans, particularly mortgage loans.

However, the ECB rate cut does not affect all borrowers in the same way. The result on your mortgage loan will depend largely on the type of rate on your contract.

1. Variable-rate or tracker loans: an immediate fall

If your mortgage loan is indexed directly to the ECB's key rate or the Euribor index, a fall in the central bank rate will reduce your monthly repayments.

For example, for a tracker loan, a 0.25% fall in the key ECB rate would lead to a 0.25% fall in your mortgage rate.

2. Fixed-rate loans: no immediate reduction, but opportunities

If your rate is fixed, changes in ECB rates will have no impact on your monthly mortgage payments, either downwards or upwards, when the central bank reverses course and raises rates.

However, a prolonged fall in central bank rates, as we have seen in recent months, may offer an opportunity to renegotiate or refinance your loan at a more advantageous rate.

For example, if your rate is around 4%, while current rates for new loans are 3%, you can renegotiate your loan at 3% and make savings over the entire term of the loan.

But beware: renegotiating or refinancing your loan may involve costs. So you need to calculate carefully whether this is worthwhile in your particular case.

3. Hybrid loans: an intermediate case

Some borrowers have hybrid loans, combining fixed-rate periods followed by variable-rate periods. For them, the fall in rates could be beneficial when they switch to the variable rate phase, potentially reducing future repayments.

Is now the right time to take or renegotiate a mortgage?

If your current rate is well over 3%, it's probably a good idea to look into renegotiating or refinancing your mortgage loan in the current climate.

However, the situation remains complex. The current rates offered by banks do not yet fully reflect the cuts done and expected by the ECB, and renegotiating too soon could mean missing out on cheaper mortgage loans in the coming months.

Conversely, waiting too long could mean missing the ideal window of opportunity, particularly if bank refinancing rates rise again in the event of international or economic tensions.

How low can interest rates go?

The ECB meeting on Thursday gave crucial indications as to the future path of rates in the Eurozone. The ECB President Christine Lagarde said that the Bank is getting near to the end of the rate cutting cycle.

Market experts still think that the current cut may not be the last for this year. Several economists anticipate that the ECB could continue its cuts, at least one more time this year. The market is currently pricing in a 45% chance of a cut in September, which is down from a 55% chance of a rate cut earlier this week.

While the ECB could indeed cut rates further this year, they should then stabilise for a longer period at around 1.75-2%.

Some analysts are predicting that property rates, currently close to 3%, could then reach between 2.5% and 2.8% by the end of the year.

However, a return to the very low or even negative rates seen before the pandemic remains unlikely in the medium term. The ECB has reiterated on several occasions that the current economic environment, marked in particular by persistent trade tensions, would not allow such a radical easing.

What about property prices?

The ECB's interest rate cuts could indeed ease the cost of borrowing, but the real benefits in terms of purchasing power will also depend on the dynamics of prices on the property market.

A sustained fall in interest rates could lead to a rise in house prices in the medium term, limiting the net positive effect on house-buying power.

What you need to know about your home loan

To sum up, if you have a property project underway or are thinking of buying in the near future, this could be a very interesting time:

- Variable or tracker loans: You benefit immediately from the ECB rate cut.

- Fixed loans: Consider renegotiation or refinancing, but weigh up the associated costs carefully.

- Hybrid loans: You will benefit from the fall in rates when your loan is converted to a variable rate.

The most important thing is to carefully analyse your situation, ideally with a financial adviser, to decide on the best time and the best strategy for optimising your property finance.

The fall in the European Central Bank's key interest rates opens up promising prospects, but the key is to seize the opportunity at the right time.

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.