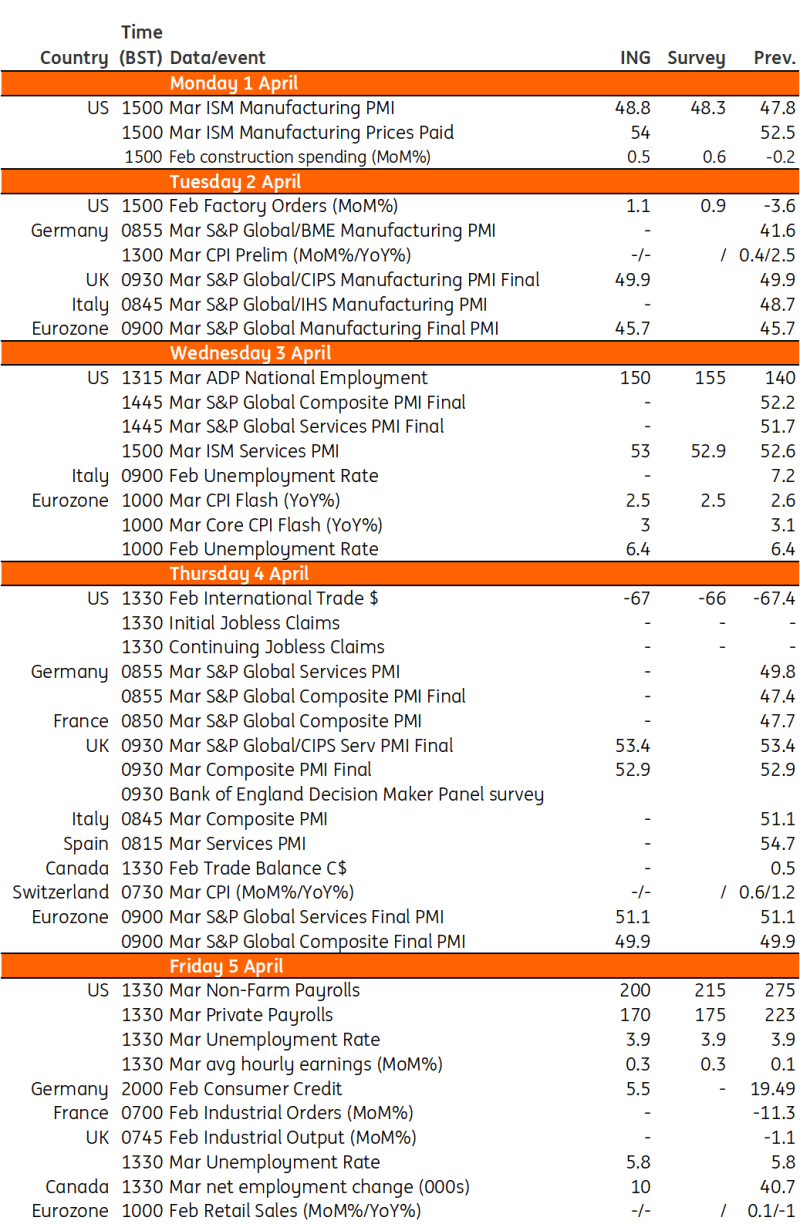

Key events in developed markets next week

Next week, the main focus will be inflation and the labour market in the Eurozone. We expect services inflation to be impacted by the easter effect, while the unemployment rate to be unchanged. In the UK, the Bank of England CFO survey will likely show further inflation progress.

Eurozone: Services inflation expected to come in higher in March

Next week’s eurozone data will focus on both inflation and the labour market. Inflation had been high month-on-month in February and January thanks to various reasons related to government measures and stronger than hoped for services inflation. In March, services inflation will be impacted by the Easter effect again, as the holiday comes early this year. That adds to inflation due to early holidays, but should subtract from it in May. For the European Central Bank, it will not be easy to look through all of this ahead of the April governing council meeting –but as ECB President Christine Lagarde stated at the March press conference, we’ll know a lot more in June.

UK: Bank of England CFO survey to show further inflation progress

The Bank of England has said it is watching services inflation and wage growth to guide policy this year, but we also know it pays close attention to its in-house survey of Chief Financial Officers. This has been pointing to less aggressive expectations of price rises among companies, but wage growth expectations have been stuck at around 5% for some time. Those expectations did tick lower in the February survey though, and we'll be looking to see if pay growth is scaled back further in the next survey due next week.

This survey won't move the dial for the BoE's May meeting, where we still think a rate cut is unlikely. But if we get more progress on this survey measure, coupled with some favourable data on CPI for April/May, this could bring a June cut into play. For now, we're sticking with our call for an August rate cut – but it's a relatively close call.

Key events in developed markets next week

Source: Refinitiv, ING

Read the original analysis: Key events in developed markets next week

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.