Gold hits new all time highs every day

Gold

-

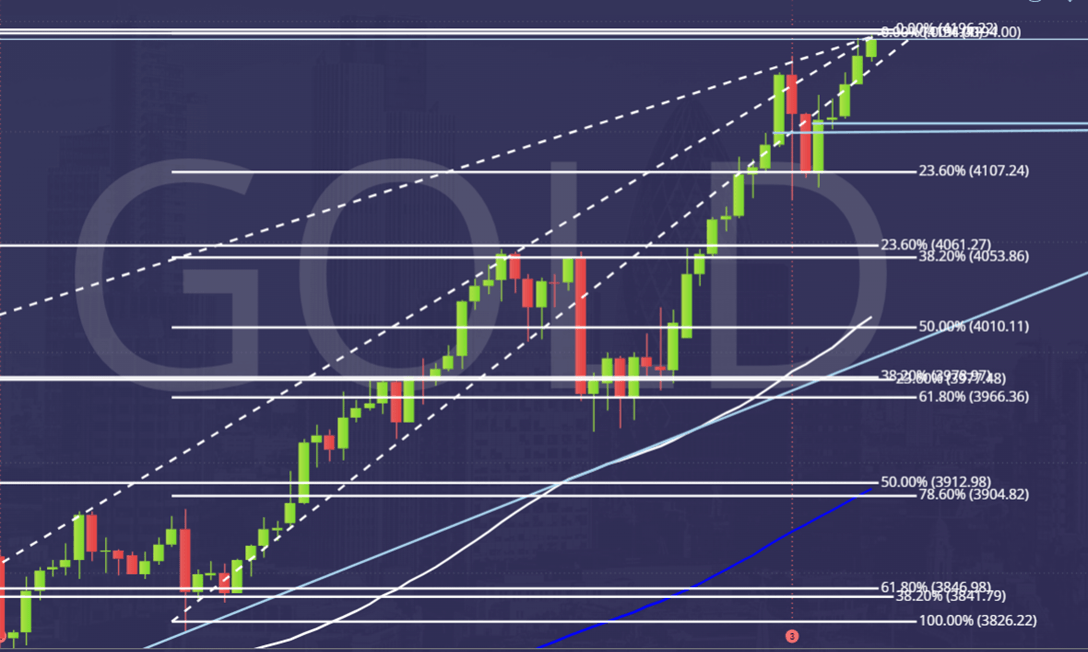

Gold we wrote: The bulls are unstoppable & there is almost panic buying. A break above 4151 can target 4166/4169, 4173/76 & 4181/84.

-

All targets were hit with a new all time high at 4186, almost exactly at the upper target.

-

Eventually we could reach as far as 4235/38.

-

Severely overbought conditions concern me but at this stage I cannot even think about a short position....however I would not be surprised to see a sudden downturn, such as we experienced last week, so keep your trading under control!

-

I wrote that yesterday and it still applies today.

-

Yesterday we collapsed to buying opportunity at 4105/4095 & longs needed stops below 4090.

-

The long worked perfectly as we caught the low of the day and shot higher from to 4090 to 4186.

-

As stated above the next target is 4235/38 & above here look for 4246/49.

-

Sharp pullbacks could still be expected at some point during the day in severely overbought conditions.

-

Support at 4120/4110 & longs need stops below 4095.

-

A break lower targets a buy opportunity at 4065/4055, with a good chance of a low for the day here but longs need stops below 4040.

-

Targets: 4100, 4150, 4180.

Author

Jason Sen

DayTradeIdeas.co.uk