Gold outlook: Why macro bulls are still in control

- Central banks, especially China, continue heavy gold accumulation in 2025-supporting long-term bullish demand.

- Gold remains range-bound between $3,250-$3,400 with failed breakouts; breakout confirmation is key.

- Hotter-than-expected CPI on June 11 could weigh on gold, while cooler data may trigger an upside breakout.

Gold prices have traded sideways in recent sessions, but the bigger story is far from neutral. Beneath the surface, macro fundamentals remain supportive-and may set the stage for a sharp move once the current range breaks.

Central banks keep stacking Gold

Global central banks are on pace to accumulate over 1,000 metric tons of gold in 2025, marking a fourth consecutive year of heavy buying. China, in particular, has extended its gold-buying streak to seven straight months-a signal of ongoing diversification away from the U.S. dollar.

This level of institutional demand provides a solid floor for gold, even as short-term price action cools off.

Easing tensions in US-China talks

Gold slipped earlier this week as the market responded to progress in U.S.-China trade talks in London. With reduced fear in the market, short-term safe-haven flows have dipped-explaining part of gold’s muted behavior.

Technical outlook: Range-bound motion on Gold

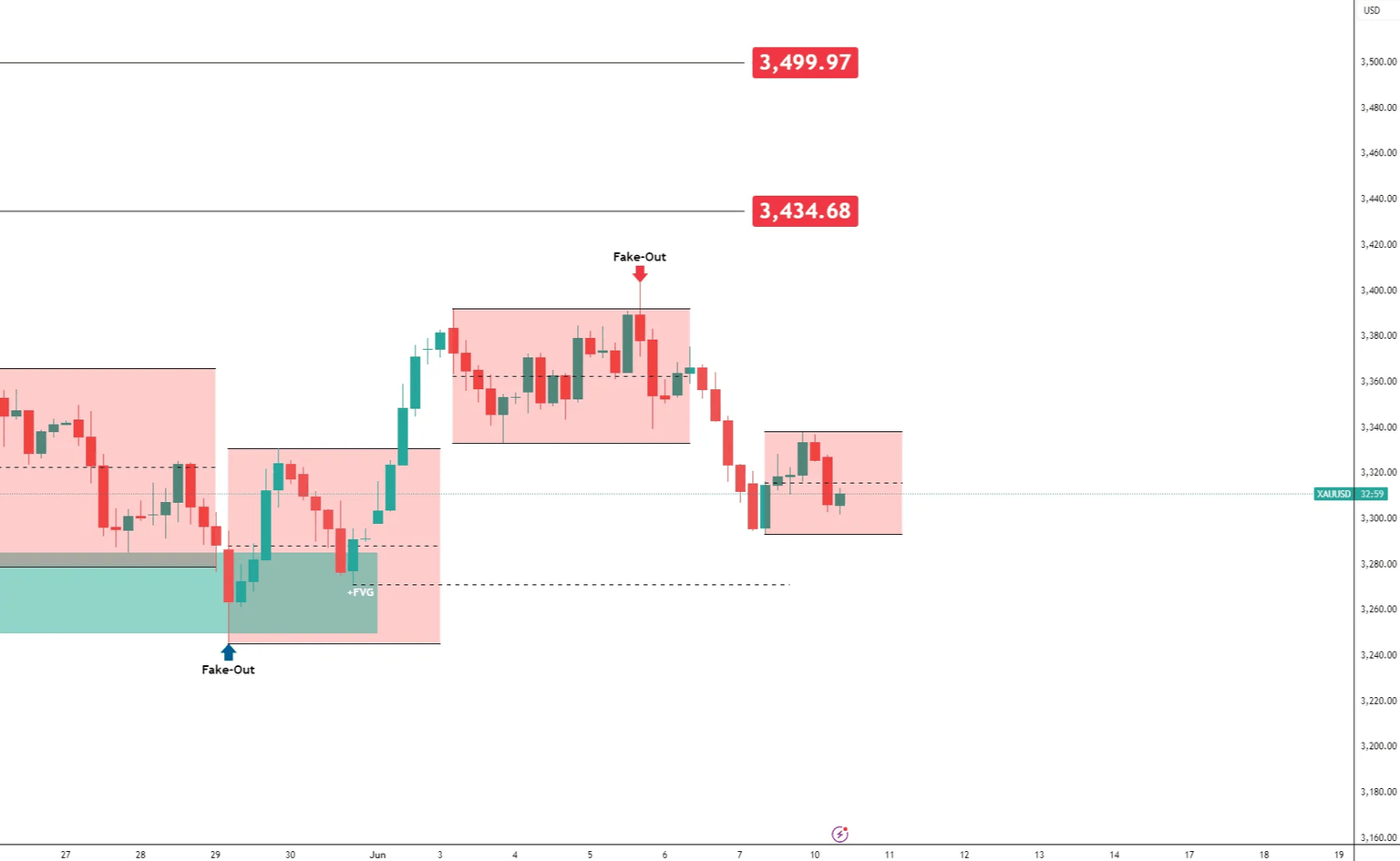

Technically, gold is consolidating between $3,200 and $3,400, with two failed breakouts on either side marking classic fake-outs.

Four-hour

Overall, the bullish Fair Value Gap sitting between $3,250 and $3,285 is still intact unless we visit the next previous low at $3,271.18.

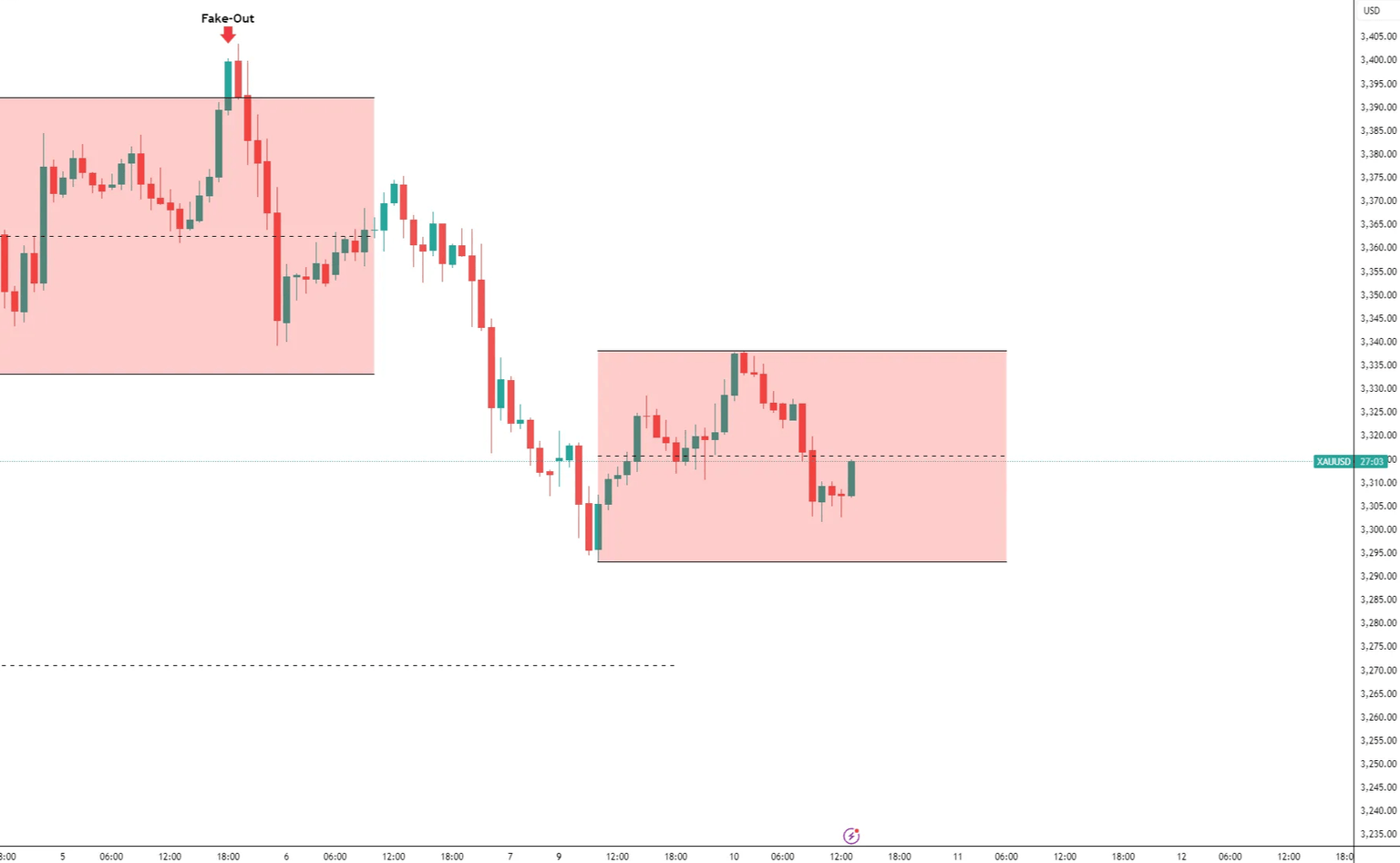

One-hour

Key levels to watch out

While gold is still in a consolidation phase at the 1-hour timeframe, watch out if it tests either support and/or resistance levels at $3,290 and $3,340 respectively.

Timeframe | Bias | Game Plan |

Short-Term | Range-Bound | Fade extremes at $3,250 and $3,400 |

Medium-Term | Bullish | Accumulate on dips with macro support just above the $3,280 level |

Breakout Watch | $3,290 / $3,340 | Only trade after confirmed breakout + retest |

Catalyst on Gold this week

Headline CPI YoY is expected to rise from 2.3% to 2.5%.

Core CPI, which excludes food and energy, is also forecasted to tick higher.

This signals sticky inflation-which may pressure the Fed to hold rates higher for longer. If these forecasts come true (or come in hotter), expect bearish pressure on gold due to a stronger U.S. dollar and rising yields.

But if the data cools unexpectedly, it could be the catalyst Gold needs to break out of its recent range.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.