Gold Weekly Forecast: Bears look to retain control following technical breakout

- Gold turned south after setting a new all-time high to begin the week.

- Investors will remain focused on Trump tariff talks ahead of February US employment data.

- The technical outlook points to a bearish reversal in the near term.

Gold (XAU/USD) reversed its direction after touching a new record high on Monday and snapped an eight-week winning streak. The near-term technical outlook highlights a buildup of bearish momentum as markets keep a close eye on headlines surrounding the United States (US) President Donald Trump administration’s trade policy ahead of Friday’s highly-anticipated US employment report.

Gold extends slide after breaking below $2,900

XAU/USD touched a new record high above $2,950 on Monday as the upbeat market mood at the beginning of the week made it difficult for the US Dollar (USD) to find demand.

On Tuesday, the yellow metal came under heavy selling pressure after US President Donald Trump noted that tariffs on imports from Canada and Mexico will go forward on March 4, as planned. Meanwhile, Reuters reported that China’s total Gold imports via Hong Kong declined by 44.8% in January to 13.816 metric tons, marking the lowest level since April 2022. Following this headline, XAU/USD extended its slide and dropped below $2,890. In the second half of the day, however, a sharp decline in the US Treasury bond yields helped Gold stage a modest rebound to end the day above $2,900. US Treasury Secretary Scott Bessent said that he believes that the Trump administration will find a way to reduce spending, ease monetary policy and lower Treasury yields all at the same time.

While US Treasury bond yields continued to edge lower mid-week, Gold stabilized above $2,900. Additionally, Trump said Canada and Mexico tariffs will go into effect on April 2, limiting the USD’s gains and allowing XAU/USD to hold its ground.

On Thursday, however, Gold turned south once again and lost more than 1% on the day as Trump clarified that tariffs will be imposed on March 4 as initially planned and added that China will also be charged an extra 10% tariff on that date. As Gold closed the day below the 20-day Simple Moving Average (SMA) for the first time since early January, technical sellers took action on Friday and dragged the price to a multi-week low below $2,850.

The US Bureau of Economic Analysis reported on Friday that the Personal Consumption Expenditures (PCE) Price Index rose 2.5% on a yearly basis in January. On a monthly basis, the PCE Price Index and the core PCE Price Index, which excludes volatile food and energy prices, both rose 0.3%. These figures came in line with analysts’ estimates and made it difficult for Gold to gain traction.

Gold investors await key US data while scrutinizing political headlines

Ahead of the highly-anticipated labor market data from the US, investors will keep a close eye on fresh developments surrounding the Trump administration’s trade policy in the first half of the week.

In case Trump reaches an agreement with Canada and Mexico to postpone tariffs, the immediate market reaction could trigger a USD selloff and help XAU/USD stage a rebound. Similarly, Gold is likely to gain traction if Trump changes his mind about doubling tariffs on Chinese imports. Conversely, Gold prices could continue to push lower in case China retaliates, escalating concerns over a deepening trade war and its potential negative impact on the Chinese economic outlook. On Friday, China’s Ministry of Commerce said that it “firmly opposes” Trump’s latest threat to ramp up tariffs on Chinese goods and vowed retaliation.

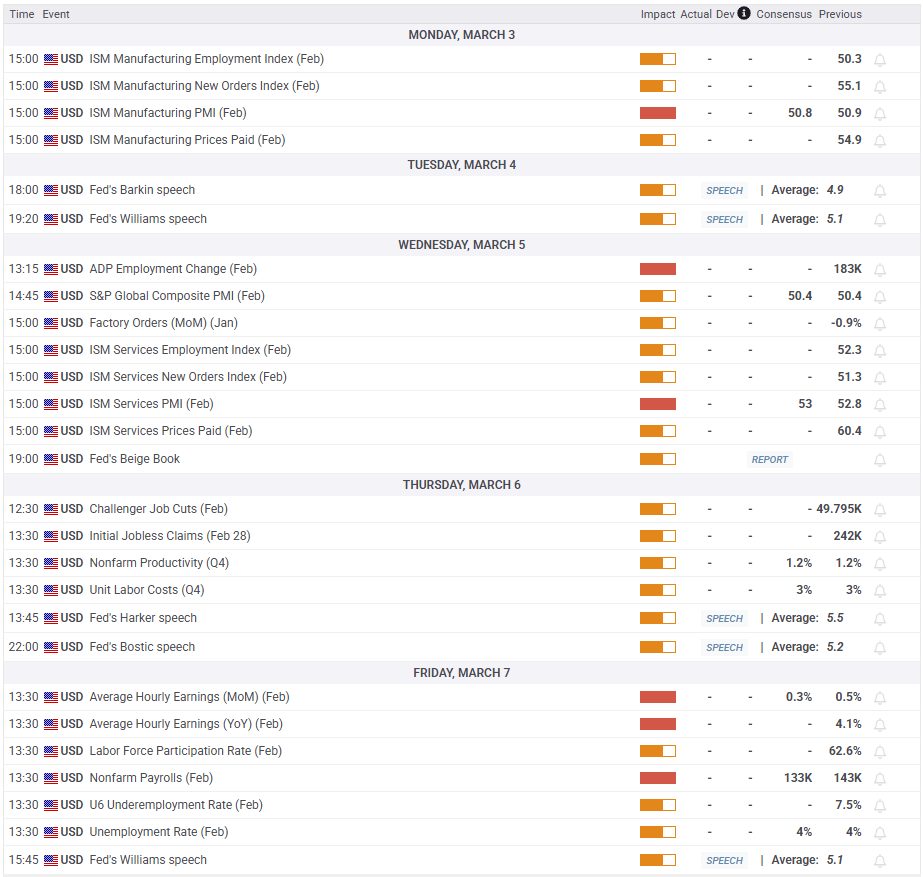

On Wednesday, Automatic Data Processing (ADP) will publish the private sector employment change data. A reading near 200,000 could support the USD with the immediate reaction, while a print below 150,000 could have the opposite effect. Nevertheless, ahead of Friday’s official employment data, market participants are likely to refrain from taking large positions based on this report alone.

Nonfarm Payrolls (NFP) are projected to rise by 133,000 in February, following the 143,000 increase recorded in January. A significant negative surprise in this release on Friday, with an NFP reading at or below 100,000, could weigh heavily on the USD and open the door for a bullish action in Gold heading into the weekend. On the other hand, the USD could stay resilient against its rivals if the NFP arrives at or above 180,000. According to the CME FedWatch Tool, markets price in about a 30% probability of a Federal Reserve interest rate cut in May, suggesting that there is more room on the upside for the USD if an upbeat employment report causes investors to reassess this probability.

Gold technical analysis

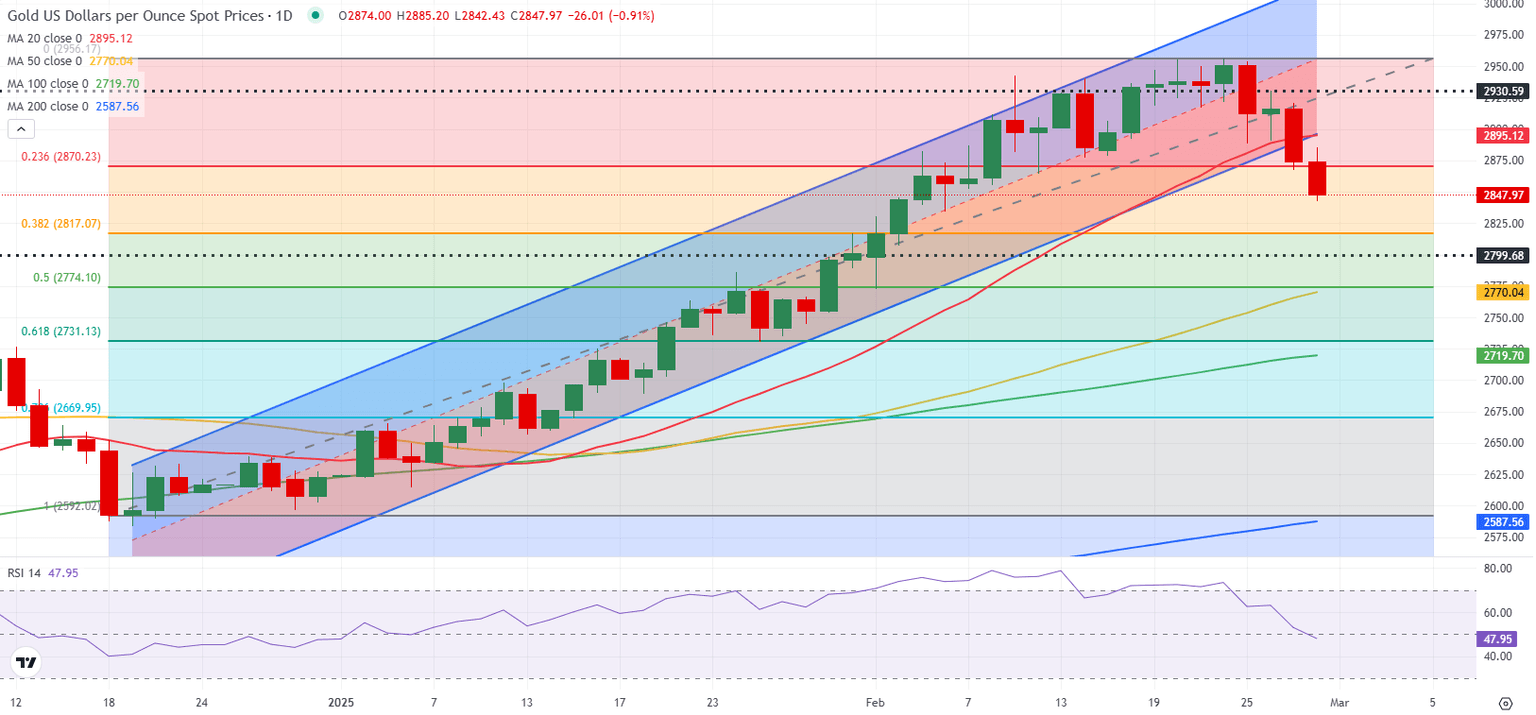

The Relative Strength Index (RSI) indicator on the daily chart declined to its lowest level since early January, near 50, reflecting a loss of bullish momentum. Additionally, Gold broke below the lower limit of the two-month-old ascending regression channel, which is also reinforced by the 20-day SMA.

The Fibonacci 23.6% retracement level of the recent uptrend at $2,870 stands out as immediate resistance. If Gold fails to reclaim this level, technical sellers could remain interested. In this scenario, $2,820 (Fibonacci 38.2% retracement) could be seen as the next support before $2,800 (round level, static level).

On the upside, Gold could face stiff resistance at $2,895-$2,900 (lower limit of the ascending channel, 20-day SMA, round level). In case XAU/USD stabilizes above this hurdle, $2,930 (static level) could be seen as the next resistance before $2,955 (record high).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.