Gold Price Forecast: XAU/USD rebounds on geopolitical risks, will it last?

- Gold price holds rebound from weekly lows early Monday, $2,650 retested.

- The US Dollar clings to NFP-led recovery amid muted Treasury yields, Middle East geopolitical risks.

- Daily RSI prods 50 level again as Gold buyers regain 21-day SMA. Where next?

Gold's price continues to face sellers at $2,650 early Monday, capping the latest uptick sponsored by fresh Middle East geopolitical tensions. Meanwhile, traders resort to repositioning heading into the US inflation week, lending some support to Gold price.

Gold price returns to the range amid a quiet start to a big week

Asian traders hit their desks on Monday, reacting to the weekend's news of Syrian rebels seizing the capital, Damascus, ousting President Bashar al-Assad, who fled to Russia with his family seeking asylum. The toppling of Assad’s government ended a 13-year civil war and more than 50 years of his family's brutal rule.

In response, the United Nations (UN) will likely convene for an emergency closed-door meeting on Monday to discuss the situation in Syria. Investors remain wary amid multiple risks emanating from the Middle East even as Israel struck a ceasefire deal with the Lebanese militant group Hezbollah a week ago.

They also remain cautious ahead of this week’s US Consumer Price Index (CPI) data, especially after Friday’s US labor data showed that the Nonfarm Payrolls rebounded by 227K in November, beating the estimated 200K increase. The Unemployment Rate ticked higher to 4.2% in the same period, as expected.

Despite the big beat on the headline NFP number, markets ramped up bets for a US Federal Reserve (Fed) interest rate cut this month to above 80%, according to the CME Group’s FedWatch Tool. This helped Gold price shake off the knee-jerk drop to the weekly low of $2,613 following the US labor data release.

Looking ahead, geopolitical developments will continue playing a pivotal role in influencing risk sentiment, significantly impacting safe-haven assets such as Gold price, the US Dollar (USD) and the US Treasuries.

Besides Syria's political upheaval, South Korea faces the same problem, with President Yoon Suk Yeol having survived the impeachment vote on Saturday. Yoon’s People Power Party boycotted the Saturday impeachment vote brought by opposition parties.

Markets also remain hopeful of more stimulus from China after the country’s consumer inflation data signalled continued demand weakness in the world’s biggest consumer. China’s stimulus optimism bodes well for the non-yielding Gold price. China’s CPI missed expectations in November, rising by 0.2% year on year (YoY), down from a 0.3% increase in October.

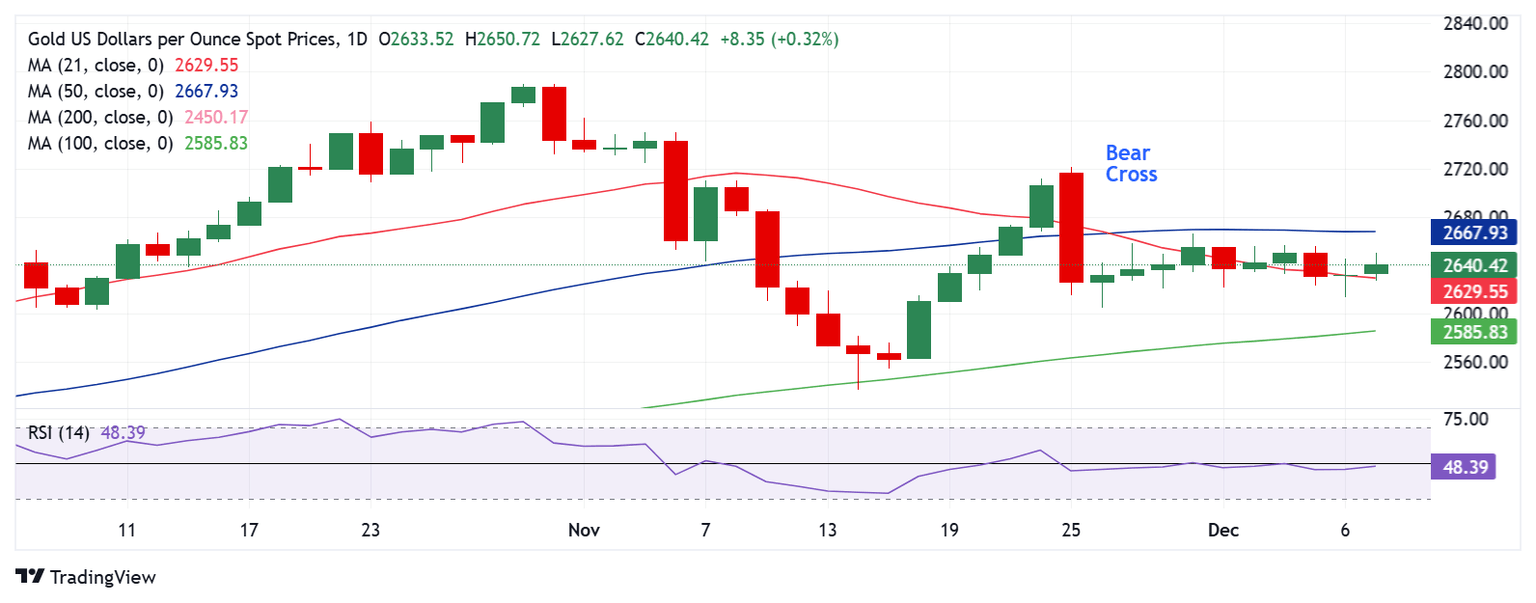

Gold price technical analysis: Daily chart

The daily chart shows that Gold's price failed to chart a range breakdown on a daily closing basis on Friday and regained the critical short-term 21-day Simple Moving Average (SMA) at $2,630 after briefly breaching it during the day.

The 14-day Relative Strength Index (RSI) has turned higher to test the 50 level, backing the renewed uptick in Gold price.

However, it remains to be seen if Gold price extends the rebound from the weekly low as the $2,650 level emerges as the immediate upside hurdle.

Meanwhile, the 50-day SMA at $2,668 remains a tough nut to crack for the optimists. The next relevant resistance is seen at $2,700.

On the flip side, a daily candlestick closing below the 21-day SMA at $2,630 will likely revive the downside.

The next support aligns at the previous week’s low of $2,613, below which the 100-day SMA at $2,586 will be the line in the sand for Gold buyers.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.