Gold strengthens on weak US data and rising Fed cut expectations

Gold (XAUUSD) is gaining strength as weak U.S. economic data and falling Treasury yields revive interest in the metal. Softer growth signals have increased expectations for earlier Fed rate cuts, pressuring the Dollar and boosting gold’s appeal. At the same time, easing geopolitical concerns and a shift in focus toward upcoming labor data are shaping market sentiment. With both macro and technical factors aligned, gold remains on a firm upward path.

Gold rises on soft US data and Fed rate cut bets

Gold is regaining momentum, with prices climbing steadily after an earlier pullback. Support came after the U.S. ISM Manufacturing PMI dropped to 47.9, falling short of expectations. The weak data raised fresh concerns about slowing growth and pushed Treasury yields lower, pressuring the Dollar. The drop in yields increased demand for gold by improving its relative value.

Market focus has now shifted to upcoming U.S. labor data, including the ADP Employment report and the JOLTS job openings. The anticipation of weak employment figures has already increased expectations for earlier Fed rate cuts. As a result, gold remains well supported above the $4,400 zone as markets adjust to a potential easing cycle.

Meanwhile, initial concerns over the Venezuela situation have eased, with the conflict now viewed as relatively contained. Still, any renewed escalation, particularly if it draws in China or Russia, could trigger fresh safe-haven demand for both gold and the Dollar. At present, gold remains supported by a weakening U.S. growth outlook and declining yields.

Gold holds firm within ascending channel as technical momentum builds

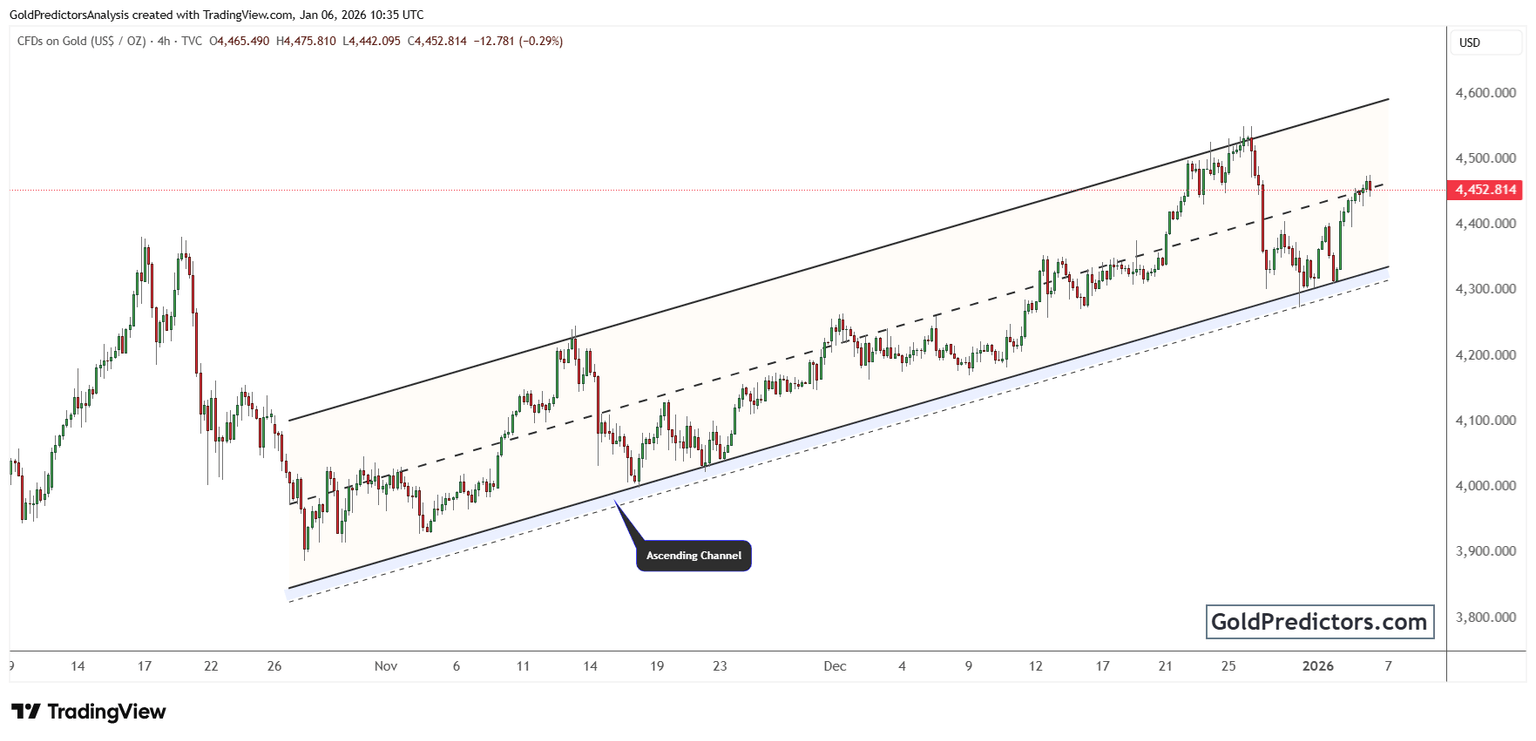

The gold chart below shows a steady climb within a well-defined ascending channel. This structure has guided price action since late October, offering clear support and resistance zones. Multiple rebounds from the lower boundary confirm strong underlying demand at key technical support.

The recent dip toward channel support was met with a sharp recovery, pushing gold back toward the upper half of the channel. This bounce aligns with fundamental drivers and confirms the channel’s validity. Price is now testing the mid-line and could re-accelerate if momentum sustains above this level.

Gold continues to trade within a well-defined ascending channel, maintaining a constructive technical outlook. A move above the channel’s upper boundary would signal a pickup in upward momentum. Until that occurs, the structure continues to provide a clear guide for near-term price action. As long as gold holds above the lower boundary, the technical bias stays bullish, with scope for further gains.

Gold outlook: Macro weakness and technical strength support further gains

Gold remains supported by a combination of bearish macro signals and a strong technical structure. Weak U.S. data, falling yields, and rising Fed rate cut expectations have improved the backdrop for gold. At the same time, the ascending channel offers a clear technical structure, with repeated rebounds confirming strong demand. As long as this setup holds, gold is likely to extend its upward move.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.