Gold holds ground on Fed signals, soft data, and geopolitical risks

Gold (XAUUSD) is holding firm as safe-haven demand and policy support drive continued strength. Global tensions and trade frictions are lifting caution across markets. At the same time, weak U.S. data and dovish Fed signals have added to gold’s appeal. Falling yields and a softer Dollar further support the metal’s upside. With key labor data approaching, gold remains on strong footing both fundamentally and technically.

Gold gains support from weak US data and dovish Fed signals

Gold continues to draw support from safe-haven flows as global tensions remain elevated. Heightened risks across multiple regions keep caution in focus, driving demand for protective assets. Ongoing trade frictions and regional disputes are also contributing to the metal’s sustained rally.

At the same time, monetary policy remains a central driver. The latest FOMC Minutes revealed a divided stance, but a majority of Fed officials signaled openness to further rate cuts if inflation continues to ease. With the economy showing signs of weakness, markets are leaning toward dovish expectations. The CME FedWatch Tool shows an 82% probability that rates will remain unchanged at the upcoming Fed meeting. Meanwhile, markets are already pricing in at least two rate cuts over the coming months.

Soft economic data has also added to gold’s bullish case. The U.S. ISM Services PMI and recent job figures have pointed to slowing momentum. A weaker labor market and softer services activity would likely increase the case for monetary easing. This environment has pushed Treasury yields lower and weighed on the U.S. Dollar, creating favorable conditions for non-yielding assets like gold. Upcoming labor data, including the December Employment Report, will be critical in shaping the Fed’s path forward.

Gold sustains bullish momentum with trendline holding firm

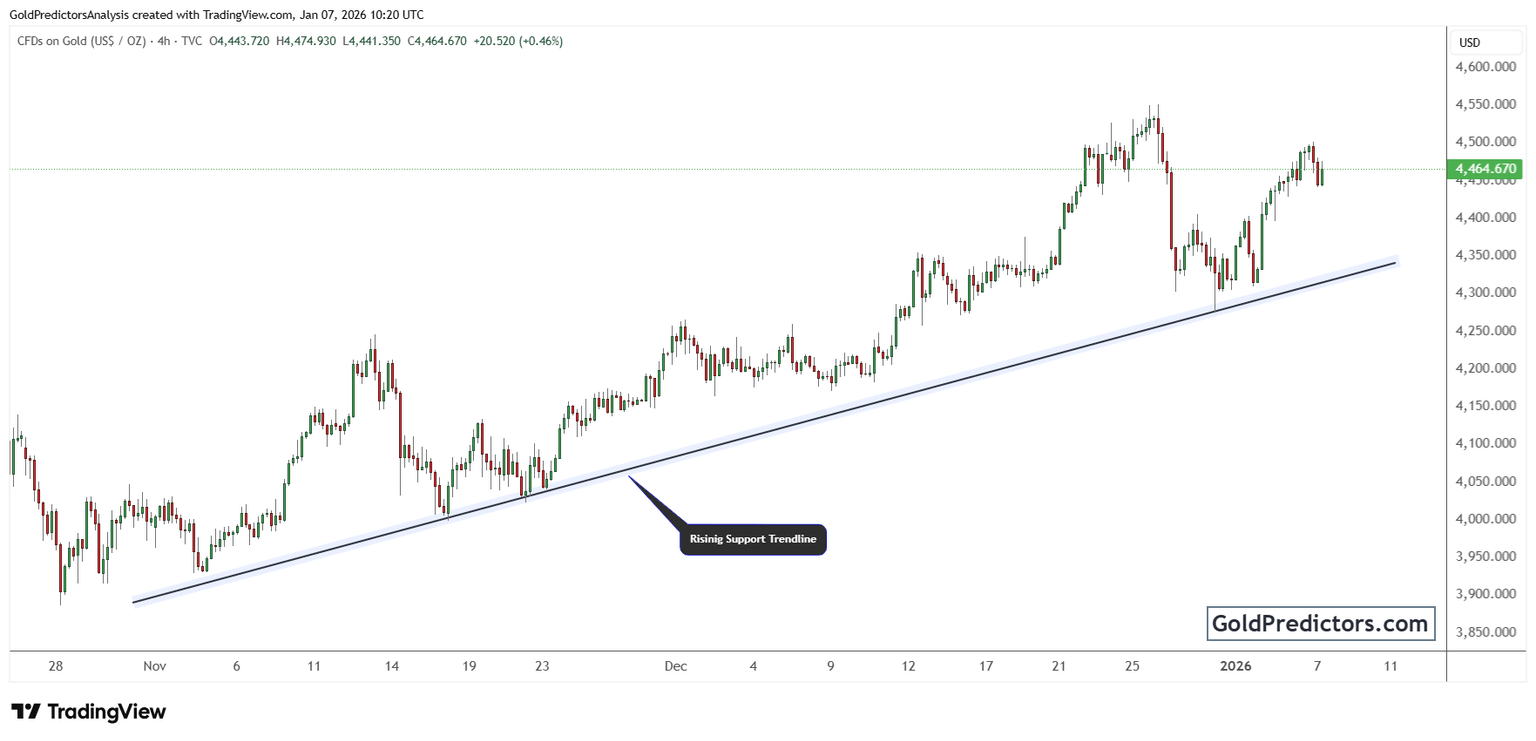

The gold chart below shows a well-defined ascending support trendline that has guided price action since the start of November. Each major pullback has found support along this rising line, confirming its role as a key technical base. Most recently, gold bounced sharply from this level, confirming the strength of this structural support.

The most recent price action shows a pullback from the $4,500 zone toward the trendline, followed by a renewed push higher. This behavior signals ongoing demand at lower levels and validates the trendline as a reliable entry zone for buyers. As long as this line holds, the broader uptrend remains intact, and gold may continue its climb toward and beyond the $4,500 mark.

Gold is nearing a key resistance zone just below the $4,500 mark. A clean break above this ceiling could trigger a stronger upside move. However, a close below the rising trendline would suggest weakness and open the door to a deeper correction. For now, the structure remains bullish, backed by both macro drivers and technical momentum.

Gold outlook: Bullish momentum remains intact above key support

Gold remains well-positioned as macroeconomic and technical factors continue to align. Global tensions and weak U.S. data have increased demand for safe-haven assets, while dovish Fed signals keep expectations for rate cuts elevated. This environment has pushed yields and the Dollar lower, creating favorable conditions for gold. Technically, the metal continues to respect its rising support trendline, with recent pullbacks attracting strong buying interest near this level. As long as this structure holds, the broader uptrend remains intact, and gold appears on track to retest the $4,500 resistance.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.