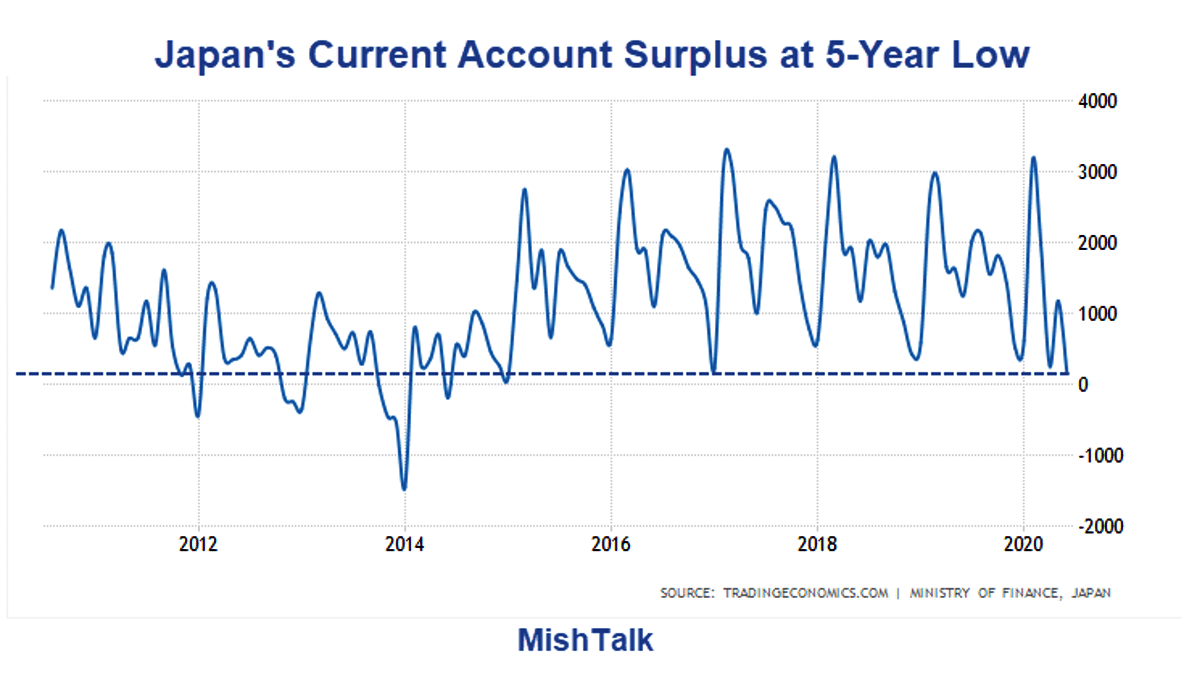

Japan's Current Account surplus at 5-year low as exports plunge

Due to plunging exports relative to imports Japan's current account surplus is barely positive.

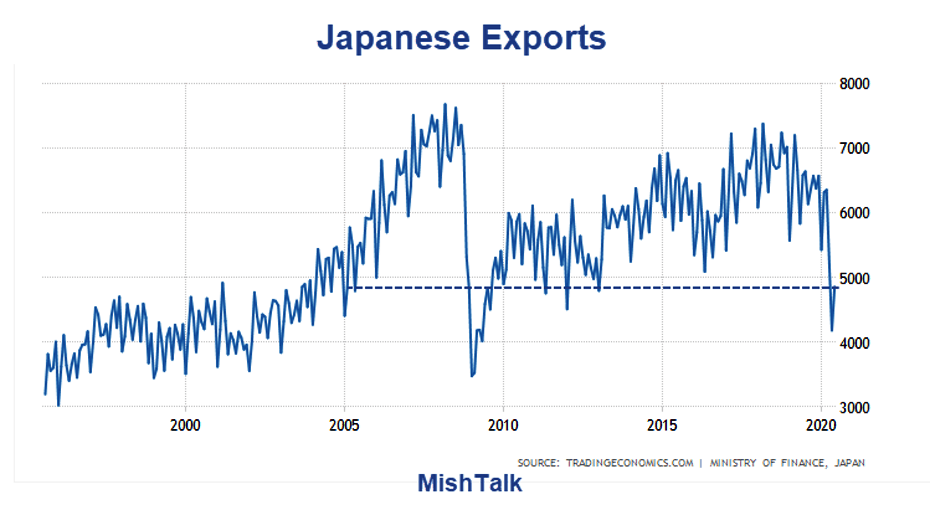

Exports plunge 25.7% from a year ago

JapanToday reports Japan's Current Account Surplus Shrinks to 5-Year Low.

Japan posted its smallest current account surplus in more than five years in June, Ministry of Finance data showed on Tuesday, mainly due to a slump in exports, highlighting the heavy hit to external demand from the coronavirus pandemic.

Details

- The current account surplus was 167.5 billion yen ($1.58 billion), the smallest monthly surplus since January 2015.

- Exports plunged 25.7% in June from a year ago, hit hard by falling shipments of cars and car parts to the United States.

- Imports shed an annual 14.4%, following a 27.7% annual fall in May.

- Japan's e trade deficit in June widened to 157.7 billion yen.

- A 99.9% drop in foreign tourists due to immigration restrictions imposed over the health crisis sent the travel account to a 157.7 billion yen deficit in June.

Japanese exports

There is little reason to expect a sudden sharp reversal.

US Trade in goods with Japan

The above chart from the Census Department.

As I have commented before, Trump's best chance to reduce trade deficits with the world was not tariffs but rather to have one hell of a recession.

Congratulations?

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc