Gold Price Forecast: XAU/USD bulls need to cross $1,940 for a sustained upside

- Gold price kicks off the week on the right footing amid extended US Dollar weakness.

- US Treasury bond yields feel the pinch of the dovish Federal Reserve expectations.

- China’s Lunar New Year holidays-led thin trading could exaggerate Gold moves.

- Gold price eyes a sustained move above the $1,940 barrier amid favorable technicals.

Gold price is seeing a positive start to a new week, following a down Friday, as bulls fight back control amid the persistent weakness in the United States Dollar (USD) and the US Treasury bond yields.

Gold price cheers dovish Federal Reserve rate hike bets

The United States Dollar is trading close to its lowest level in seven months against its major competitors amidst soggy US Treasury bond yields and a better market mood. The Japanese stocks are advancing this Monday, tracking a solid rally on Wall Street last Friday, as investors cheer expectations of smaller US Federal Reserve (Fed) rate hikes going forward amidst talks of a pause in the Fed’s tightening cycle after the first quarter of this year. Dovish sentiment around the Federal Reserve is weighing down on the US Dollar while thin trading conditions also add to the bearish pressure on the USD. Many of the major Asian markets are closed in observance of the Chinese Lunar New Year holiday. The last words from the Federal Reserve policymakers Patrick Harker and Christopher Waller on Friday before the ‘blackout period’ continued pointing at a slow down in the Fed’s tightening pace, which is acting as a sustained headwind to the US Dollar bulls. Weak US Dollar alongside the US Treasury yields remains supportive of the ongoing upside in the non-interest-bearing Gold price.

European Central Bank hawks cap the upside in Gold price

The further upside in Gold price, however, remains restricted amid increased bets for 50 basis points (bps) rate hikes by the European Central Bank (ECB) in February and March. ECB Governing Council member Klaas Knot said on Sunday, "expect us to raise rates by 0.5% in February and March and expect us to not be done by then and that more steps will follow in May and June.” His colleague Olli Rehn noted that he sees grounds for "significant interest rate increases from the ECB this winter and the coming spring.” Additionally, the latest Reuters poll of economists showed that a majority of them now expect the European Central Bank deposit rate to peak at 3.25% by the second quarter of this year, up from the previous estimates of 2.75% a month ago. Odds of the European Central Bank delivering relatively big rate hikes going forward keep Gold buyers slightly on the edge.

Looking ahead, European Central Bank President Christine Lagarde’s speech will be eyed in absence of top-tier economic data from the United States. While Chinese New Year holiday could keep Gold price trading largely subdued but subject to volatility amid thin liquidity.

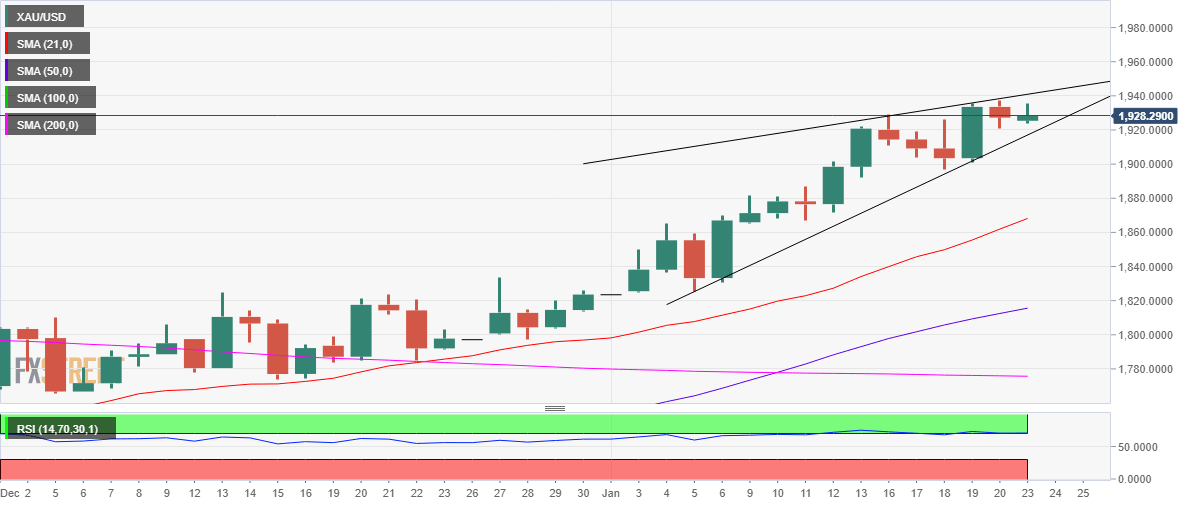

Gold price technical analysis: Daily chart

Gold price is facing an immediate hurdle at the rising trendline resistance at $1,940 on its renewed upside. Should buyers find a strong foothold above the latter, a fresh upswing toward the $1.950 psychological level will be in the offing.

The 14-day Relative Strength Index (RSI) is sitting just above the overbought territory, suggesting that there is more room to the upside.

It’s worth noting that Gold price is wavering in a rising wedge formation since early January and now looks for a breakout, as the range gets squeezed further.

To the downside, strong support is seen at the lower boundary of the wedge, now at $1,917, although Friday’s low at $1,921 could come to Gold buyers’ rescue before.

Further south, the January 18 low at $1,897 could challenge bullish commitments.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.