Gold pulls back after testing upper bound of rectangle [Video]

![Gold pulls back after testing upper bound of rectangle [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-coins-on-a-weight-scale-gm173237086-20246712_XtraLarge.jpg)

Gold pulls back after testing upper bound of rectangle

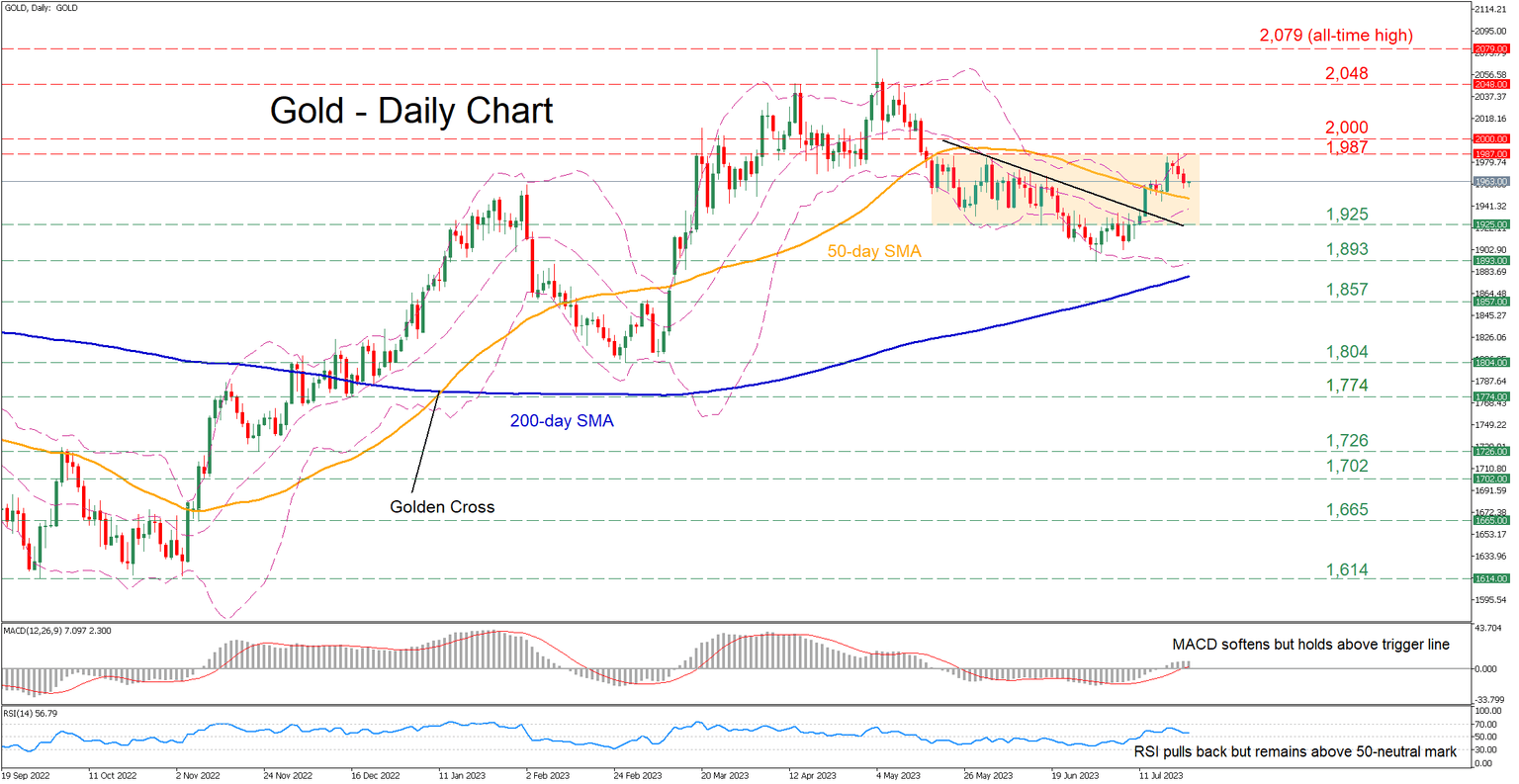

Gold had been in recovery mode after posting a false bearish breakout from its recent rangebound pattern. Even though the price sliced through the descending trendline that connects a series of lower highs since early June and the 50-day simple moving average (SMA), it retraced lower after failing to claim the upper end of the rectangle.

The short-term oscillators are endorsing this latest correction but there are still no signs of a sustained downtrend. Specifically, the MACD lost some ground but remains above its red signal line, while the RSI retreated within the positive territory.

If the slide continues and the price declines below the 50-day SMA, the lower end of the rangebound pattern at 1,925 might be the first barrier for the bears to clear. A drop below the sideways pattern could ignite more selling pressures that might bring the three-month low of 1,893 under scrutiny. Further declines may then cease at the March resistance of 1,857, which could serve as support in the future.

Alternatively, bullish actions could propel bullion towards the recent rejection region of 1,987. Should that barricade fail, attention could shift towards the crucial 2,000 psychological mark. Even higher, the April peak of 2,048 could cap any upside attempts.

In brief, gold has been experiencing a mild correction due to its failure to break above its recent rectangle pattern. However, the technical picture could remain neutral for as long as the price fluctuates within this range.

Author

Stefanos joined XM as a Junior Investment Analyst in September 2021. He conducts daily market research on the currency, commodity and equity markets, from a fundamental and a technical perspective.