GBP/USD: the Pound Remains Under Pressure

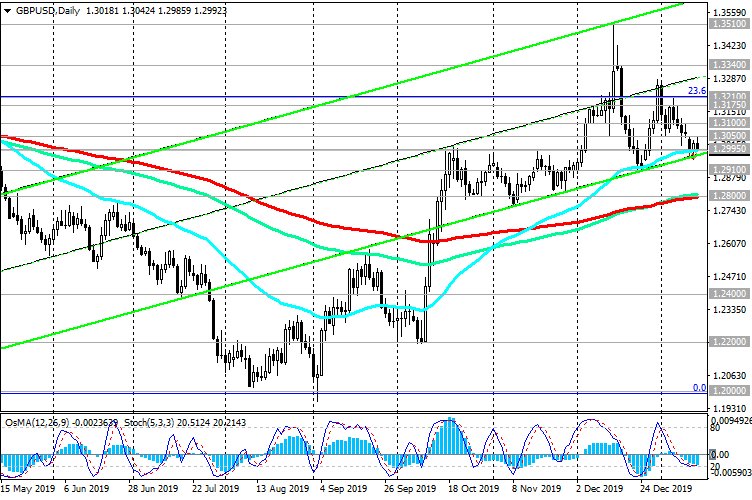

After the release of fresh UK macro data (at 09:30 GMT), GBP / USD continued to decline on Wednesday, trading at the moment near the 1.2995 mark and the EMA50 support level on the daily chart.

The dynamics of the pound, which has already fallen by about 2% since the beginning of the year, is determined by weak macro data coming from the UK and the continuing uncertainty about Brexit.

The UK should leave the EU on January 31, although access to the EU markets in their current form will remain at least until the end of this year, while the terms of a new agreement are being worked out.

However, weak economic data suggests that uncertainty about Brexit harms the economy more than many observers expected.

Following comments by Bank of England management and disappointing macro data this week, market participants sharply increased the likelihood of policy easing at a Bank of England meeting on January 30. If the bank really lowers the rate (as predicted by some economists, by 0.25%), then the drop in the pound in the absence of progress on Brexit is likely to accelerate.

Now the attention of market participants has shifted to the signing of a trade agreement between the United States and China. The signing process will begin at 16:00 (GMT). The White House will evaluate the progress made and, possibly, reduce duties on goods from China again, but not earlier than 10 months after the signing of the trade agreement planned for today. Existing duties on Chinese imports will remain in effect until the end of the US presidential election in November 2020.

Despite today's decline in the pound, above the key support level of 1.2800 (EMA200, EMA144 on the daily chart), medium-term positive dynamics of GBP / USD remains.

If GBP / USD returns to the zone above the resistance level 1.3050 (EMA200 on the 4-hour and 1-hour chart), the pair will continue to grow towards the resistance levels 1.3210 (Fibonacci level 23.6% of the correction to the GBP/USD reduce in the wave that started in July 2014, near the level of 1.7200), 1.3340 (EMA200 on the weekly chart).

Support Levels: 1.2995, 1.2955, 1.2910, 1.2800

Resistance Levels: 1.3050, 1.3100, 1.3175, 1.3210, 1.3340, 1.3510, 1.3960, 1.4350, 1.4580, 1.5080, 1.5190

Trading Recommendations

Sell Stop 1.2985. Stop-Loss 1.3055. Take-Profit 1.2955, 1.2910, 1.2800

Buy Stop 1.3055. Stop-Loss 1.2985. Take-Profit 1.3090, 1.3175, 1.3210, 1.3340, 1.3510, 1.3960, 1.4350, 1.4580, 1.5080, 1.5190

GBP/USD Current Trading Positions

Author

Yuri Papshev

Independent Analyst

Independent trader and analyst at Forex market. Trade experience - more than 10 years. In trade Yuri Papshev uses a combination of fundamental and technical analysis.