Gold eyes $3,400 as Dollar struggles ahead of NFP

- Gold is extending gains above $3360 after bouncing from the $3,355 support level.

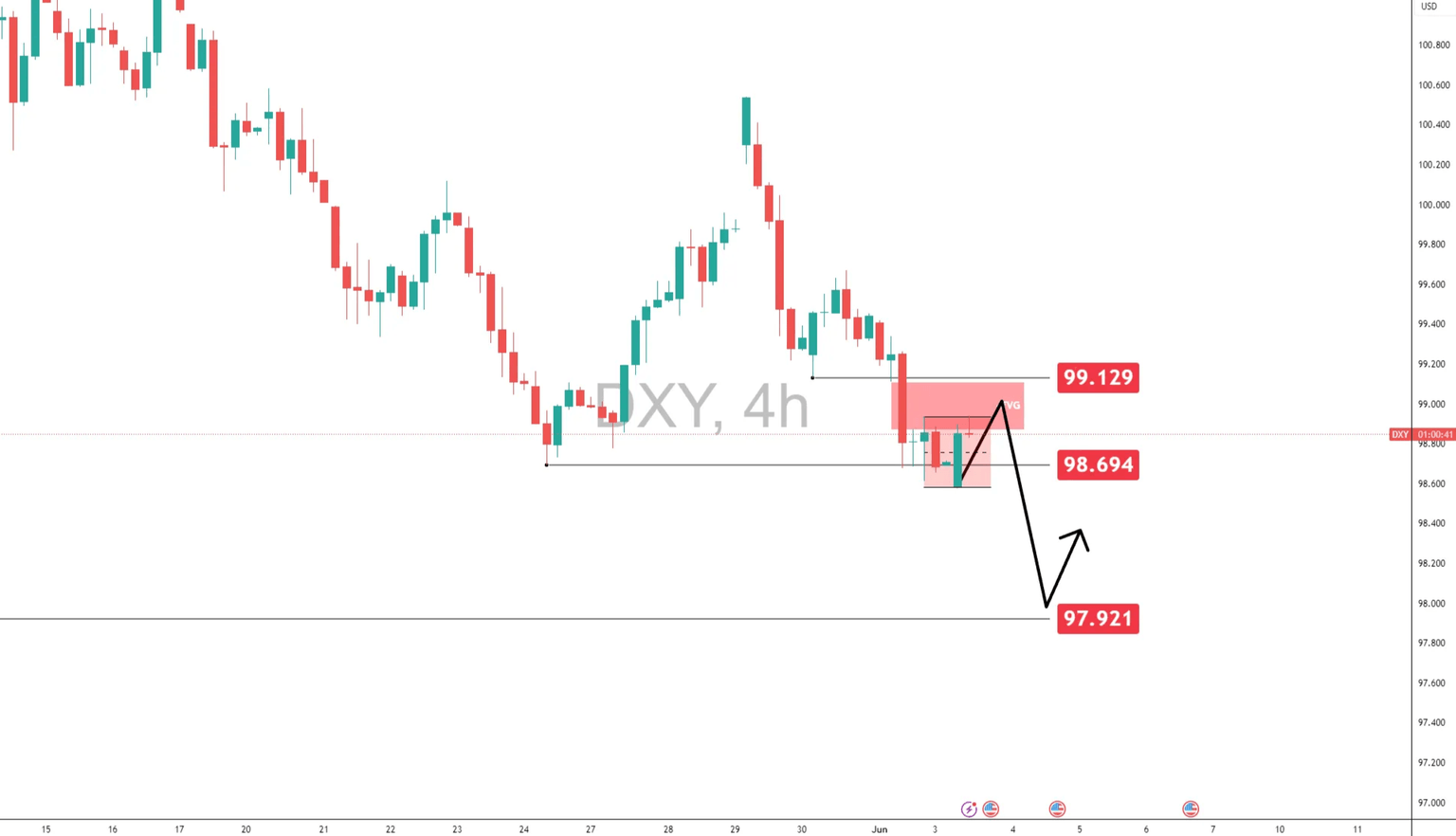

- The U.S. dollar remains capped below 99.129, limiting any meaningful recovery, benefiting Gold.

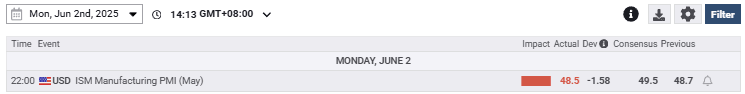

- As long as Gold holds above $3355, the path toward $3400 and $3500 remains open.

Gold is extending gains this Tuesday, trading above $3360 as bullish momentum continues to unfold. Gold is holding its ground after last week’s pullback and is now pressing higher while the U.S. dollar remains capped below the 100 level. With NFP just a few days away, the broader tone remains risk-sensitive, but so far, gold is benefitting from a softening greenback and bullish structures.

Greenback faces headwinds near resistance

The dollar is attempting to recover but remains stuck below the 99.129 level, a level that lines up with a key 4-Hour Bearish Fair Value Gap. Despite a slight bounce after yesterday’s ISM data miss, there’s no strong follow-through from dollar bulls and that’s keeping gold well-supported.

Unless the U.S. Dollar can push firmly above this FVG, the broader trend still favors the downside, especially with the Fed expected to lean more dovish in the coming months.

Gold four-hour chart: Bullish move already in motion

As outlined from my previous analysis: Gold holding support, more upside ahead as NFP looms, Gold gears up to reach $3400 level that could potentially, if momentum holds, there’s potential to stretch toward $3500.

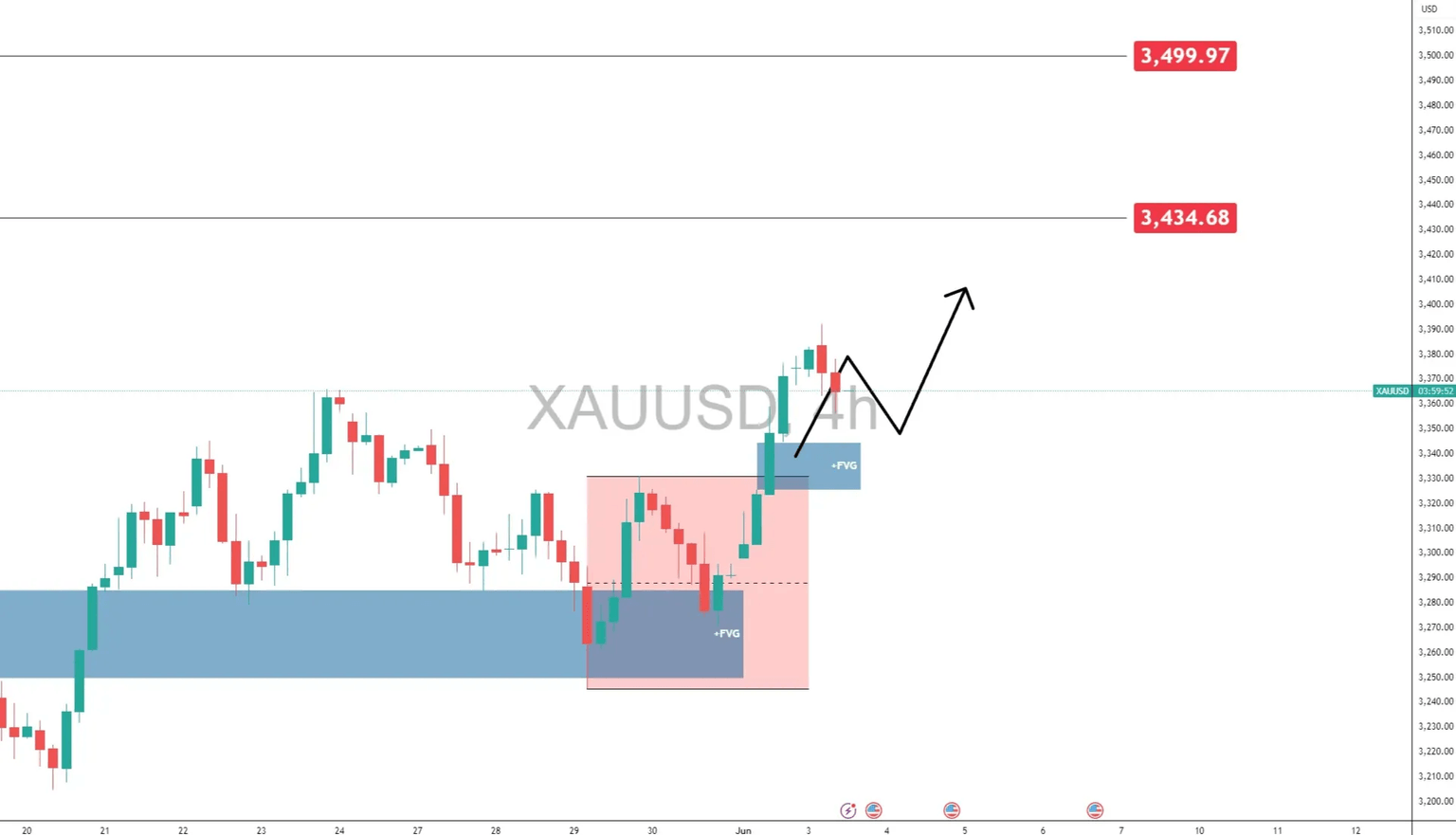

One-hour: Intra-day pullback offering opportunities

A pullback towards the $3325 - $3345 level could be an opportunity for a bounce play for upside potential.

This level remains important. If this level holds, we could see another leg higher develop before the week’s major risk events unfold, particularly, the Non-Farm Payroll.

What to watch today

- Dollar reaction near 99.129: A rejection keeps the bearish pressure on and allows gold to keep grinding higher.

- $3325 - $3345 level on gold: This level is shaping up as short-term support. A clean bounce could open the door to $3400.

- Market positioning into NFP – Expect some choppy behavior as traders begin to adjust exposure ahead of Friday’s jobs release.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.