Growth risk key question for the second half of 2022

As we start the second half of 2022 investors remain focused on these major fears outlined in our previous article. However, the growing risk for the second half of 2022 is starting out to be over recession worries. The latest core PCE print from the last day of June would have provided some relief as the headline print came in below forecast at 4.7% vs 4.8% forecast.

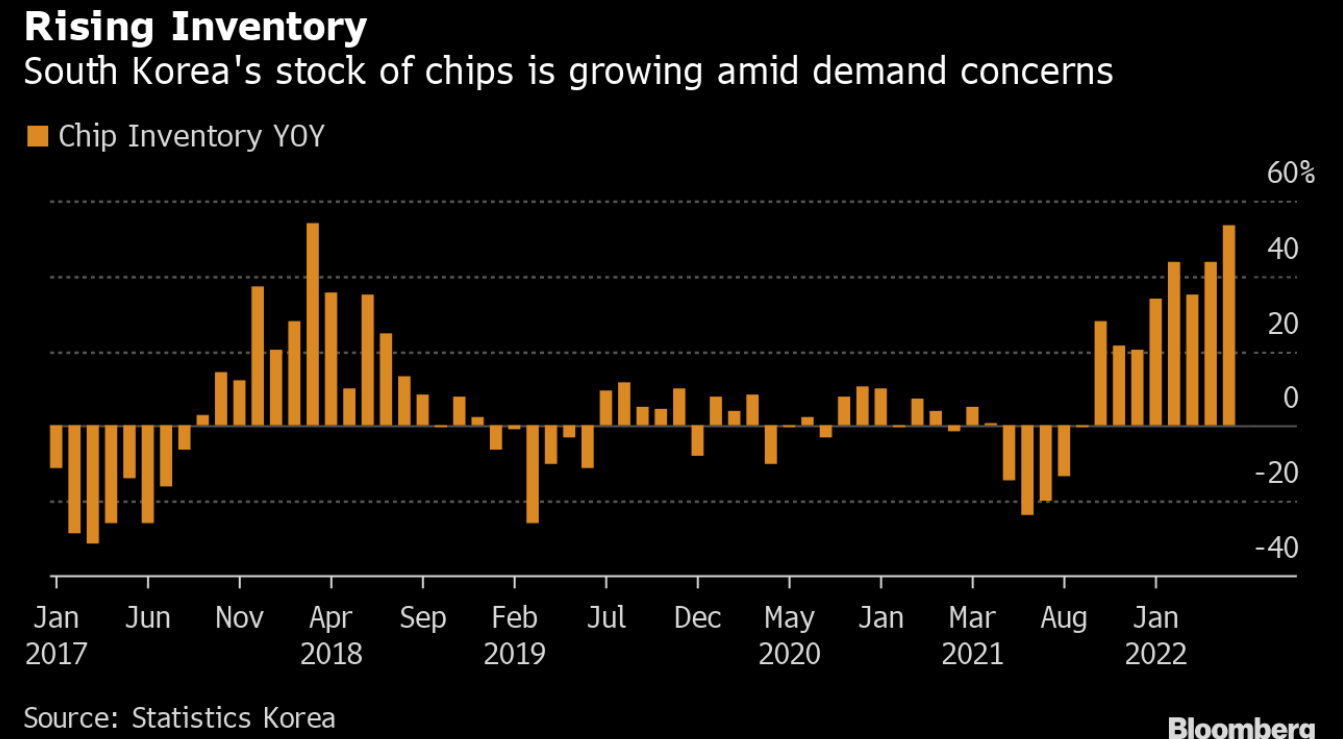

So, inflation fears can take a step back as we start 2022. However, growth fears cannot. Copper prices have fallen on slowing growth worries and industrial metals have been falling over the last few weeks too. Commodity markets are sensing a slow down in demand. Oil markets, with their disparate drivers, have also been showing signs of weakness. Similarly, we see some signs of inventories rising. Here is a quick snapshot of South Korea’s chip inventory. You can see that the chip shortage can quickly be replaced by a glut in chip supply.

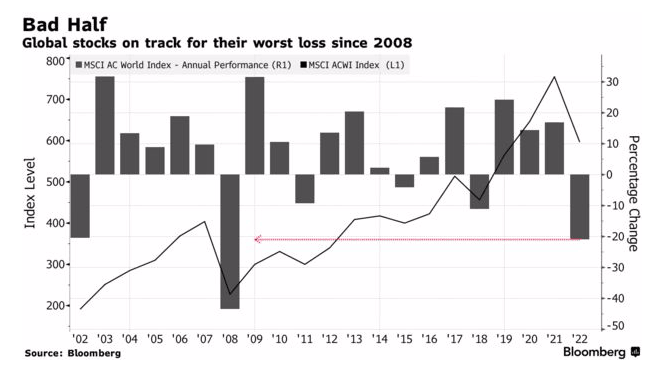

These narratives are not new. This is what many canny investors have been fearing from the start of the year. You can see this chart from Bloomberg illustrating stocks on track for their worst drop since 2008 below. Now in one sense that is not so surprising given the huge amounts of fiscal and monetary policy support during COVID’s surge. The prospect of the central bank’s hiking into slowing growth has been the cause for stock falls.

So, as inflation fears fade - growth worries will not. So, where will the turning point be for stocks to start gaining again? Most likely at the first point where investors sense that central banks will be pausing interest rate hikes to allow growth to recover. Look at these key tech levels ahead on the Dow. Some inverts will use key tech levels to manage risk once/if the monetary policy tide has turned.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.