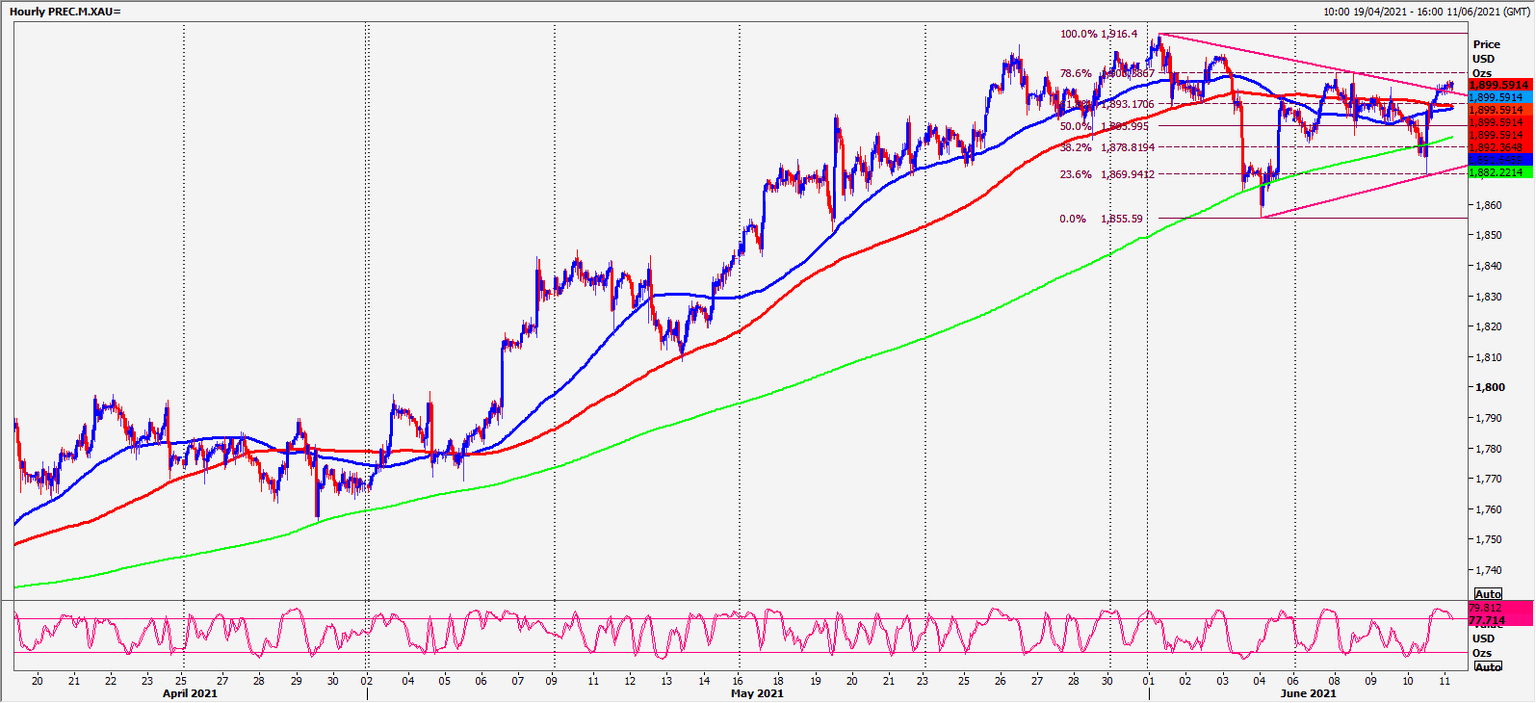

Gold sell opportunity at 1895/1899

Gold, Silver, WTI Crude

Gold Spot shorts at the sell opportunity at 1895/1899 have worked perfectly all this week. Yesterday we bottomed exactly at first support at 1871/69 for a 25 point profit. A weekly close tonight above 1903 is a buy signal for next week.

Silver Spot stuck in a 1 month sideways trend, with first resistance at 2810/20 tested as I write this morning. Shorts need stops above 2835.

WTI Crude JULY Future crashed breaking 200 month moving average support at 6985/75 but bottomed exactly at good support at 6860/30 for a potential 200 tick profit on longs.

Daily analysis

Gold sell opportunity at 1895/1899. Stop above 1903. (We topped exactly here yesterday). A break higher is a buy signal targeting 1912/16. Further gains this week look for 1925 & 10 month trend line resistance at 1935.

Shorts at the sell opportunity at 1895/1899 target 1885 (hit), minor support at 1880/78 today & perhaps as far as first support at 1871/69 for some profit taking. Further losses test key support at 1859/56 with further important 10 month trend line & 200 day moving average support at 1845/40. Perhaps bulls can try to scale in to longs across this range.

Silver first resistance at 2810/20 tested as I write this morning. Shorts need stops above 2835. Further gains retest last week’s high at 2850/54.

First support at 2730/20 but below 2710 is a sell signal targeting 2690/80 before very strong support at 2650/45.

WTI Crude if you managed to buy in to longs at good support at 6860/30 (we bounced just 8 tick above) we shot higher to to 200 month moving average at 6985/75 & as far as 7000/20. On further gains look for 7050/60 then 7085/95 & 7135/55.

Minor support at 6985/65, good support at 6860/30. Longs need stops below 6800.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk