Gold Price Forecast: XAU/USD eyes further correction toward $1,870 amid bearish technicals

- Gold price is on a three-day corrective decline as the US Dollar recovery gathers strength.

- United States Retail Sales and Producer Price Index data eyed for fresh impetus.

- The USD/JPY upsurge powers the US Dollar, but US Treasury bond yields plunge.

- Gold price sees downside opening up as the 4H technical setup turns bearish.

Gold price is extending its correction from nine-month highs into the third straight day this Wednesday. Gold price is undermined by resurgent United States Dollar (USD) demand, despite the sell-off in the US Treasury bond yields. Investors brace for the critical United States Retail Sales and Producer Price Index (PPI) data slated for release later in the day.

United States Retail Sales and Producer Price Index data up next

The United States Dollar is firming up early Wednesday, continuing its recovery momentum from seven-month troughs reached at the start of the week. A sense of caution prevails as investors eagerly await the United States Retail Sales and Producer Price Index (PPI) data for fresh insights on the US Federal Reserve (Fed) future policy course.

The US Retail Sales are foreseen at 0.1% MoM in December vs. -0.6% previous, while the Core figure is expected to drop 0.7% MoM in the reported period. Meanwhile, the US Producer Price Index is expected to ease to 6.8% and -0.1% on an annualized and monthly basis, respectively. The US economic data releases will provide further evidence that the Federal Reserve needs to slow down its tightening pace amid growing risks to consumer demand. The CME FedWatch Tool shows a 95% probability of a 25 basis points (bps) February Fed rate hike, followed by another 25 bps in March, which stands at around 78%.

Weak United States macro data could check the US Dollar’s correction, motivating Gold bulls to fight back for control. However, the sentiment on Wall Street will play a pivotal role, as corporate earnings remain on the agenda, especially after some financial companies’ results disappointed on Tuesday.

US Dollar rallies with USD/JPY post-Bank of Japan verdict

In the meantime, the US Dollar strength will continue to dominate and keep the Gold price on the defensive. The US Dollar follows the massive upsurge seen in the USD/JPY pair after the Japanese yen collapsed on the Bank of Japan’s (BoJ) decision to maintain key rates alongside its yield control policy. In doing so, the BoJ defied the market pressure to tweak its yield framework after a few days of the Japanese government bond yields (JGB) topping the 0.50% cap widened by the central bank at its December policy meeting.

The BoJ inaction has triggered an explosion in the global bond market, triggering turmoil in the US Treasury bond yields across the curve. The 10-year JGB yields are down 13.5 bps at 0.365%, down 27% on the day.

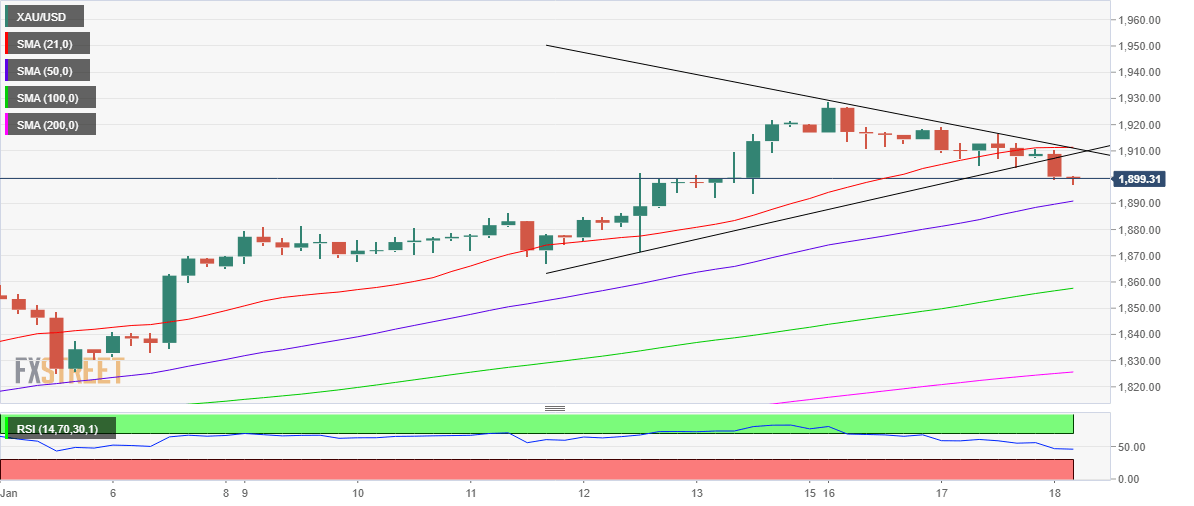

Gold price technical analysis: Four-hour chart

After defending the $1,900 mark on Tuesday, Gold buyers have given up control, as the price yields a downside break of a symmetrical triangle on the four-hour chart.

Gold price breached the rising trendline support at $1,907 on a four-hourly candlestick closing basis, validating the triangle breakdown.

The Relative Strength Index (RSI) has pierced the midline for the downside, suggesting that the tide has turned in favor of bears.

Therefore, the downside remains exposed toward the $1,870 previous critical support should the bullish 50- Simple Moving Average (SMA) at $1,890 cave in.

On the flip side, recapturing the triangle support-turned-resistance is critical to resuming the recent uptrend. The next key upside target is seen at the mildly bullish 21SMA at $1,911, which coincides with the triangle resistance.

Gold price could accelerate toward the $1,920 round figure on a sustained bullish momentum.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.