Gold prepares for massive bullish trend but break needed

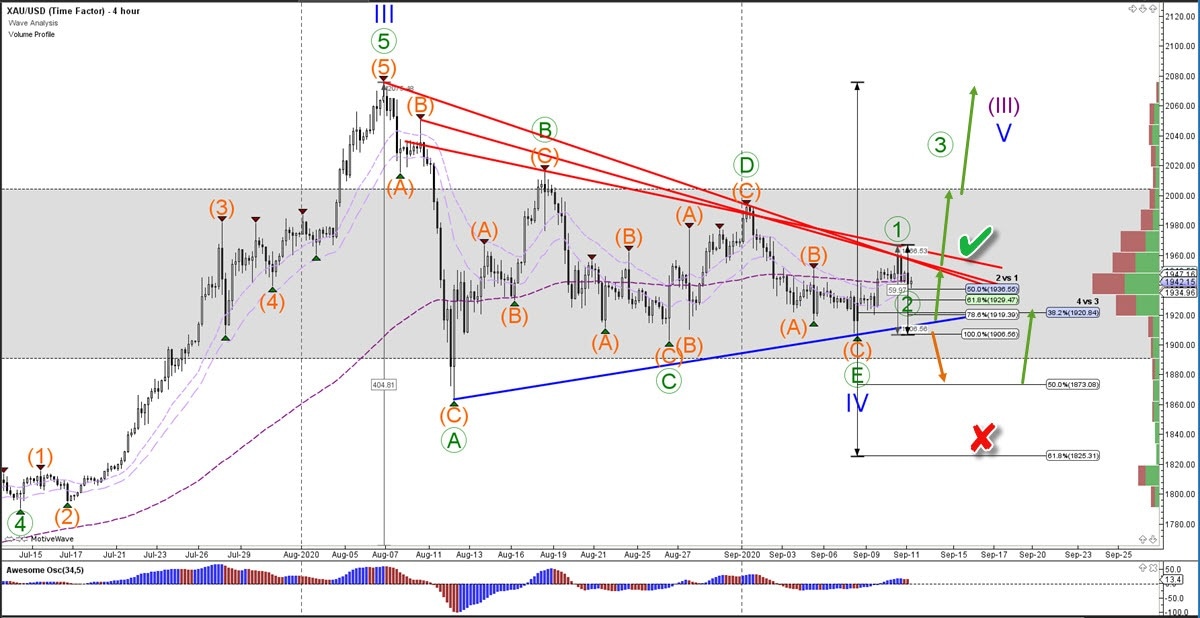

The XAU/USD (Gold) chart is showing the end of an ABCDE triangle pattern (green). This could complete a wave 4 (blue) retracement and restart the uptrend. What is the key breakout zone for the bulls?

Price Charts and Technical Analysis

Gold needs to make a bullish break above the resistance trend lines (red) to confirm the upside (green check). There is not much resistance ahead from a volume point of view once the breakout occurs. Although the tops of wave B and D remain sub levels to be aware of. The current wave 1-2 pattern remains valid as long as price stays above the Fib levels of 2 vs 1. A break below the 100% Fib could indicate a deeper retracement first within the larger uptrend.

Although Gold has probably completed the triangle pattern, the wave C of a triangle is known to be complex and lengthy. A new low could easily expand the wave C and hence the entire triangle (small red x). The entire triangle pattern would become invalid if price breaks below the bottom (big red x). For the moment, a bullish breakout and uptrend resumption do seem close by. The Wizz 9 and previous top are the next immediate targets

The analysis has been done with the ecs.SWAT method and ebook.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.