Gold Price Forecast: XAU/USD sees upside risks intact, with eyes on the $2,000 mark

- Gold price finds fresh demand in Asia early Wednesday, as risk flows cap the US Dollar rebound.

- US bonds hold its recovery, keeping US Treasury bond yields undermined while supporting Gold price.

- Gold price is carving out a potential Bull Flag pattern on the daily chart.

Gold price is replicating the recovery moves seen in Asian trading on Tuesday, as buyers jumped back early Wednesday amid a pause in the United States Dollar (USD) rebound across the board and sluggish US Treasury bond yields.

Gold price cheers US Treasury bond yields downtick

The United States bond market is holding up its recovery mode, exerting downward pressure on the US Treasury bond yields. This, in turn, is helping the non-yielding Gold price. The recent weakness in the US bond yields is keeping the US Dollar turnaround in check, further adding to the Gold price uptick in Wednesday trading so far.

Additionally, the US Dollar also feels the heat of persistent risk-on flows, as investors cheer China’s approval of a trillion-yuan sovereign bond issue in a bid to stimulate economic recovery. “Also helping the mood was state-owned investment company Central Huijin announcing it was buying exchange-traded funds, a move which has sparked strong rallies in the past,” Reuters reported.

The steady retracement in the US Dollar on the back of an upbeat mood is aiding the renewed upside in Gold price. However, it remains to be seen if Gold price sustains the bounce, as the safe-haven US Dollar could regain poise on a renewed risk-aversion wave, which could be triggered by simmering Middle East tensions. Earlier this week, tensions calmed surrounding the Hamas-Israel strife after media outlets reported that US President Joe Biden pressured Israel to delay the Gaza ground invasion.

But President Joe Biden denied their intervention, noting that “the Israelis can make their own decisions.” Therefore, any escalation on the geopolitical front is likely to rush safety flows in the US Dollar. Gold price could also benefit in such a situation, extending its uptrend back toward $2,000.

On Tuesday, the US Dollar staged a solid comeback on the back of strong US S&P Global Manufacturing and Services PMI data and solid earnings results. S&P Global said its preliminary US Composite Purchasing Managers Index tracking both the manufacturing and service sectors rose to 51.0 in October, registering the highest level since July this year.

A major US Dollar turnaround triggered a fresh sell-off in Gold price toward $1,950. However, the extended correction in the US Treasury bond yields helped Gold price recover ground to settle marginally lower on the day at $1,971

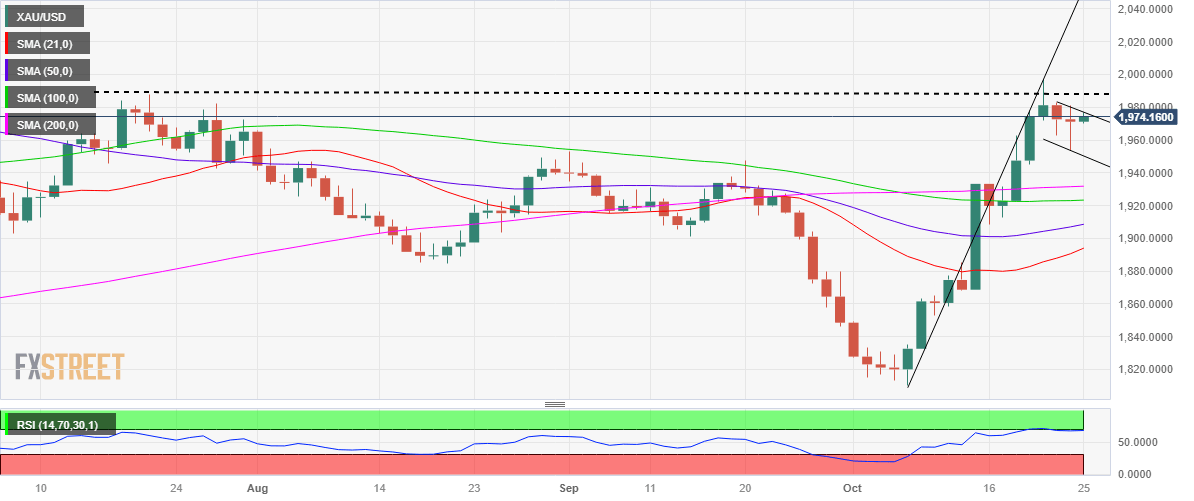

Gold price technical analysis: Daily chart

From a short-term technical perspective, nothing seems to change for Gold price, as it still remains a ‘buy-the-dip’ trade. The 14-day Relative Strength Index (RSI) indicator is sitting just beneath the overbought region, suggesting that there is more scope to the upside.

Further, Gold price is carving out a porential Bull Flag formation, in the wake of this week’s consolidation that follows a relentless upsurge from the October low of $1,811.

The daily technical setup for Gold price remains in favor of bullish traders, with the immediate resistance now seen at the $1,980 barrier.

Acceptance above the latter is needed to challenge the July 20 high of $1,988. Gold buyers will then target the five-month highs of $1,997 en-route the $2,000 barrier.

On the flip side, if Gold sellers regain control, they would seek a sustained break of the October 23 low of $1,963. Further south, the $1,950 psychological level will be retested.

The line in the sand for Gold buyers is envisioned at the October 19 low of $1,945.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.