Important change in trend US stocks, T-bonds, US dollar

1/18 Recap - The S&P opened with a 31 handle gap down and then traded another 44 handles lower into a 9:57 AM low. From that low, the S&P rallied 29 handles into a 10:12 AM high. From that high, the S&P zig-zagged 41 handles lower into a 1:07 AM low. From that low, the S&P rallied 34 handles into a 2:54 PM high. From that high, the S&P declined 35 handles into a 3:55 PM low of the day. From that low, the S&P rallied 9 handles into the close.

1/18 – The major indices had a large down day per the following closes: INDU - 571.57; S&P 500 - 86.33; and the NASDAQ Composite - 335.83.

Looking ahead - We had a big down day on Tuesday as forecasted and in line with a change in trend from Friday’s rally. Now, the market must make a low by the first half of Wednesday or it may be going much lower. This is the moment of truth. Longer-term, the fact that the S&P closed near it’s low of the day, rather than reversing early in the day, maybe an indicating that the market has lost some of its resiliency. Whichever trend is established on Wednesday is likely to continue into the end of this week.

The NOW Index is in the NEUTRAL ZONE.

Coming events

(Stocks potentially respond to all events).

2. D. 01/14 AC – Saturn Contra-Parallel US Mercury. Important change in trend US Stocks, T-Bonds, US Dollar.

E. 01/14 AC – Mercury Perihelion. Major change in trend CORN, Gold, Oats, OJ, Soybeans, Wheat.

F. 01/14 AC – Full Moon in Cancer. Major change in trend Financials, Grains, Precious Metals and especially Silver.

G. 01/14 AC – Uranus in Taurus turns Direct. Major change in trend Cattle, Copper, Cotton.

3. A. 01/21 AC – Geo Mars enters Capricorn. Important change in trend Coffee.

B. 01/21 AC – Venus Perihelion. Major change in trend Cattle, Corn, Copper, Cotton, Gold, OJ, Sugar, and Wheat.

C. 01/25 AC – Jupiter 120 US Jupiter. Important change in trend US Stocks, T-Bonds, US Dollar.

D. 01/25 AC – Saturn 120 US Saturn. Important change in trend US Stocks, T-Bonds, US Dollar.

E. 01/28 AC – Venus in Capricorn goes Direct. Major change in trend Cattle, Coffee, Copper, Cotton, Sugar, & Wheat.

F. 01/28 AC – Jupiter 90 US Ascendant. Important change in trend US Stocks, T-Bonds, US Dollar.

Stock market key dates

Market Math

DJIA* – 1/18, 1/20, 1/24, 1/25-26, 1/28 AC.

S&P 500* - 1/18, 1/19, 1/28 AC.

Fibonacci – 1/21, 1/25.

Astro – 1/18, 1/24, 1/25-26, 1/28 AC.

Please see below the S&P 500 10 minute chart.

Support - 4530 Resistance – 4610.

Please see below the S&P 500 Daily chart.

Support - 4530 Resistance – 4610.

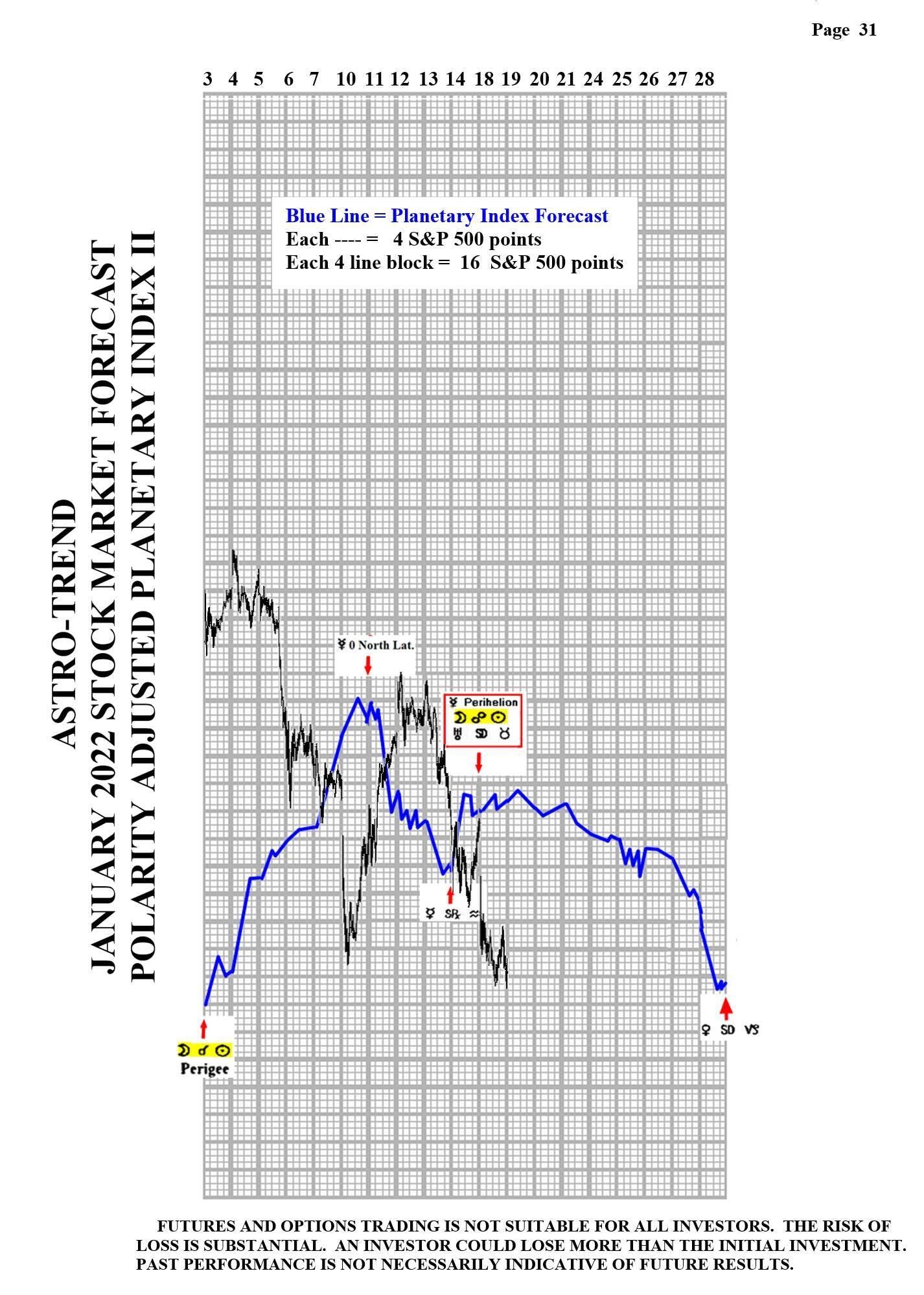

Please see below the January Planetary Index charts with S&P 500 10 minute bars for results.

Author

Norm Winski

Independent Analyst

www.astro-trend.com