Gold: uncertain outlook for US Dollar helped to support Gold [Video]

![Gold: uncertain outlook for US Dollar helped to support Gold [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/stack-of-golden-bars-in-the-bank-vault-60756080_XtraLarge.jpg)

Gold

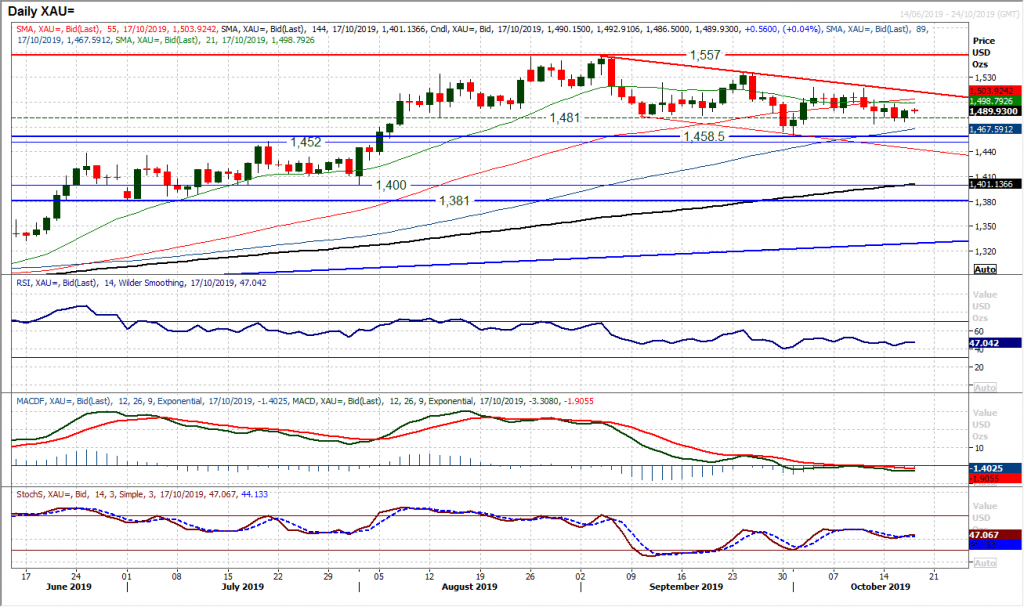

The uncertain outlook for the US dollar (heightened since the disappointing retail sales data) helped to support gold. The outlook for the yellow metal subsequently remains rather clouded within the medium term range. However, there continues to be a mild negative bias that is holding within the range as gold is now consistently trading under $1500. Despite this though, there remains an appetite for the bulls to defend the old support around $1481 even in the midst of this apparent negative drift. Momentum indicators are reflective of all of this, with the RSI a shade under 50 and MACD lines a shade under neutral, but they all lack any conviction. The key resistance remains the highs of the past couple of weeks at $1518.50 but the longer that the market sits under $1500 there will be growing negative pressure. A close under $1481 would open the $1458.50 key September low.

Author

Richard Perry

Independent Analyst