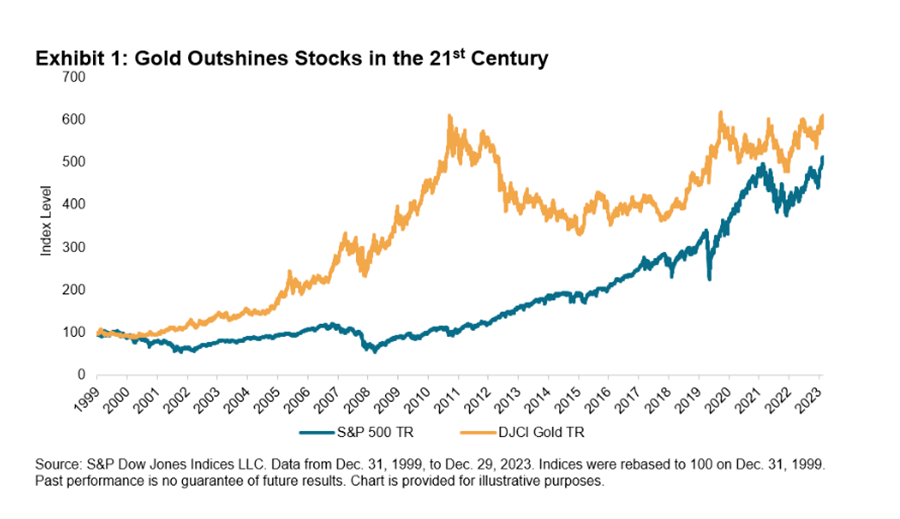

Gold has outperformed the S&P 500 in the 21st century

Gold has outperformed both stocks and bonds since the turn of the century.

Gold was among the best-performing assets of 2023.

According to analysis by the World Gold Council, gold outperformed emerging market stocks, U.S. bonds, the U.S. dollar, global treasuries, and commodities in general. The only asset classes that performed better than gold were U.S. stocks and developed-market foreign stocks.

But if we go back deeper in time to 1999, gold has narrowly outperformed stocks on an annualized basis as well.

Dow Jones Commodity Index Gold (DJCI) tracks the gold market using the futures index. Dating back to the turn of the century, the DJCI has produced a 7.8 percent annualized return, according to S&P Dow Jones Indices head of commodities Brian Luke.

That compares to a 7 percent return for the S&P500 over the same period.

Bonds are even further behind in the race. The iBoxx USD Overall Index, measuring the performance of government and corporate bonds, has charted an average return of 4.1 percent since 1999.

Adjusting for volatility, gold has also demonstrated better risk-adjusted returns than stocks in the 21st century, with a Sharpe ratio of 0.48 versus 0.45 for equities.

The DJCI reached an all-time high in December, charting a 12.8 percent return. That outpaced both bonds and the broader commodity markets. Equity markets won 2023 with a 26.3 percent return for the S&P500.

Gold charted a strong performance in 2023 despite significant headwinds, including a strong dollar and rising interest rates.

Gold is a non-yielding asset. It doesn’t pay dividends like many stocks, and it doesn’t produce interest income like bonds. That means there is a higher opportunity cost when holding gold in a higher interest rate environment.

This is often cited as a knock on the yellow metal, and it certainly impacted gold’s performance through the first three quarters of 2023. Nevertheless, gold has proven to be a strong addition to an investment portfolio through the 21st century.

Luke noted that central banks have taken notice of gold’s performance over the long haul. Total central bank gold buying in 2022 came in at 1,136 tons.

It was the highest level of net purchases on record dating back to 1950, including since the suspension of dollar convertibility into gold in 1971. That buying spree continued into 2023 with central banks adding another 800-plus tons of gold to their reserves through November of last year.

Gold has historically provided investors an alternative to fiat currency,” Luke wrote. “Digging into the central bank purchase data, countries including Russia and China have led the increase in central bank holdings. Foreign central banks appear to increasingly value gold’s hedge against inflation, debt default and dollarization.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.