Gold prices corrects amid positive US-China trade developments and Fed hawkishness

Gold (XAUUSD) prices have dropped sharply as global sentiment shifts. Investors are turning away from safe-haven assets like gold. The main trigger is positive news from US-China trade talks. These developments reduce fears of a prolonged trade war. At the same time, a strong US Dollar and stable economic outlook add pressure to gold. Let's dive into the key fundamental and technical forces fueling this sharp move in gold.

US - China trade talks spark global optimism, weigh on Gold demand

Recent developments in US-China trade relations are pivotal. Talks in Switzerland ended with optimism. US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer confirmed a deal had been struck. China's Vice Premier He Lifeng echoed this by highlighting "substantial progress." This news sparked a global risk-on mood.

Investors shifted funds from gold into equities and riskier assets. As a result, demand for gold weakened sharply. Additionally, the Federal Reserve's hawkish stance continues to support the US Dollar. The Fed has paused rate hikes but isn't ready to cut rates yet. This strengthens the greenback and adds pressure to gold. A strong USD makes gold more expensive for other currency holders. There's also a fading fear of a US recession. Minor positive economic signals give hope for economic resilience. This adds another layer of pressure on gold's appeal.

However, there's caution too. Neither side of the trade talks has committed to lowering tariffs. US tariffs on Chinese goods remain at 145%, and China's tariffs stand at 125%. This incomplete resolution has kept some investors from making bold moves. Market players now await more clarity. Two events are crucial this week: US inflation data and Fed Chair Jerome Powell's remarks. These will influence the direction of interest rates and gold.

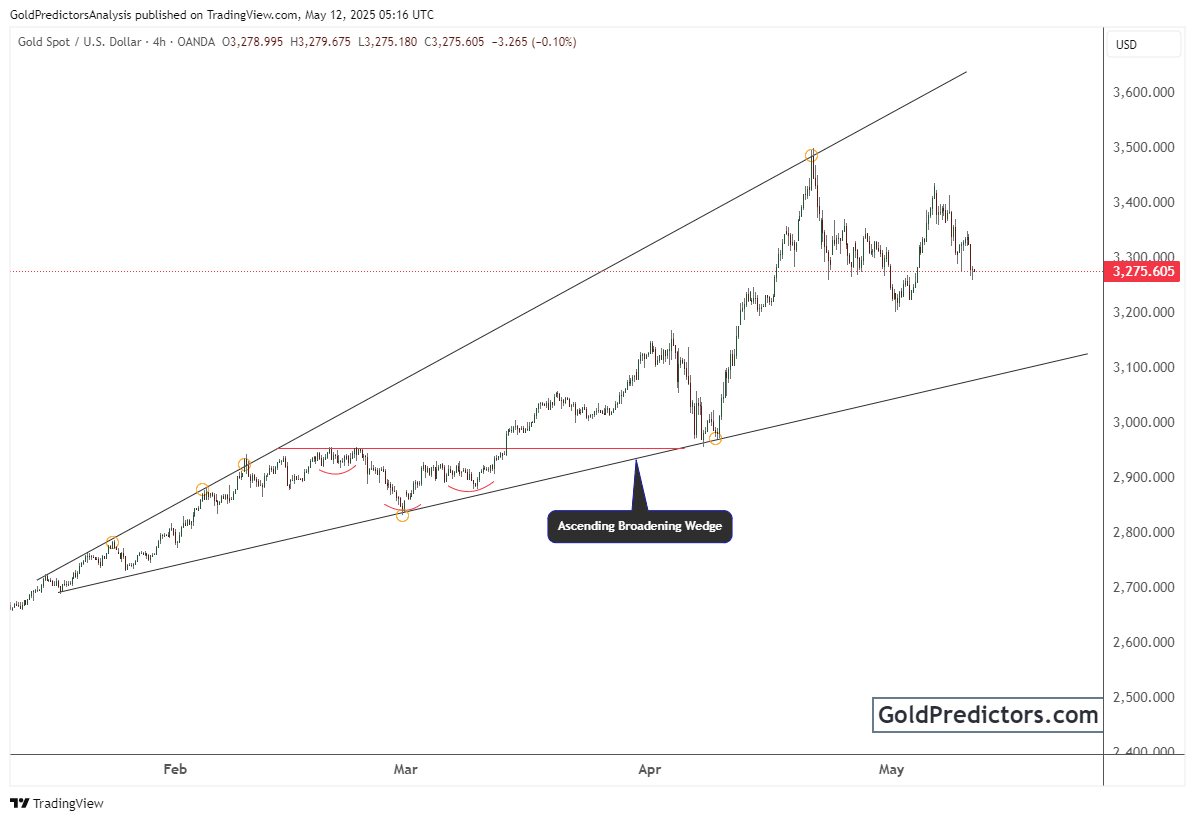

Ascending Broadening Wedge signals potential trend reversal

The gold chart below shows the formation of an Ascending Broadening Wedge pattern. This is a bearish pattern that signals potential volatility and trend reversal. The pattern consists of higher highs and higher lows, widening over time.

In this chart, gold moved strongly within the wedge from early February to late April. Each price swing became larger. This pattern often suggests increasing uncertainty in the trend's direction.

A key point of support formed near $3,000. After testing this zone in late March, gold surged to a new high above $3,500 in April. This marked the upper resistance of the wedge. After hitting this resistance, the price reversed and is now showing signs of weakness.

Currently, the price has dropped toward the $3,275 area. This represents a one-week low. The lower trend line of the wedge now becomes a key support level. If gold breaks below this line, it could signal a deeper bearish move.

Traders are waiting for confirmation before taking fresh positions. The volume profile and price action suggest caution. The broadening pattern implies that the next move could be sharp once a breakout or breakdown occurs.

Conclusion

Gold dropped sharply to a one-week low amid optimism over US-China trade talks. Positive signals from weekend negotiations in Switzerland boosted risk appetite and reduced demand for safe-haven assets. Easing US recession fears and the Fed's hawkish stance also supported the US Dollar, adding pressure on gold. However, the lack of concrete tariff rollbacks kept bears cautious, prompting a strong range. Traders now await US inflation data and Fed Chair Powell's speech for clues on future rate moves and gold's next direction.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.