Is the Federal Reserve Out of Ammunition?

Executive Summary

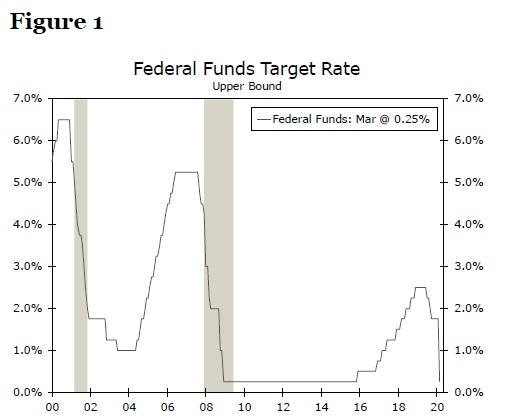

After raising its target range for the fed fund rate 225 bps between December 2015 and December 2018, the FOMC has rapidly reversed itself (Figure 1). Indeed, the committee unanimously decided to slash rates 50 bps during an extraordinary conference call on March 3, and then managed to top this with an even more extraordinary move on March 15, when it returned the target range to 0.00%-0.25% and restarted quantitative easing (QE). With short-term rates in the United States back at 0% again, the question that naturally arises is whether the Fed has run out of ammunition.

Source: Federal Reserve Board and Wells Fargo Securities

In this report, we discuss what policy tools remain at the Fed's disposal to combat a period of economic weakness that appears to be in train in the U.S. economy. These options include: forward guidance to signal the fed funds rate will remain at zero for an extended period of time, additional QE purchases of Treasury securities and mortgage-backed securities (MBS), the resurrection of several alphabet-soup programs created during the 2008 financial crisis, such as the recently revived Commercial Paper Funding Facility (CPFF) and the Primary Dealer Credit Facility (PDCF), and the expansion of asset purchases into short-dated (six months or less to maturity) municipal debt. Although these tools should be helpful in the event of their eventual adoption, they are unlikely to solve the current economic challenges alone. For that, it will likely take a significant fiscal salvo, a topic we explore in a separate piece.

Forward Guidance and Standard Quantitative Easing

First, recall that the FOMC undertook "forward guidance" when the economy was still crawling out of the depths of the Great Recession. For example, the policy statement that was released at the conclusion of the May 1, 2013 FOMC meeting stated "the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens." By publicly committing to keep the target range for the fed funds rate at extraordinarily low levels for a considerable length of time, the FOMC was attempting to pull down long-term borrowing costs. In the current environment, the FOMC could either commit to keep its target range low until some objective was met (e.g., the unemployment rate has fallen to at least some specific level) or for some specific length of time.

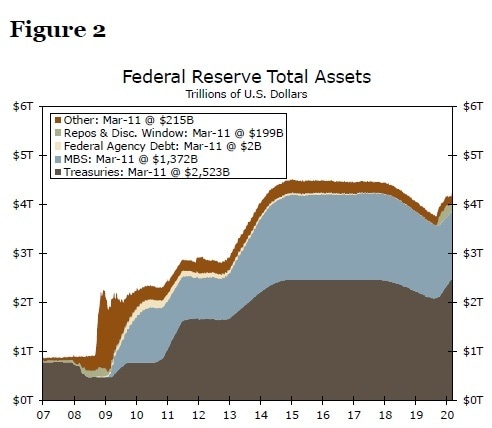

The Federal Reserve also embarked on a program of quantitative easing (QE). Between the fall of 2008 and mid-2014 the Fed's balance sheet mushroomed to more than $4.5 trillion from less than $1 trillion as it purchased about $2 trillion of U.S. Treasury securities and $1.8 trillion of mortgagebacked securities (Figure 2). The purchases of Treasury securities were meant to bring the long end of the U.S. yield curve lower, which supports lower borrowing costs for businesses and households, and purchases of MBS were intended to breathe life back into the moribund housing market, which essentially collapsed during the financial crisis.

Source: Federal Reserve Board and Wells Fargo Securities

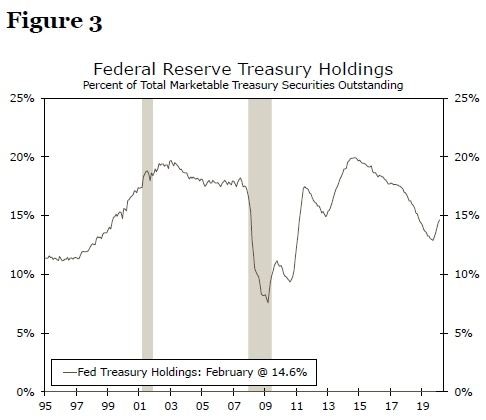

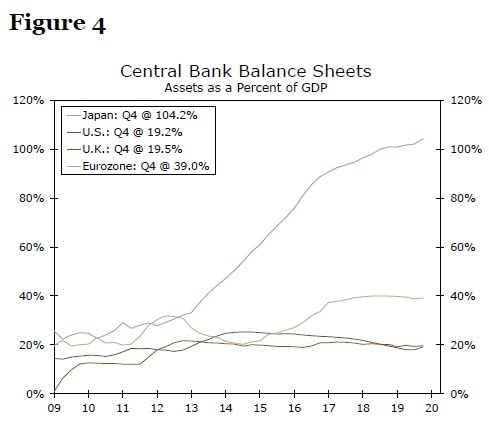

More recently, the FOMC has returned to QE, announcing on March 15 that it will buy $500 billion of Treasury securities and $200 billion of MBS "in the coming months." In our view, the Fed could certainly expand these purchases either in duration or size. At present, the Fed's holdings of Treasury securities as a share of the total market is relatively in line with history (Figure 3). And compared to some other developed market counterparts, the size of the Fed's balance sheet as a percent of GDP is still fairly small, at least on a relative basis (Figure 4). In our view, however, QE purchases of Treasury securities and MBS may not be quite as effective as they were a decade ago. The yield on the benchmark 10-year Treasury security has already plunged to less than 1.00%. How much lower could it go?

Source: Federal Reserve System, Bloomberg LP and Wells Fargo Securities

Source: Federal Reserve System, Bloomberg LP and Wells Fargo Securities

Is a Negative Fed Funds Rate an Option?

Of course, the yield on the 10-year German government bond is nearing -1.00%. But the European Central Bank has cut one of its main policy rates to -0.50%. Money market funds (MMFs) play an instrumental role in the financial system of the United States, whereas MMFs are not as crucial in European financial markets. Negative short-term instrument rates in the United States could lead to extreme difficulties with MMFs, with potentially adverse consequences for the U.S. financial system. The minutes of the October 2019 FOMC meeting showed that all members (emphasis ours) "judged that negative interest rates currently did not appear to be an attractive monetary policy tool in the United States." Chairman Powell reinforced this message on the March 15 conference call, stating in response to a question from a reporter that "We do not see negative policy rates as likely to be an appropriate policy response here in the United States." Although we would hesitate to say it is impossible, the likelihood of the FOMC taking the fed funds rate negative is quite low, in our view.

Author

Wells Fargo Research Team

Wells Fargo